Rule #2: Your credit score is super important.

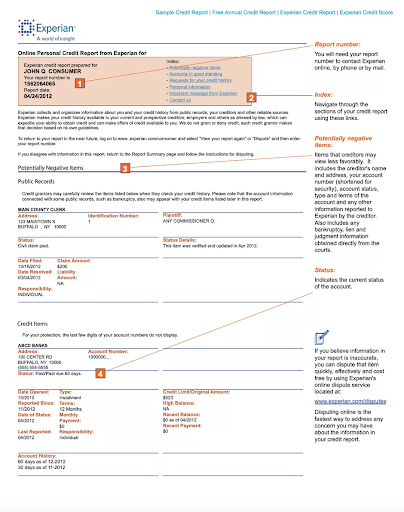

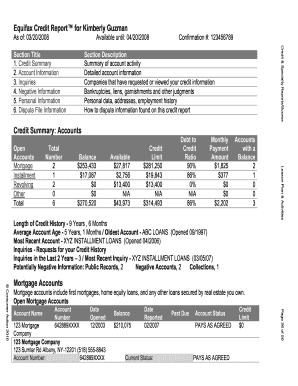

Using credit cards builds your credit, which eventually leads to your credit score. There are three main credit bureaus here in the U.S.: Equifax, Experian, and TransUnion. Most banks and financial institutions use these reporting companies to make decisions on whether or not to grant you a mortgage, a loan, or any other form of credit. When you use and pay off your credit card, all that transaction history is sent to one or more of these bureaus. Using the history on your credit accounts, the agencies determine a credit score, and process credit reports for the financial institution. The credit score is ever-changing, and impacted by a myriad of factors, which we will explore further on in this section. Before that, I would like you to take a look at a few sample credit reports, shown below.

The credit report outlines many of the important factors that go into your credit score. On the Equifax report, we can see the length of credit history is just above the average account age. For the younger folks reading this, the age on your accounts will definitely matter. I recall that when I got my first credit card and credit score, I was always upset with how low the number was, as I made all my payments in full and on time. This is because just like with investing, it takes time to see important results. Most lenders like to see years, if not decades, of solid credit history behind a client. Just as you should with owning assets, start building that credit early and it will provide many great opportunities down the road. Until then, however, your length of credit may pull back on your credit score until the reporting agencies see a solid long-term history. Below this, you will see a “most recent account” heading. On the Experian report, you will also see similar information under the “credit items” section. The reporting agencies always like for you to be using some sort of credit. It is important to show that you can handle and operate open credit accounts. Actually, having too few credit accounts will negatively affect your score more than having too many.[1] There is no magic number, but a good rule of thumb is to have one from each category. For example, a credit report showing a mortgage loan, a few student loans, and two credit cards would be sufficient. A report showing only five credit card accounts would be a possible warning sign. Basically, you want to show these agencies that you can handle all different types of loans and credit.

