11

Dr. Kevin Bracker; Dr. Fang Lin; and jpursley

Chapter Learning Objectives

After completing this chapter, students should be able to

- Identify and discuss reasons why firms engage in international operations

- Identify and discuss challenges/risks associated with international operations

- Define a fixed exchange rate system and a floating exchange rate system

- Identify and discuss factors that may cause the currency to strengthen or weaken

- Convert between an indirect quote and a direct quote for exchange rates

- Convert from dollars to a foreign currency or from a foreign currency to dollars given either an indirect or direct exchange rate

- Identify whether a currency is getting stronger or weaker relative to another currency given either indirect or direct exchange rates

- Identify who benefits or suffers from a currency getting stronger or weaker (first-level effect)

- Calculate cross-currency exchange rates (given two exchange rates with the dollar, calculate the exchange rate between those two foreign currencies)

- Differentiate between spot and forward exchange rates

- Discuss and differentiate between hedging exchange rate risk and speculating on exchange rate fluctuations

- Identify and discuss advantages to international investing

- Compare the size of the US equity market to global equity markets

- Identify and discuss key approaches to adding international equity exposure

Why Do Firms Establish International Operations?

Business and finance are no longer national activities. Instead, they are global activities. Regardless of whether you are looking at retailers like Wal-Mart, technology firms like Apple, restaurants like McDonalds, money-center banks like Citigroup, or investment companies like Goldman Sachs, today’s firms have a global footprint. In 2018, the S&P 500 saw 42.9% of their sales come from outside the US. There is also a combination of US firms with international production facilities and foreign firms with US-based production facilities. Why is global such an essential part of business? Here are a few reasons.

To get access to additional customers

While the US is one of the biggest consumer markets in the world, it still represents only a fraction of the total consumer market worldwide. Remember from Chapter One that we estimated that more than 95% of the population and more than 75% of global GDP is based outside the US. If firms operate solely in the US, they are giving up a large amount of potential sales. Expanding to new markets worldwide is especially important for firms that have saturated the US markets (Coca-Cola, Pepsi, Wal-Mart, etc.) or firms that see a decline in their US market (tobacco firms).

To acquire raw materials

Raw materials necessary to produce many products are found throughout the world. We can think of many different materials (oil, coffee, cocoa, diamonds, etc.) that are primarily found outside the US. For firms that use a significant amount of non-US-based resources, it makes sense to open production facilities in countries where these resources are more prominent.

To lower costs

Firms can increase profitability in two ways: (1) increase revenues and/or (2) lower costs. In many situations, firms can lower costs by producing outside the US. This cost savings may come from direct wages, benefits (such as health care), or less restrictive regulatory environments. Typically, these costs have been high in the US compared to some developing economies (although this article, The Rising Cost of Manufacturing, shows that this international cost advantage is lessening). There are also markets where production costs are higher than the US. This is one of the most controversial aspects of international operations. Are firms taking necessary steps to stay competitive (and creating economic growth in areas that need it), or are they exploiting foreign laborers and at the same time depriving the US labor force of jobs in exchange for higher profits for shareholders and upper level management? There are legitimate arguments on both sides and we do not plan to solve the debate here. However, consider the article linked above showing manufacturing costs of 25 major exporting nations. Note that many have seen their costs rise relative to the US over the 10-year period between 2004 and 2014. This happens as the capital flowing to cheaper manufacturing areas tends to push up the relative cost.

To diversify

Given that national economies tend to move in different business cycles, firms can diversify some of their business risk by operating internationally. Interest rates, inflation, and recessions occur at different times in different countries. By having operations across the globe, firms can offset down years in one country with strong years in markets in other countries. While there are significant “world economy” impacts (such as the Global Financial Crisis of 2008) that cannot be diversified away, there are still some benefits in diversifying country-specific risk.

To reduce currency risk

One of the issues we will encounter in this chapter is the impact of currency risk associated with international operations (or international competitors). When firms market their products outside their home country, they open themselves up to currency risk. A US firm that earns revenues in euros must convert those euros back to dollars. If the dollar increases in value relative to the euro, each euro received in revenue is now worth less than previously anticipated. By moving production costs into the same currency as their revenues, the firm will have less currency risk.

