14

Dr. Kevin Bracker, Dr. Fang Lin and Jennifer Pursley

OBJECTIVE – The purpose of this handout is to walk you through the topic of financial statement analysis. This should be used as a supplement to the online text chapter on Financial Statement Analysis.

LEARNING OBJECTIVES

After completing this tutorial, students should be able to

- Discuss the purpose and key issues associated with the income statement, balance sheet, and statement of cash flows

- Identify the three components of the statement of cash flows and interpret each of the three components

- Calculate and interpret key financial ratios

- Calculate and interpret a common size income statement and common size balance sheet

- Discuss and apply the concept of trend analysis, including both its strengths and weaknesses

- Discuss and apply the concept of comparative analysis, including both its strengths and weaknesses

- Identify key users of financial statement analysis

- Identify potential strengths and weaknesses for a firm, given financial statements for the firm and industry (or competitor)

- Discuss and interpret the many issues associated with financial statement analysis (such as seasonality, context, etc.)

Introduction

One of tools that finance professionals have at their disposal for analyzing the health and performance of corporations is financial statement analysis. Financial statement analysis can be used by a variety of people for different purposes. Some examples are presented below:

Company (and competitor) management

Company (and competitor) management can use financial statement analysis to identify the firm’s (or the firm’s competitor’s) strengths and weaknesses. Knowing this information can improve management’s ability to make strategic decisions that improve financial performance and the value of the firm.

Stock Investors

Stock investors (both current stockholders and potential stockholders) can use financial statement analysis to evaluate the potential risks and rewards of owning the stock, make forecasts of future performance, and help them determine if the stock prices are overvalued, undervalued or fairly valued.

Short-term Creditors

Short-term creditors (such as suppliers and banks) can use financial statement analysis to evaluate the ability of a firm to repay their loans before they extend credit.

Bond Investors

Bond investors (both current bondholders and potential bondholders) can use financial statements to evaluate the ability of the firm to make all the promised coupon payments and the maturity payment at the bond’s maturity. This can help bond investors decide if the expected return that they anticipate earning on the bond is sufficient to compensate them for the risk.

All of these parties place their emphasis on different aspects of financial statements and use different tools to develop the information that helps them with their decision process.