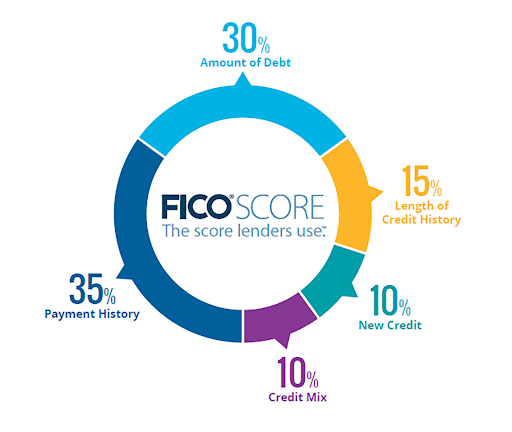

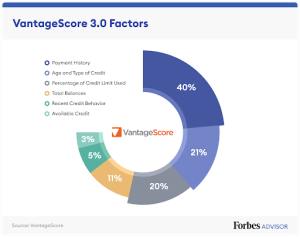

The report will also outline any history of negative public records, such as declared bankruptcy, or liens, and judgment information of financial importance on court records. Lower along the report, there is a section titled “Inquiries”. An inquiry is an important credit concept, used as part of creating your score. An inquiry is recorded as any financial institution that pulls your credit. Credit pulls are necessary for loan and credit card applications, but please note that an increasing number of inquiries is cause for concern. The report will also show any bills that have gone to collections. Collections are bills that have not been paid in a defined time period and get sold to a collections company. If you recall, the credit card debt you have is an asset to the financial institution issuing it. The same goes for unpaid bills. Special financial institutions known as debt collectors or collections agencies will buy this unpaid debt from hospitals, landlords, electric utility companies, and so on, and attempt to collect the missed payments. These debt collectors are either reporting or non-reporting, meaning they will or will not tell the credit bureaus about your unpaid bills. Having anything in collections is bad and should be taken care of immediately, regardless of whether or not the debt collector reports. Debts in collections that are reported to credit agencies are detrimental to credit scores in a big way. Finally, the report will provide you with your credit score, along with actionable tips on how to improve it. Credit scores (both FICO and Vantage) operate on a sliding scale from 300-850, with 300 being very poor and 850 being near perfect. The score is made up of different categories, each of which has a different weighting. The weightings for FICO and Vantage3.0 are shown below. Afterward, we will look into each category individually.

The biggest contributor to both of these scores is payment history. That’s what we’ll start with. Your payment history is simply the schedule on which you pay back your debts. Most credit requires monthly payments, just like a mortgage. The credit card issuer will often offer you many options to pay your balance. For example, you can pay a minimum amount that they designate, known as your minimum payment. Most of the time this is a single percentage or less of your total balance. You may pay in full, or designate an amount comfortable for you (just remember the aforementioned risks of not paying in full). Each transaction has one month before it is added to the interest-bearing balance, so if you pay it off in full before then, you’ll never pay a dime in interest. This is also the best way to show the reporting agencies that you keep good track of your credit. Just like with investing, setting up a hands-off, automated action process will ensure you stick to the plan and achieve the long-term results you desire. Each credit card statement will have a payment due date. You must make the minimum payment before this date in order to avoid costly late payment fees. Not only will these fees further add to your debt, but the missed payments will also impact your credit score as well. It is hard to estimate the exact impact a late payment may have on credit for any single person, but according to FICO, one missed payment could set you back 180 points in the worst-case scenario. That’s a big deal.[2]

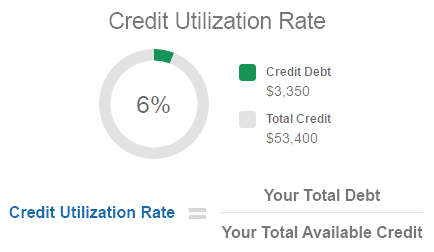

The next big category for both FICO and Vantage is the amount of debt or percentage of credit line used. Say Jim has a credit card with a $10,000 limit, and he goes out to the Home Depot and gets himself a beautiful new ride-on lawnmower. The lawnmower costs him exactly $10,000, his whole credit limit. He goes back home to his partner, who is astonished and rather upset. They also needed cleaning supplies and groceries for the house, but since Jim used the entire credit limit, anything else will be declined. In the eyes of the credit reporting agency, this is a big red flag. The bureaus like to see a constant amount of credit used, known as revolving utilization or credit utilization. The revolving utilization is the monthly average of the credit card balance divided by the total credit limit. It looks something like this.

In the case of our friend Jim, things wouldn’t be looking too hot. His revolving utilization infographic would have the ring full of green and a percentage of 100. Perhaps Jim thought he had a limit of $50,000 – this would make the whole situation less concerning. However, credit companies are required by law to explicitly detail the credit limits they give to consumers and the explanation behind them. Jim would have been made aware of his limit before ever receiving the card. If a 100% revolving utilization is the worst-case scenario, what should we aim for? The consensus knowledge around the topic indicates that reporting agencies like to see it below 30%.[3] Since this is a long-term average, it is okay to have higher balances one month, offset with lower balances during others. Even if you pay your balances in full for each statement, revolving utilization will be a key indicator of your financial health. While it isn’t wise to carry a balance every month, it is wise to make sure there is some dollar amount posted to the account at any given point, in order to show active status. You could even pay your full bill on the due date of the 3rd, then proceed to go out for dinner that evening. The new charge will not be posted on the past statement. Instead, it will be due the following month. Charges on the card are posted and due in the order in which they were transacted. You will never have to worry about a payment being applied to a newer charge while an older charge sits unpaid and gathers interest.