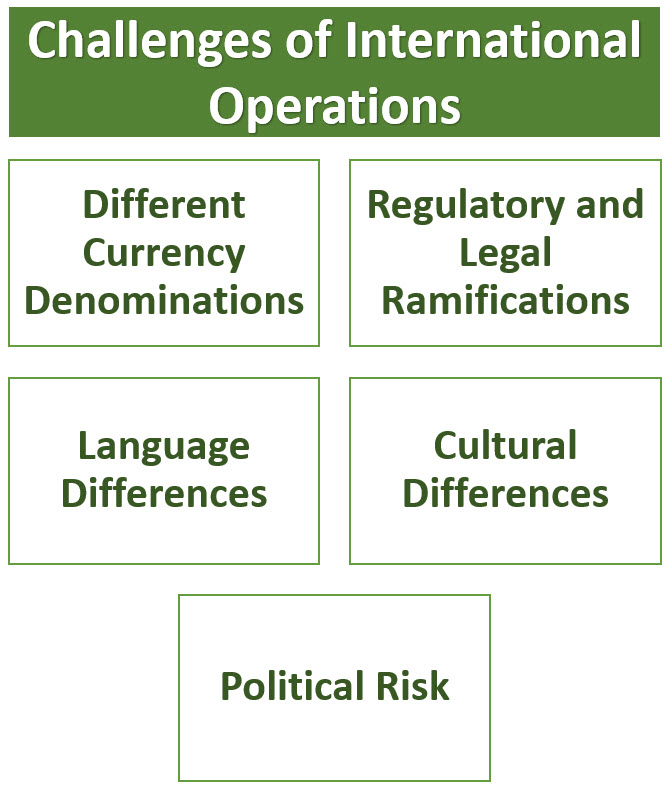

Difficulties in International Operations

Businesses face a number of risks and challenges when operating internationally. Here we’ll discuss some of the key issues.

Different currency denominations

Today’s multinational corporation handles transactions in pesos, euros, yen, and many other currencies (including many “dollars” that are not equivalent to US dollars such as the Canadian dollar). However, most US shareholders are concerned with their return in US dollars. Therefore, the exchange rate between these other currencies and the US dollar will influence the revenues (a weaker dollar means sales made in a foreign currency will be worth more in dollars and vice-versa), expenses (if the firm has expenses outside the US, a weaker US dollar will mean those expenses effectively cost more), and competition (a weaker US dollar means international firms will likely have to charge more in US dollars) for a US-based firm. The changing value of a currency may improve the value of some firms while lowering the value of others (depending on each firm’s particular exposure). While a firm’s value is greatly impacted by fluctuations in exchange rates, the exchange rate fluctuations are not something individual firms have the ability to influence. Thus, we can think of exchange rates as another important risk element that firms must manage.

Regulatory and legal ramifications

If a firm has operations in many different countries, than it also has numerous tax and other legal regulations that must be addressed. Tax codes, import/export regulations, and other costs of doing international business are an important element that firms must address. Legal business practices in one country may be illegal in another. Managing these legal factors can generate additional costs and exposes the firm to greater risk.

Language differences

To operate internationally, we must be able to communicate internationally. Multilingual employees are considered a valuable resource by firms that are doing business in many different countries. While translation software has made significant improvements over recent years, it is still not as accurate as a bilingual individual.

Cultural differences

Language is only one of the many cultural differences that firms undertake when operating internationally. Many other cultural differences develop that can drastically affect the effectiveness of our human resources, marketing, and general management strategies. What works in the US may not work in Mexico or Germany. We must respect the cultures of our customers and employees in order to be successful. Ignoring these cultural differences can result in lower efficiency within the firm and offending potential customers.

Political Risk

Political instability can make it very difficult to do business in a given country. This can range from the extreme case involving expropriation of a firm’s plant and equipment (a situation where the government claims the firm’s assets as their own) to subtle changes in the political climate that cause movements towards a more pro-business or anti-business regulatory environment.

Here is an article that looks at the biggest risks to international business.

Currency Issues

The current currency environment can best be described as a managed floating system. Following the collapse (in 1972) of the Bretton Woods System in which countries strived to maintain fixed exchange rates, the international community has allowed currency rates to be established primarily by market forces. Supply and Demand conditions operate on a daily basis to influence the level of exchange rates. Exchange rates fluctuate on a daily basis. However, government central banks may operate in the market in attempts to influence the movement in currency markets. This intervention is why it is sometimes referred to as a managed floating system as opposed to a pure floating system. It should be noted that government intervention is typically a very minor component in exchange rate fluctuations. One important implication of a floating system is that by allowing exchange rates to fluctuate on a daily basis, currency risk becomes an important element that firms must address.