Financial Statements

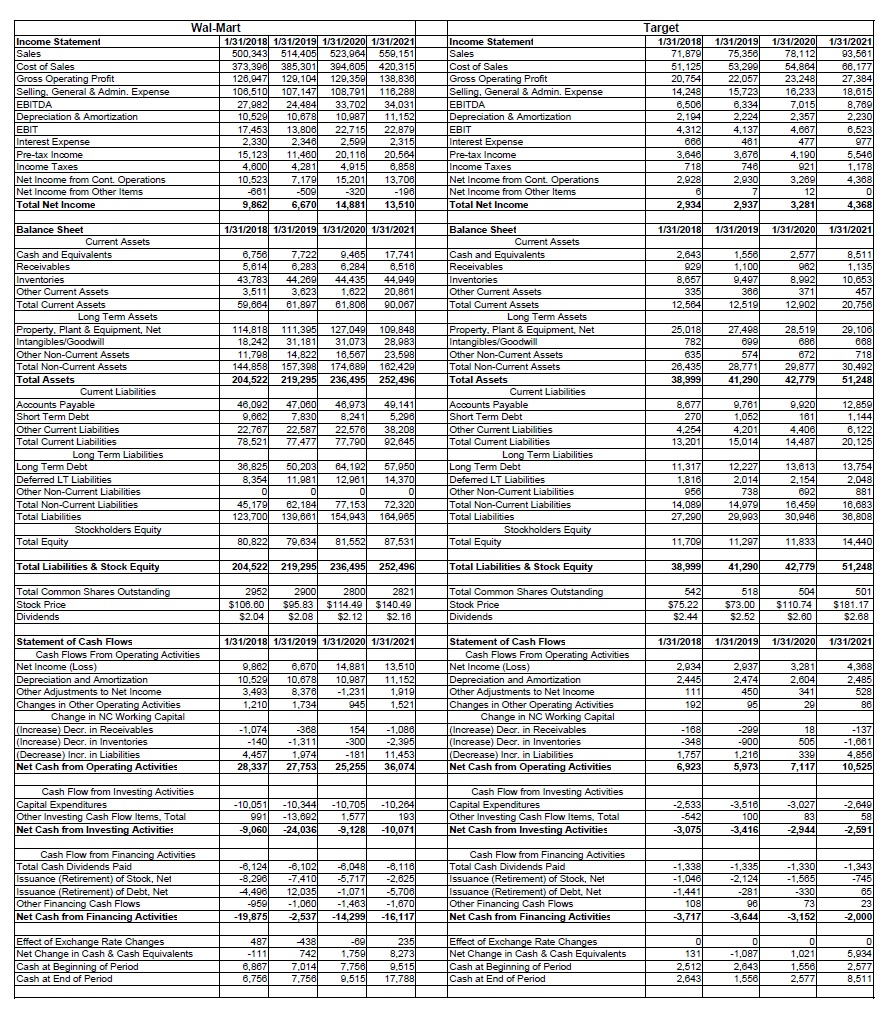

There are three key financial statements that we will focus on in our coverage of financial statement analysis – the income statement, the balance sheet, and the statement of cash flows. I have included information from these three statements from the 2017 fiscal year for Wal-Mart (WMT) and Target (TGT) with data pulled from Yahoo!Finance. Financial Statements are reported according to Generally Accepted Accounting Principles (GAAP). The advantage of a source like Yahoo!Finance is that they put the reports into a standard format for easier comparison. The disadvantage is that they do not contain the full statements as reported in the annual reports along with the footnotes. In order to do a professional-quality financial statement analysis, it is critical that you read through the annual and/or quarterly reports (10-K and 10-Q documents) so that you know not only what numbers are reported, but the details behind those numbers. This information will not be seen in summary reports like presented in Yahoo!Finance or other common repositories of financial statement information.

Income Statement

The income statement is designed to provide information related to a company’s revenues (sometimes called sales), expenses, and profits.

The income statement is presented on an “accrual” basis. This means that revenues are recognized as they are earned and expenses are recognized as they are incurred. This is very different from a “cash” basis which looks at when money is received or spent. For example, consider a company that manufactures and sells widgets. When this company purchases a large piece of equipment to manufacture their widgets, they will record the expense of the equipment spread out over its lifetime (usually several years) instead of recording it when the equipment is purchased. Now, let’s assume that a customer purchases 1000 widgets on credit and doesn’t have to pay until 3 months after the purchase. The revenue is still recorded at the time of the sale, even though no money was received. Being aware of these accrual concepts and their implications is very important from a finance perspective because in finance we are focused on cash. While accrual accounting does a good job of capturing a firm’s performance, it can distort timing and have an impact on valuation analysis due to the time value of money.

The income statement captures a firm’s performance OVER time. This means that all transactions during the period are treated equally regardless of when they occur within the period. For instance, if I am preparing an annual income statement, sales made at the start of the year are no different than sales made at the end of the year. All transactions related to revenues and expenses are a part of the income statement as long as they occurred in the period.

Balance Sheet

The balance sheet is designed to capture information about a firm’s assets, liabilities, and equity at a point in time.

- Assets represent things the firm has. These can be long-term assets (such as property, plant, and equipment) or current assets (such as cash, accounts receivable, and inventory).

- Liabilities represent what the firm owes and can also be long-term (such as bonds the firm has issued) or short-term (such as short-term loans, accounts payable, or accruals).

- Owners’ equity represents what belongs to the shareholders. This is often broken down into what was originally contributed when the firm issued the shares and retained earnings (profits that have not been paid out in dividends – note that retained earnings are an accounting tool and do not represent cash that the company is holding).

A fundamental relationship in the balance sheet is the following formula Assets = Liabilities + Owners’ Equity. Firms finance their assets through debt (liabilities) or equity. Everything that the firm has (its assets) minus its debt obligations (liabilities) belongs to the stockholders (equity).

The Balance Sheet tends to understate the true value of the firm’s assets (and, in turn, the equity). The reason for this understatement comes from a couple of sources:

Assets are reported on the balance sheet at historical cost minus accumulated depreciation. This may be different than the market value of the asset.

Some assets (such as land) tend to appreciate in value over time.

Some assets do not depreciate on an economic basis as fast as they do on an accounting basis.

Some assets are more valuable in their cash-flow generating capability as they are employed by the firm then what the firm paid for them.