Credit utilization is not only provided for your single cards, but for your credit portfolio (so to speak) as a whole. Consider that Jim also has another credit card, which he shares with his partner The card has a $50,000 limit. Jim attended an expensive private college and has roughly $15,000 in student debt. Suddenly, his credit utilization is different. His total balance is $25,000 ($10,000 from the lawnmower and $15,000 in student debt), and his limit is $60,000 (the limits of both credit cards). When calculated on a whole credit portfolio scale, this metric is no longer known as revolving utilization, but rather as debt-to-credit ratio. Jim has $25,000 in total debt, and his active limit is $60,000. This makes his DTC ratio 41.6. For every $100 of credit Jim has available to him, he has debt totaling $41.67. I personally like thinking about it this way.

So what are the recommended guidelines for the DTC ratio? Just like with revolving utilization, the specifics differ – but the consensus rule is the same. A 30% maximum is a very healthy place to be. Our friend Jim here is also looking to buy a house and secure a mortgage. Before doing this, however, he would like to get his DTC ratio lowered below that 30% mark, in order to get a better interest rate from the mortgage lender. What should Jim do? While this may seem backward, Jim has the option of getting a third credit card to achieve his goal. Let me break that down. If Jim is able to find himself a no-fee credit card with a $25,000 limit which he promises not to use, his ratio will change drastically. He will now have a total combined credit limit of $85,000, and since he isn’t using this new card for anything more than getting his limit up, his total debt will remain at $25,000. Thus, his new DTC ratio is 29.4 or 25,000/85,000.

There is one more ratio that is important for you to know about – the debt-to-income ratio, or DTI. The DTI is another financial health ratio, used not by the reporting agencies but by the credit card and mortgage lenders. The DTI ratio takes into account your working earnings and debt and uses them to estimate the reasonable level of debt you can service. The term service simply means to pay off. The credit card issuers use these estimations to decide what credit limit to give you on a card, or the maximum amount they will lend you to help buy a home. The DTI will be smaller when debt is low and income is high. Generally, as with the other two ratios, lenders like to see a DTI around 30, with numbers in the low to mid-40s being the typical “we can’t do your loan at all” rejection point.[4] For credit card lenders, these numbers vary, but may not accept anything above 50.[5] For our friend Jim, this shouldn’t be a problem for his new card as long as he makes $100,000 a year or more. This is also assuming he uses the entire balance on his new card (25,000 + 25,000/.50). More likely, his DTI would already be low, even if he didn’t make $100,000 (25,000/.50 = 50,000). Whew, that’s enough ratio math for now.

The next big constituent of your credit score is the length and type of credit (or credit mix). Depending on the score system used, this will be between 15% and 25% of your total score. Credit length simply measures the number of years you have been using credit products. Lenders like to see larger periods of time. It is for this reason it is much easier for an older person to have a high credit score than a person just starting out with their first credit card. As I have indicated before, the sooner one starts, the sooner time benefits will be on their side. The second part of this portion is your credit mix or type of credit. The reporting agencies like to see a multitude of different “types” of credit, so to speak. This includes mortgage loans, student loans, auto loans, business loans, and credit cards. Just like with asset ownership, we want to be well diversified. By having these different types of debt, we are showing the credit bureaus how we can handle and service any type of loan we may need.

The last category we should concern ourselves with is the recent credit activity category. The recent credit activity shows any big credit events that have happened to us within a recent period of time. An example of this might be opening or applying for a new credit card, getting a loan to start a business, or applying for a mortgage. It could also be smaller things, like closing a card or refinancing one’s home. Remember that strategy news business owners use that we discussed before, bootstrapping? This would be an example of recent credit activity that could be cause for concern. See if someone takes out 5 credit cards with high limits during a very short period of time, it is seen as risky behavior and will lower a credit score. Oftentimes, business owners who successfully do this will end up having to provide an explanation letter to lenders regarding the circumstances of their mass applications for credit. While it is ultimately up to the lender whether or not to accept the loan, they will, at minimum, need an explanation for the risky recent credit activity.