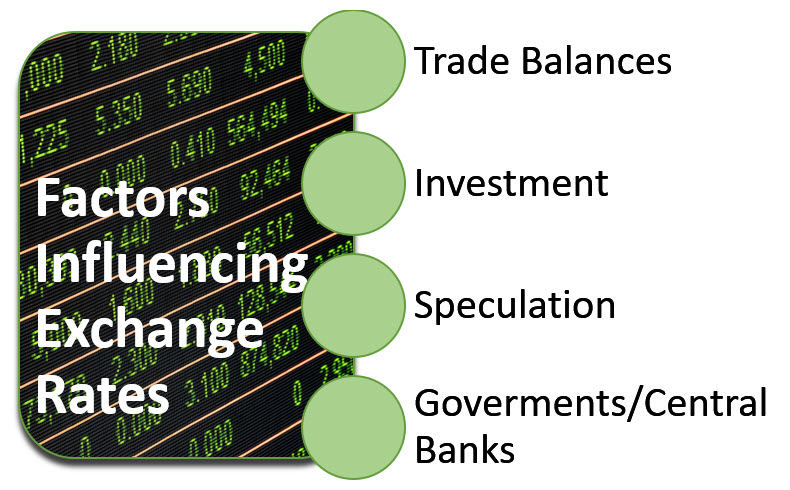

Factors Influencing Exchange Rates

In the above paragraph, we mention that supply and demand conditions are the primary factor setting exchange rates and leading to the changing values of currencies. What factors influence supply and demand and what impact do they have on exchange rates? There are too many forces that impact supply and demand to make an inclusive list, but here are a few examples.

In the above paragraph, we mention that supply and demand conditions are the primary factor setting exchange rates and leading to the changing values of currencies. What factors influence supply and demand and what impact do they have on exchange rates? There are too many forces that impact supply and demand to make an inclusive list, but here are a few examples.

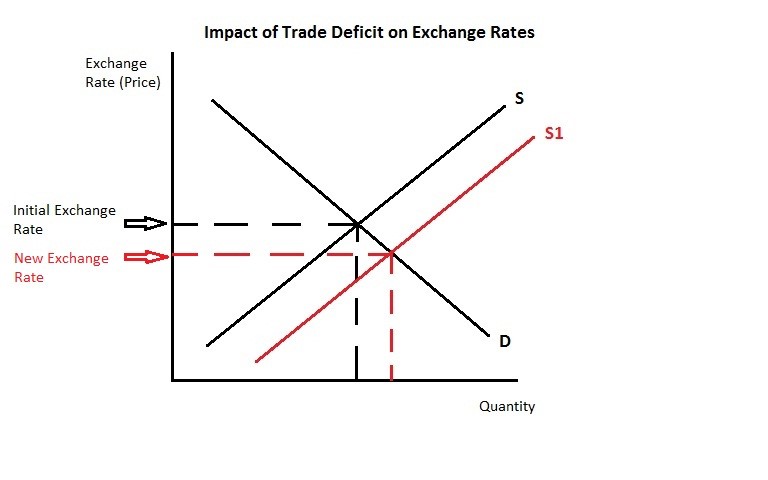

Trade balances

When foreign firms and consumers purchase US goods and services, there is demand for US dollars (either because the US firms demand dollars or because they convert the foreign currency to dollars after the transaction). When US firms and consumers purchase foreign goods, there is increased supply of US dollars in the marketplace (either because US importers are selling dollars to buy foreign currency or foreign exporters are selling dollars to convert to their home currency after the transaction). Thus, when the US runs a trade deficit, we should expect weaker US dollar (and vice-versa). See the diagram below, which illustrates the supply curve shifting out from S to S1 to reflect increased selling of US dollars and the subsequent drop in the exchange rate.