Intangible Assets are not recorded on the balance sheet unless they are purchased (such as in an acquisition). Intangible assets are things like brand name, copyrights, patents, etc. They have important economic value in that they help firms generate cash flows, however they typically are not purchased and therefore are hard to value from an accounting standpoint. (Note – Both Pepsi and Coca-Cola have Goodwill and Other Intangible Assets on their Balance Sheets. These are primarily derived from purchases of many smaller companies over their corporate lives and are not capturing the FULL value of the intangible assets these companies possess.)

For many companies, their brand name and reputation are among their most valuable assets. Consider a company like Nike. People pay more for their products partially due to the brand name. Coke sells for more than generic cola because people identify with the name brand.

Patents and copyrights can be valuable due to the pricing power that they provide, however, the value of these will vary significantly based on the specific patent and copyright. Some may be worth millions and others may be virtually worthless.

Some activities that are treated as expenses (such as marketing, research and development, employee training, etc.) can create intangible assets.

The Balance Sheet reflects a POINT IN TIME. It represents the firm’s assets, liabilities, and equity on a specific date. If a firm makes its payroll payment one day before the balance sheet is prepared, the cash account may appear low. If it is ready to make the payroll payment one day after the balance sheet is prepared, the cash account may appear high. Several items on the balance sheet (mainly current assets and current liabilities) will vary significantly throughout the year, so the seasonality factor in balance sheets will be high. Also, if a firm borrows a large sum of money one week after the fiscal year starts and pays it back one week before the fiscal year ends, this transaction will not have any direct impact on the annual balance sheet.

The Statement of Cash Flows

The Statement of Cash Flows is designed to present the firm’s income on a cash basis and to show where cash flows came from and went to during the period.

The Statement of Cash Flows has three main components – Cash Flows from Operating Activities, Cash Flows from Investing Activities, and Cash Flows from Financing Activities.

Cash Flows from Operating Activities

CF from Operating Activities measures the firm’s operating income on a cash flow basis.

Starts with net income and then adjusts to remove accrual-based impacts.

For a healthy company, we want to see this be positive and growing over time. If a company cannot earn positive cash flows from its operating activities, it will not be able to stay operational over time. Also, companies strive for growth. If it is not positive and growing over time, we want to see (A) a reasonable explanation and (B) a plan for moving towards a positive and growing cash flow from operating activities.

Often, young firms lose money during their first few years. If the firm has negative CF from operating activities due to it being young, it is important that we see the values moving towards a positive level. We also want to make sure the firm has enough capital and/or access to additional capital to stay alive until it starts generating positive cash flows from operating activities.

Sometimes when there are industry problems or the economy enters a recession, many normally healthy companies will see a decline in (or even negative) CF from operating activities. If this happens, we want to make sure that it is a short-term issue and is correctable.

Cash Flows from Investing Activities

CF from Investing Activities looks at cash outflows associated with purchasing new property, plant and equipment (PPE) along with other long-term investments. Also, cash inflows from selling existing PPE and other LT investments will fall in this category.

Cash Flows from Investing Activities will typically be negative for almost every company. In order to grow over time, companies need to spend on long-term assets which causes the cash outflows in this category to outweigh cash inflows in most cases. However, if CF from Investing Activities is growing more negative over time without seeing CF from operating activities also increasing at the same rate or better, this is likely a problem.

Cash Flows from Financing Activities

CF from Financing Activities looks at cash outflows from repaying existing debt, buying back shares of stock, and paying dividends along with cash inflows from issuing new debt or issuing new shares of stock.

CF from Financing Activities often tells us more about where a company is in its life cycle than it does about the company’s health (although negative cash flows from financing activities are preferred to positive values, all else equal).

Young firms will typically have positive CFs from Financing Activities as they are spending more on LT investments than they are bringing in from operations. This difference must be financed by borrowing or issuing new equity.

Rapidly growing firms will typically have positive CFs from Financing Activities as they are spending significant amounts on Property, Plant, and Equipment and other LT Investments to support the growth. Often, not all of this growth can be financed from operating CFs and must come from financing.

Older, established firms will typically have negative CFs from Financing Activities as they are generating significant CFs from Operating Activities and can use the excess cash to pay off existing debt, buy back existing shares of stock, or pay dividends.