![]()

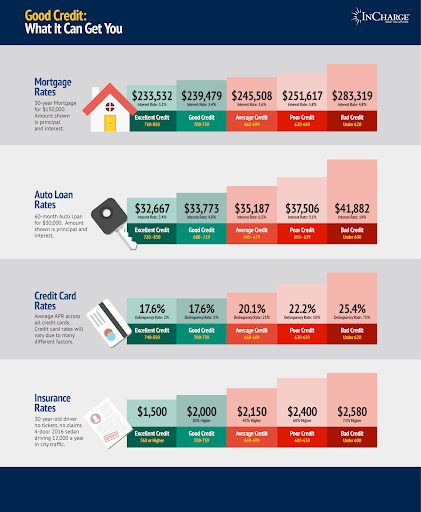

Now you may be wondering why exactly you need a credit score. What benefits will it give? This next section will hopefully provide those answers. In short, the credit score will determine what you pay for your debt on home mortgages, business loans, school loans, equity lines of credit, credit card rates, and so on. By having a good credit score, you save yourself the many unnecessary expenses of high interest on debts. This will mean that, just like your assets, your debt will be working for – or at least not egregiously against – you. The example we will give is in the form of a mortgage, but the chart below shows all the different debts this could apply to.

On a $150,000 home loan, the difference credit will provide to the total cost of the loan is roughly $50,000. Take this and extrapolate it for a bigger loan, as it will take much more money to buy a house in reality. The savings could be massive. For example, on a $700,000 loan at a rate of three percent, the monthly payment will be roughly $3,000. Three percent is what we would assume to pay for someone with good credit, but what about someone with poorer credit? That lower credit will raise their cost of debt. Therefore, they may be looking at a 5% rate on their mortgage. On the same loan amount of $700,000, the monthly payment at 5% will be $3,800 – an $800 monthly increase. Take this over the whole 30-year life (360 months), and their loan will cost them an extra $288,000. The larger the loan, the more pronounced the difference.

Your credit score will also affect things you might not think about. For example, insurance. Car insurance will cost more if you have bad credit. Credit is also used for job applications in financial fields. When I began my work in finance at the bank, I was shocked to see that they ran my credit. It makes sense though – I wouldn’t want an employee who can’t handle their own debts managing others’ money. Throughout the financial lifecycle, you will undoubtedly borrow money – even if it is just for school expenses and a home. Very few people can waltz through life paying entirely in cash. Your credit score will determine how much this borrowing will cost you, and may save you hundreds of thousands of dollars in the long run. Your credit score is super important.

- NerdWallet, “How Many Credit Cards Should I Have?,” NerdWallet, October 8, 2021, https://www.nerdwallet.com/article/finance/how-many-credit-cards#:~:text=Credit%20scoring%20formulas%20don. ↵

- Gerri Detweiler, “Does One Late Payment Hurt My Credit Score?,” MarketWatch, November 4, 2020, https://www.marketwatch.com/story/does-one-late-payment-hurt-my-credit-score-11604078238. ↵

- Amanda Dixon, “What Is Debt-To-Credit Ratio?,” SmartAsset, May 21, 2018, https://smartasset.com/credit-cards/debt-to-credit-ratio. ↵

- Chris Murphy, “Debt-To-Income (DTI) Ratio,” ed. Margaret James, Investopedia, May 30, 2022, https://www.investopedia.com/terms/d/dti.asp. ↵

- Adam West, “Credit Cards for High Debt-To-Income Ratio in 2022,” CardRates.com, January 7, 2021, https://www.cardrates.com/advice/credit-cards-for-high-debt-to-income-ratio/. ↵

Another term for borrowed money, credit refers to money a lender (normally a bank or credit card company) has extended a person. This could be a mortgage, student or auto loan, business loan or regular credit card.

This marks an important credit event where a possible lender pulls credit on an applicant. An inquiry means a person is actively seeking some sort of loan or a business entity is looking into the credit characteristics of a given individual. Credit reports often accompany inquiries.

This is where debts go when they haven't been paid in an extended period of time. Collections generally occur after the 6 month mark, when the original lender hands the debt over to a specialized debt collection agency who tracks the borrower down to receive payment.

Agencies tasked with collecting on bad debts, debt collectors often buy bad debt from hospitals, credit card companies and auto dealerships and track down those the debt belongs to in order to collect payment.

The least you can pay on a given debt balance without incurring fees, the minimum payment is charged monthly as a dollar amount based on your total outstanding balance.

The same as Debt-to-Credit, but only for revolving credit. Revolving utilization is the balance on your revolving credit accounts (most often credit cards) as compared to your total allowed limit on them.

Also known as credit utilization, the Debt-to-Credit Ratio measures how much outstanding debt you have as a percentage of your total credit limits.

DTI stands for Debt-to-Income Ratio, which compares how much you owe with how much you make each given month.

The different types of credit one has, credit mix is the combined picture of all mortgage, student, auto and credit card debts and their respective balances as a percentage of the whole.