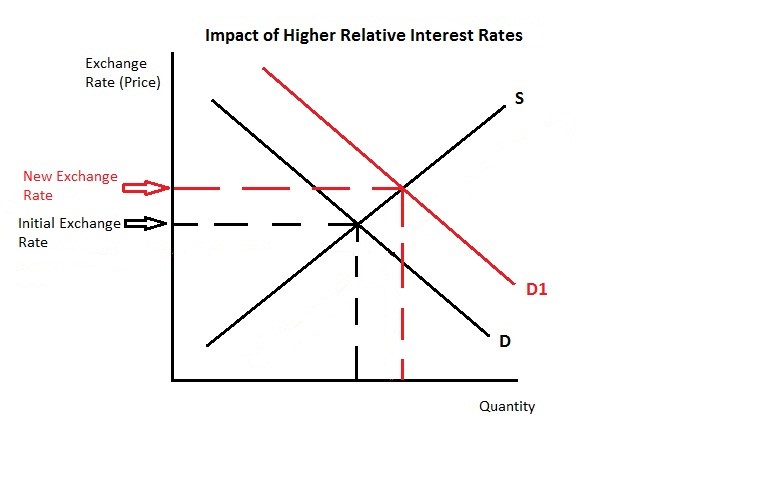

Investment

When foreign firms and individuals invest in the US (purchasing stocks/bonds, real estate, bonds, etc.), they need US dollars (creating demand for dollars). This is referred to as capital account activity. When US firms and individuals invest outside the US, the opposite situation develops (creating demand for foreign currencies). Thus, as investment flows into the US increase, the US dollar should get stronger (and vice-versa). As US interest rates and investment prospects increase, we would expect more net investment inflows into the US (and a stronger US dollar). As US interest rates and investment prospects decrease, we would expect more net outflows (and a weaker US dollar). See the diagram below, which illustrates the demand curve shifting up from D to D1 to reflect increased demand for US dollars due to higher relative interest rates in the US and the subsequent increase in the exchange rate.

Speculation

Sometimes supply and demand are driven by real economic forces (as in the two situations above) and sometimes by investor (currency speculator) psychology and expectations. For instance, if currency speculators anticipate that the US dollar is going to decline due to reduced demand or increased supply, then they will likely sell US dollars. This selling will result in increased supply and cause the value of the dollar to decline (assuming all other forces are held constant). Note that this looks like an easy way to make money. All a speculator has to do is to start buying US dollars and then the price will increase due to the increased demand that she created. However, several things make this much more difficult. First, she is one of many investors in the currency market and it is very unlikely she can buy/sell enough to move prices. Second, all the other factors impacting supply and demand are likely to dominate any influence her actions create. Third, even if she can raise the value of the US dollar by buying enough dollars, in order for her to profit she will need to sell them. If she made the price go up by buying, she will make the price go down by selling and offset her influence. Thus, any one speculator is not likely to influence prices. However as a group they will be one of the factors driving supply/demand.

Governments/Central Banks

The US Government (through the Treasury and Federal Reserve system) determine the monetary supply. Thus, they influence the amount of US dollars available in the markets (supply) and impact the value of the US dollar. Also, many foreign governments hold US dollars (as well as their own currencies) and can buy/sell these dollars (or change the supply of their currencies) to influence the market prices of exchange rates. Sometimes these actions are undertaken to influence exchange rates (the managed portion of the managed floating system) and sometimes they are done for other purposes (such as using monetary supply to influence inflation and economic activity).

Types of Currency Quotations

A direct quotation is an exchange rate stated to tell us how many dollars are required to purchase one unit of a foreign currency. For example, if we say that the exchange rate is .009132 $/yen, we know that it will cost $0.009132 to buy 1 yen. Alternatively, we could state the exchange rate as 109.50002 yen/$. This is an indirect quotation and tells us how many foreign currency units we can buy with one dollar. In this case, we can buy 109.50002 yen with $1. We can move from direct to indirect quotations by inversion. One divided by the direct quotation gives us the indirect quotation and one divided by the indirect quotation gives us the direct quotation. Use the link below to access several currencies relative to the US dollar during 2020 (as of the first day of each month).

Table: Foreign currency relative to US dollar in 2020

Currency Conversion

The process of converting from one currency to the next is relatively simple, but can also be confusing. Because currencies quotations can be presented in two ways (direct vs. indirect quotes) it is not always easy to remember if you should multiply by the exchange rate or divide by the exchange rate. One way to keep this straight is through labels. For instance, let us say we need to convert $400 US into British pounds. We know the exchange rate is 0.7280 pounds/dollar (an indirect quote). Since I want to know the value in pounds, I set this up as follows:

[latex](\$400)(\frac{0.7280 pounds}{\$1})=291.20 pounds[/latex]

Note that the “$” labels cancelled out with one in the numerator and one in the denominator, leaving me with pounds. What if I would have divided instead of multiplied?