Financial Statements for Walmart & Target from Appendix B

Financial Ratios

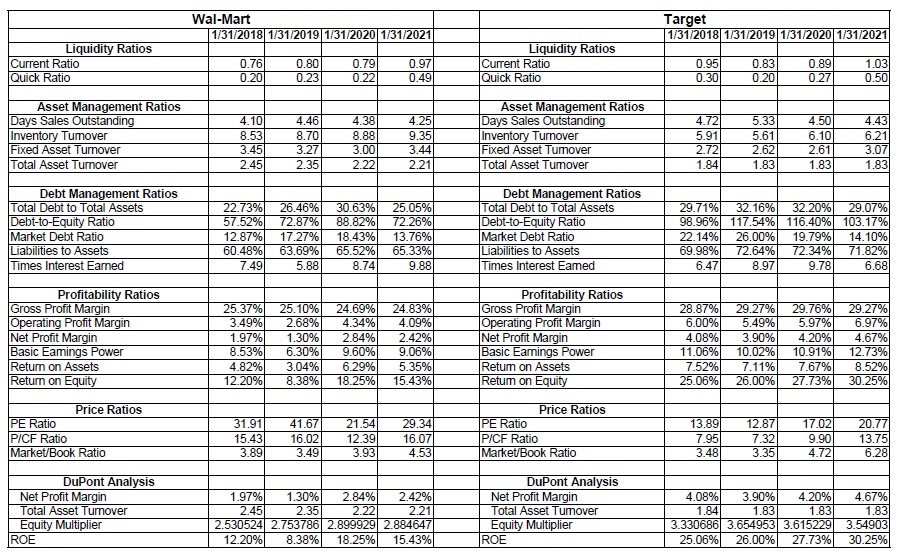

In addition to this handout, the chapter includes a list of key financial ratios along with their formulas. Also see Explanation of Ratios in Appendix B for explanations and interpretations of these ratios. Note that the ratios covered in this class are a subset of financial ratios and not an inclusive list. Financial ratios are a tool that allows us to use information from the Income Statement and Balance Sheet to look at specific issues associated with a company’s financial health. Using the Wal-Mart and Target financial statements, we have prepared ratios for their fiscal years 2017 through 2020. We would encourage you to calculate at least one year of these ratios for practice). Here are the results of all the ratio calculations:

Financial Statements for Walmart & Target from Appendix B

When conducting analysis of Wal-Mart, having the financial ratios for Target is critical for comparative analysis (ideally you would use the industry averages, however in this situation Target makes a nice comparison as they are a similar competitor). Also, we have included four years of data so that we can do some trend analysis. Be sure to read the online text for more discussion on trend analysis and comparative analysis. Both trend and comparative analysis are essential for providing some of the context necessary for financial statement analysis. Note that we say “some” of the context, as it is also important to really understand the specific companies under analysis, their strategies, and the overall economy to get the most out of looking at ratios and common size statements.

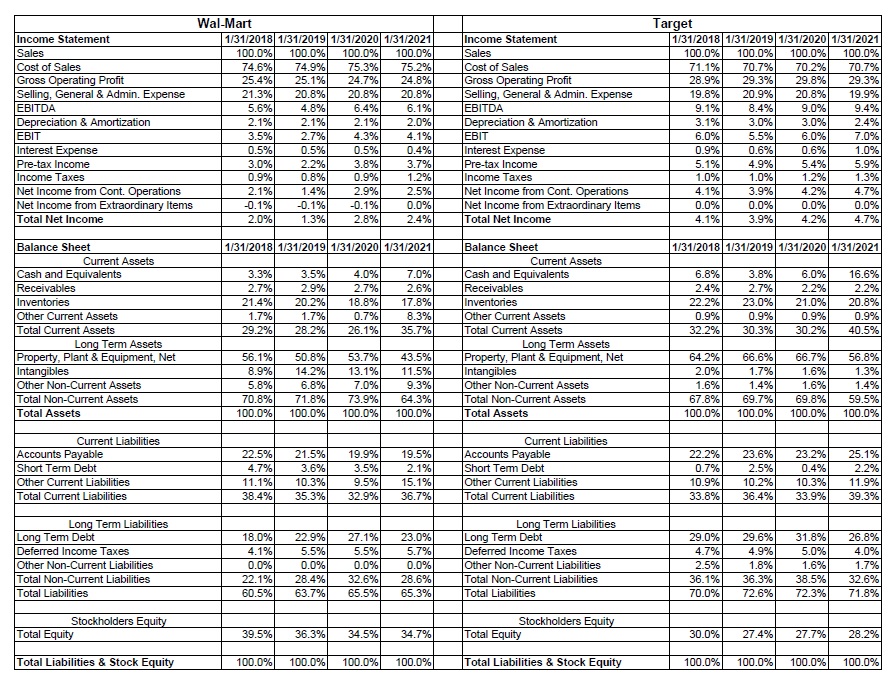

Common Size Statements

Common Size Statements are designed to present each line item in the income statement as a percentage of total revenues and each line item in the balance sheet as a percentage of total assets. This makes it easier to compare changes from year to year and from one company to the industry. For instance, below you will find common size income statements and common size balance sheets for Wal-Mart and Target. Be sure you understand how these statements are generated.

Financial Statements for Walmart & Target from Appendix B

When you look at these statements, you can quickly see two important pieces of information. First, Wal-Mart has seen their cost of sales increase over the first three years and then decrease in the last year (albeit only slightly) which indicates that Wal-Mart is taking steps to manage their costs. The second item is that Target’s cost of sales is much lower than Wal-Mart’s each year. These comparisons are much easier to see on a percentage basis than they would be when just looking at the dollar values in the original financial statements. As a potential investor (or management), the next step would be to try to understand what is driving this. Is Wal-Mart doing a better job of negotiating terms with suppliers? Is there ordering and distribution system resulting in more efficient inventory management? Are they able to raise prices slightly? Is Target more efficient than Wal-Mart with respect to inventory costs or are they able to charge higher prices? Remember that financial statement analysis doesn’t really identify and fix specific problems. Instead, it is a starting point that tells us where there MIGHT be a problem. Once we dig deeper we can then identify if there is a problem and how we might go about trying to address it. We will come back to these specific concerns with cost of sales in a little bit.

One issue that you will often find when developing common size statements for comparative analysis is that most companies follow slightly different formats for their income statements and balance sheets. In order to create common size statements for comparative analysis, there are two approaches. One is to obtain financial statements from a source such as finance.yahoo.com (as I did for this handout) which standardize all financial statements into a standard format. Alternatively, you can obtain the financial statements from each firm’s annual report and make your own judgments as to how to form them into a standard format. While the first approach is easier, if you are doing a formal financial statement analysis, it is essential that you do read through the financial statements in their annual report rather than just pull up the statements from a source like Yahoo!Finance. The reason for this is that the annual report will explain all the accounting issues associated with the numbers so that you can better understand the story behind the numbers.

Analysis Using Financial Ratios and Common Size Statements

Conducting financial statement analysis using ratios and common size statements is as much of an art form as it is a science. These tools provide us with a quick way to skim the surface and identify areas that need to be explored in further detail. Contrary to popular opinion, the ratios and common size statements are the STARTING points for identifying strength/weaknesses, not the ENDING points. They help raise red flags over stuff that needs further investigation and identify POTENTIAL strengths and weaknesses. There are many reasons why something that appears to be a weakness may not really be a problem for the firm or something that appears to be a strength be more illusion than real competitive advantage. As has been stated a few times previously, it is critical that you understand the story behind the numbers (the context) in order to adequately use them.

A Quick Example of Ratio/Common Size Analysis for Wal-Mart

Let’s look at Wal-Mart and do a quick glance for potential strengths and weaknesses using ratios and common size statements.

Potential Weaknesses

Selling, General and Administrative Costs

Over the four-year time frame, Wal-Mart has seen their SGA costs decrease from 21.3% of sales to 20.8% of sales. While this is not a huge movement, keep in mind these lower costs directly impact the final margin. As Wal-Mart’s net profit margin was 2.4% or more each of the last two years, it is easy to see that this decline in SGA expenses is having a noticeable impact on the bottom line. Also, while Wal-Mart had more than a 150-basis-point (100 basis points = 1%) disadvantage in SGA relative to one of their larger rivals (Target) at the start of the analysis period, it was able to close the gap in the following years. This is another indication that SGA costs are a concern for Wal-Mart. Now, the key is to figure out why these costs are declining. Is it a sign of efficiency or is Wal-Mart intentionally decreasing spending in this area but lose other advantages?

Accounts Payable

We want to be careful calling this a “weakness” as having higher accounts payable could be a sign that we are struggling to repay our inventory purchases or it could be a strategy to improve our cash flow (by hanging onto our cash a little longer). However, the fact remains that the accounts payable as a percent of assets has been increasing over the last few years. It would be worthwhile for analysts to get a good understanding of why.