[latex](\$400)(\frac{\$1}{0.7280pounds})=549.45 \$^2/pound[/latex]

Now, the dollars will not cancel out and I am left with “dollars squared/pound” which makes no sense. By leaving the labels in unless they cancel out, I can tell if I did my conversion correctly. This system will work for any currency conversion regardless of which direction I am converting (from foreign currency to US dollars or US dollars to foreign currency) or which quote format (direct or indirect) I am given.

Strengthening vs. Weakening Currencies

We often hear on the news about the US dollar strengthening or weakening and this concept has been mentioned a few times above. However, what does it mean, what are the implications, and how do we know if the dollar is getting stronger or weaker? First, let us look at what we mean by strengthening and weakening. We can think of exchange rates as prices — the price of one currency relative to another. If the US dollar is getting stronger relative to another currency, that means that it costs more of the foreign currency to purchase one dollar (or one dollar can buy more of the other currency than it could previously). In other words, the price of the dollar has gone up. If the dollar is weakening, then the price of the dollar has gone down and it takes more dollars to purchase a specific amount of foreign currency. Let’s look at two examples from the currency table above.

Example One – Indirect Quote

On October 1, 2020, the exchange rate was 0.8509 euros/$. A month prior (September 1, 2020), the exchange rate was 0.8370 euros/$. This means that on the starting month (September), one US dollar could buy 0.8370 euros. At the ending month (October), the same dollar could buy 0.8509 euros. Since each dollar buys more euros on Oct. 1st than it could on Sept. 1st, the US dollar has gotten stronger relative to the euro (or, alternatively, the euro has weakened relative to the dollar).

On October 1, 2020, the exchange rate was 0.8509 euros/$. A month prior (September 1, 2020), the exchange rate was 0.8370 euros/$. This means that on the starting month (September), one US dollar could buy 0.8370 euros. At the ending month (October), the same dollar could buy 0.8509 euros. Since each dollar buys more euros on Oct. 1st than it could on Sept. 1st, the US dollar has gotten stronger relative to the euro (or, alternatively, the euro has weakened relative to the dollar).

Example Two – Direct Quote

On October 1, 2020, the exchange rate was $1.1752/euro. A month prior (September 1, 2020), the exchange rate was $1.1947/euro. This means that on the starting month (September), a single euro could buy $1.1947. At the ending month (October), the same euro could buy $1.1752. Since each euro buys fewer dollars on Oct. 1st than it could on Sept. 1st, the euro has gotten weaker relative to the US dollar (or, alternatively, the US dollar has strengthened relative to the euro).

Note that the exchange rates used in example one and two are exactly the same, just presented in a different format. However, some students try to focus only on the number and not the meaning of the exchange rate and this can cause problems. In the first example, the number got larger (0.8370 ⇒ 0.8509) and in the second example, the number got smaller (1.1947 ⇒ 1.1752). However, in both cases the US dollar got stronger relative to the euro. Be sure to think of what the numbers represent (dollars per foreign currency or units of foreign currency per dollar) and not just on whether the number got larger or smaller.

One thing to keep in mind here is that currencies are a relative price. The price of the US dollar in yen (the yen/dollar exchange rate) is different from the price of the US dollar in euros (the euro/dollar exchange rate). Therefore, it is important when we talk about the US dollar getting stronger or weaker to be precise and say what currency it is stronger or weaker relative to. The US dollar may strengthen relative to the yen while weakening relative to the euro. Look at the month from May 1, 2020 to June 1, 2020. Each dollar bought fewer euros (0.8991 euros in June vs. 0.9093 euros in May). Meanwhile, each dollar bought more yen (107.5741 yen in June vs. 106.7809 yen in May). Therefore, during this time period, the dollar weakened relative to the euro (dollar buys fewer euros) and strengthened relative to the yen (dollar buys more yen).

Second, we need to look at the implications. Who benefits from a stronger US dollar? Who benefits from a weaker US dollar? Let’s start with a disclaimer. The effects of changing exchange rates are often complex and impact a variety of economic factors (some of which feed back to the exchange rate itself). Therefore, think of these as the primary (or first-level) impacts.

- US-based consumers will typically benefit from a stronger US dollar. The stronger dollar means that it is now cheaper for US consumers to buy imported goods. This may also cause US firms to lower prices to stay competitive. A weaker US dollar will typically increase the costs of goods and services for US-based consumers.

- US-based firms will typically benefit from a weaker US dollar. A weaker dollar means that foreign firms will become less competitive. Also, exports will be cheaper to foreign customers (as each unit of foreign revenue buys more US dollars). A stronger US dollar will typically have a negative impact for US-based firms.

- Foreign-based firms will typically benefit from a stronger US dollar. The stronger dollar means that each dollar in revenues they receive in US markets translates into more revenues in their home currency.

- US-based investors in international markets will typically benefit from a weaker US dollar. Their investment returns in these foreign markets will need to be converted back into dollars. A weaker US dollar means each unit of foreign currency earned as investment income will buy more US dollars, increasing their return in US dollars.

- Foreign-based investors in US markets will typically benefit from a stronger US dollar. As the dollar strengthens, each dollar received in investment income will buy more of their home currency, which increases their rate of return in their home currency.

Cross Currency Exchange Rates

If we know the exchange rate between currency one and the dollar and we know the exchange rate between currency two and the dollar, we can get the exchange rate between currency one and two. For example, let us assume that we know the following two exchange rates: 21.99704 pesos/$ and 0.899054 euros/$. What is the euro/peso exchange rate?

[latex](\frac{0.899054 euros}{\$1})(\frac{\$1}{21.99704 pesos})=0.040872 euros/peso[/latex]

Note: One key to converting currencies is to make sure the units in your final answer make sense. If the dollar in the numerator cancels out the dollar in the denominator, we know we are doing it right. Let’s walk through another example. Assume that the exchange rates are given as direct quotes ⇒ $0.045461/peso and $1.112281/euro and I asked for the euro/peso exchange rate. Again, you want to make sure the dollars cancel out and you are left with euros in the numerator and pesos in the denominator so it would be set up as follows:

[latex](\frac{\$0.045461}{1peso})(\frac{1euro}{\$1.112281})=\frac{0.045461euros}{1.112281pesos}=0.040872 euros/peso[/latex]

Spot vs. Forward Rates

The Spot Rate refers to the exchange rate for a transaction to take place today. Alternatively, the Forward Rate refers to an exchange rate that is set today, but the transaction does not take place until a later date. The spot and forward rates will rarely be equal and the difference is typically based on interest rate differentials between the two countries. Forward rates (and associated forward contracts) provide a way for firms to reduce (hedge) their exchange rate risk by locking in an exchange rate. Consider a US firm that agrees to sell 10,000 widgets to a German firm for 125,000 euros on credit with the payment being due in 2 months. The US firm is now subject to exchange rate risk (if the dollar strengthens, the euros will be worth less at the time they are received). By entering into a forward contract that allows them to exchange euros for dollars at the agreed forward rate, they no longer have this exchange rate risk as they now know exactly how much the 125,000 in euros will be worth when payment is received in 2 months.

Hedging vs. Speculating

Hedging is the process of entering into a forward, future, option, or swap contract to offset a natural risk position (note – there are also ways to hedge risk exposure without the use of derivative contracts). The object is not to make a profit, but to eliminate risk. One example would be a US company that knows it will need to make a payment of 2,000,000 yen six months from now purchasing a forward contract to exchange dollars for yen in six months at forward rate set today. Entering this contract allows the company to eliminate the natural risk arising from their currency situation. While the spot rate of exchange may be more or less favorable in six months when the payment is due, this is not relevant. What is relevant is that the exchange rate fluctuation had no impact on the dollar cost of that payment because it had been hedged away with the use of the forward contract.

Speculation is the process of entering into a forward, future, option, or swap contract in an attempt to generate a profit. This type of transaction creates risk where none previously existed. For instance, if a speculator thought that the US dollar was going to get weaker in the near future relative to the euro (the euro price in dollars would increase), he might enter into a futures contract which would allow him to buy euros at a price set today (the futures price). If he was right and the dollar did indeed get weaker relative to the euro, his futures contract would increase in price and he would make a profit. If he was wrong and the dollar got stronger relative to the euro, his futures contract would decrease in price and he would lose money. Therefore, he has created a situation where he will make or lose money based on the dollar/euro exchange rate — creating a risk position in an attempt to make a profit.

The primary contracts for hedging and speculating in currencies are forward, future, swap, and option contracts. The characteristics of each are quite different. Some (futures and options) are tools for both individual investors and institutions while others (forwards and swaps) are institutional contracts. Also, the risk, complexity, and costs can vary across the contracts. For this class, you will not need to know the differences across these instruments. The following information describing the basics of each contract.

Forward Contracts

Forward contracts are negotiated instruments (size, pricing and expiration date are determined between the parties involved in the contract). They are a legal agreement in that we are bound to carry out our contract regardless of whether it is profitable for us. There are no money flows taking place in forward contracts until the expiration. Also, forward contracts tend to be used primarily by large creditworthy corporations. Individuals do not use forward contracts.

Futures Contracts

Futures contracts are standardized instruments. They have a set expiration date and contract size. Prices are determined in financial markets. They are also a legal agreement that we are bound to carry out (or settle) regardless of whether it is profitable for us. Money flows take place throughout the contract period as gains/losses are settled on a daily basis (referred to as “marked-to-market”. Futures contracts can be used both by corporations and individuals and typically involve significant leverage.

Swap Contracts

Swap contracts are negotiated instruments between the parties involved in the contract. In a swap, parties agree to exchange cash flows associated with specific assets. For example, company A in Japan may issue a bond in its home market in yen. Company B in the US may issue a bond in its home market in dollars. Then, they agree to swap the interest payments so that the US firm’s interest expense is in yen while the Japanese firm’s interest expense is in dollars. This is attractive if the Japanese firm has some revenues in dollars and the US firm has some revenues in yen. By matching their revenues and expenses in the same currency, they reduce their overall currency risk.

Options Contracts

Options contracts are standardized instruments. They have a set expiration date and contract size. Prices are determined in the financial markets. The give the option holder the right to buy (a call) or the right to sell (a put) at the contract expiration if the holder of the option chooses to do so. If the currency fluctuation is in the option holder’s favor, the option will be exercised. If the currency fluctuation is against the option holder, the option will expire worthless (costing the option holder the initial price paid to purchase the option).

International Investing

While the majority of people invest in stocks and bonds from their home country, there are reasons to consider investing at least a portion of one’s assets with an international perspective. International investing may be beneficial due to increased diversification benefits and more opportunities. Complications with international investing can include currency issues, tax complications, information, and potentially greater risk. However, there are also ways to invest internationally while reducing the complications.

There has been ample evidence to document that international stock and bond markets do not always move in the same direction. Therefore, the correlations across the various national markets are less than one. See Table: Correlations, Returns and St. Deviations Across National Equity Markets (table based on returns from single country exchange traded funds from January 2011 – December 2020). If you remember from Chapter Seven, we can reduce the risk of our portfolio by investing in countries that have low correlations with our home markets. While these risk reductions are real, there is also evidence to suggest that the correlations are highest at the times when markets are crashing. This means that the diversification benefits are smallest when they are needed the most.

Another reason to invest internationally is the increased opportunities. There are many great companies that exist outside the US. By expanding our horizons to include these companies, we can develop stronger portfolios. Also, some developing and emerging markets might offer the opportunity for higher returns (although likely with more risk) that might appeal to many investors. Note that returns vary significantly from country-to-country across time period. Therefore, while the US appears to be the dominant market in the table above (with the highest average return and virtually lowest standard deviation), that does not imply that it will (or won’t) be the dominant market over the next 5-10 years.

While there are advantages to investing internationally, it can also lead to many complications. Countries outside the US don’t follow the same Generally Accepted Accounting Principles (GAAP) and thus financial statement analysis can be challenging. Also, tax complications can occur when profits are made in other countries. Additionally, we have currency issues to worry about as investing in different countries means investing with different currencies and introducing exchange rate risk (the table above is reported based on US dollar returns). Finally, getting information and trading while the markets are open can sometimes be a challenge.

If we do decide to invest internationally, there are a few different ways to accomplish this.

International Mutual Funds and ETFs

International mutual funds allow us the advantages of international investing while letting a professional manage the currency, tax, and information issues. In addition to traditional mutual funds, there are Exchange Traded Funds that allow us to purchase a basket of stocks from a specific country that represent an index of that country’s stocks. Note that while mutual funds eliminate the hassle of currency conversion, they are still affected by currency fluctuations.

Direct International Purchases

Most large brokerage firms allow their customers to make purchases of stocks outside the US. However, these purchases need to be made in a foreign currency which entails an additional transaction. In addition, investors may face additional tax issues. Finally, due to time differences, many foreign exchanges are open during inconvenient hours for trading. These complications make direct international purchases the most difficult method of international investing.

US Listed (ADR’s) International Stocks

Many international companies are listed on the US exchange. Many of these are structured as American Depository Receipts (ADR’s). These allow us to buy stock in many foreign firms (Nokia and Sony for instance) in the US markets. This eliminates many of the extra hassles. Specifically, our purchases are in dollars and trading takes place during normal US hours. As with the International Mutual Funds, the currency risk is not eliminated, merely the need for trading in different currencies.

Multinational Firms Based in the US

Finally, we might be able to get some of the same benefits by investing in companies with substantial international activities. For instance, Coca-Cola gets a substantial amount of its revenues and profits from outside the US and thus might provide us with some international diversification. Unfortunately, it appears that the benefits from investing in Multinationals are not as good (from a diversification standpoint at least) as other strategies for investing internationally.

Key Takeaways

Finance, like other areas of business, is a global discipline. In order to achieve the goal of maximizing shareholder wealth, it is necessary for management to consider the role of international opportunities for production and marketing of goods and services. However, engaging in international operations introduces additional risks, one of which is currency risk. Given that most major currency markets operate on a floating rate system, the US dollar will strengthen and weaken relative to other currencies over time based on trade balances, international capital flows, interest rates and many other factors. These currency fluctuations provide advantages and/or disadvantages to different parties. It is essential that financial decision makers understand how to interpret currency fluctuations and how to manage the risk associated with these fluctuations. In addition, investors also need to consider the role of international markets into their investment allocations. Adding international stocks and bonds to a portfolio can provide diversification benefits and increase the potential returns. However, it also provides additional complications in the form of currency risk, information risk, and taxes.

Exercises

Question 1

What are some risks associated with doing business internationally? Given these risks, why do companies engage in international business?

Question 2

Your instructor has argued that the current international currency market could best be described as a managed floating rate system. Explain what is meant by this. Also, do all countries follow this model?

Question 3

Differentiate between a spot and forward exchange rate.

Question 4

If Citigroup (one of the largest banks in the world and based in the US) makes loans to a German corporation in Euros, which would they benefit the most from — a weaker or stronger US$ (with regard to the German loans)?

Question 5

Briefly discuss how an increase in the value of the US Dollar could impact

5a. A US investor with significant foreign investments

5b. A foreign investor with significant US investments

5c. The US Consumer

5d. A US-based manufacturer that sells its products internationally

5e. A foreign-based manufacturer that sells its products in the US

Problem 1

We are considering the purchase of some parts from a German manufacturer. The German manufacturer wants us to pay 2,000,000 Euros. If the current exchange rate is 0.7347 Euros/$, how much will the parts cost in dollars?

Problem 2

Our sales staff has reached an agreement to sell our product to a large customer in Argentina. Normally the product sells for $455 per 25 units. How much must we charge in Argentina Pesos in order to get the same price? Assume that the exchange rate is 3.0875 Pesos/$?

Problem 3

Today the exchange rate is 1.1304 Canadian Dollars per US$. Last year, the exchange rate was 1.0422 Canadian Dollars per US$. Has the US$ strengthened or weakened relative to the Canadian Dollar over the last year?

Problem 4

Today the exchange rate is $0.0308 per Thai Baht. Last year the exchange rate was $0.0267 per Thai Baht. Has the US$ strengthened or weakened relative to the Thai Baht over the last year?

Problem 5

We know that the Japanese Yen/US $ exchange rate is 118.43 yen/$. Also, the Mexican Peso/US$ exchange rate is 10.998 pesos/$. What is the yen/peso exchange rate? What is the peso/yen exchange rate?

Solutions to CH 11 Exercises

Student Resources

Table: Foreign Currency relative to US dollar in 2017

Table: Correlations, Returns and St. Deviations Across National Equity Markets

Attributions

Image: Globalization by TheDigitalArtist licensed under CC0

Image: Currency Exchange by Clker-Free-Vector-Images licensed under CC0