Profitability Ratios

As mentioned earlier, Wal-Mart has seen its SGA expenses decline as a percentage of sales. This in turn has had a positive impact on their profitability ratios. The net profit margin (which we can see as both a ratio or in the common size statements) has improved (albeit in a volatile way) over the four-year window. Their return on assets and return on equity have also increased over this time-period. While we know the key reason for the increase in profitability (lower SGA expenses) it is not clear whether the trend can continue. That said, awareness of the issue can be useful to management/investors.

Net Income

Wal-Mart has seen their net income decline by more than 30% in FY2018 with a dramatic rebound in FY2019 and FY2020. While part of the volatility can be explained by the COVID-19 pandemic, this is still something that should draw the attention of both management and current/potential stockholders.

Potential Strengths

Days Sales Outstanding

If we look at Wal-Mart’s DSO ratio, we can see a couple of things. First, the ratio itself is quite low as it takes them less than 5 days on average to collect their credit sales. Second, it also has declined over the past few years.

Inventory Turnover

Wal-Mart has seen their inventory turnover ratio increase slowly over each of the past four years. Importantly, it is also significantly higher than one of their primary competitors (Target). This indicates that Wal-Mart does a good job of moving through their inventory and not building up excess inventory. Maintaining a high inventory turnover ratio helps avoid spoilage costs and frees up financing costs as the firm has less time with “dead” money invested in inventory that is either sitting on store shelves or in the warehouse.

Fixed and Total Asset Turnover

While there is a slight downtrend in the asset turnover ratios, the real advantage is seen in comparison to Target. Wal-Mart does a much better job of generating sales from its investment into assets. One thing that should be noted is that some of this could be tied to strategy. Remember that Wal-Mart had a notably higher cost of sales than Target did. One explanation for this is that Wal-Mart is pursuing a lower-margin, higher-turnover strategy while Target is pursuing a higher-margin, lower-turnover strategy. This is not an argument that one strategy is better than another, but instead is a way for the two firms to create a little differentiation in their markets.

Cash Flow from Operating Activities

While Wal-Mart’s net income has declined noticeably over the past two years, their cash flow from operating activities has increased rather significantly over the past three years. Given some of our issues with net income, this may be more relevant. On the other hand, it may be a little misleading. For example, over the past year, Wal-Mart has seen their inventory drop by a little over a billion dollars and their liabilities increase by about $5.5 billion. Are those sustainable changes? Probably not. This may lessen the importance of the increase in cash flow from operating activities over the past year and without those changes, we could be looking at a net decline over the past two years.

Other

From the cash flow from financing activities portion of the statement of cash flows, we can see that both firms have been active in buying back shares of their own stock over the past few years. This is not a strength or weakness, but a way to return cash to shareholders (in that these firms use buybacks as a partial substitute to paying higher cash dividends).

Similarly, both companies have been engaged in retiring their debt over the past few years, although Wal-Mart had a big net increase in debt in FY 2018. The fact that cash flow from operating activities has been significantly higher than the outlays these firms have allocated to cash flow from investing activities, they have had significant ability to pay dividends, buy back shares of stock, and pay back portions of their long-term debt.

Other Issues with Financial Statement Analysis

Seasonality

When dealing with quarterly financial statements, we must be aware that many firms face seasonal patterns that can cause the numbers to behave strangely. Be careful to compare quarter one of this year with quarter one of last year instead of the previous quarter when you have significant seasonality.

Quarterly income statements, quarterly balance sheets, and annual balance sheets all have seasonality. When calculating ratios using inputs from any of these statements, we must be aware of seasonality.

While firms in the same industry will often have similar seasonal patterns, it is important to watch the fiscal year. A fiscal year is different from the calendar year and some firms end their fiscal year at the end of December while others end their fiscal year at the end of January or March. If firms have different fiscal years, their ratios and common size statements may not be comparable.

Accounting differences

While all firms use GAAP, there is a lot of flexibility in applying GAAP. Different depreciation approaches, inventory methods, etc. can cause two firms with similar levels of business activity appear to have different levels of profitability. The better you understand financial accounting, the better you will be able to dig into a company’s financial statements and understand exactly how comparable the ratios are across firms.

Industry differences are not always clear

While Wal-Mart and Target have a lot of overlap in their primary business activities, they also have some differences. Be careful when comparing firms that the difference in the ratio or common size statement is not caused by non-comparable differences. This is where a thorough understanding of the company comes in. We discussed above how the differences in cost of sales and turnover ratios could be related as much to strategy differences as they are to differences in the underlying performance. The best way to find out about this is read each company’s annual/quarterly reports (10-K and 10-Q), listen to conference calls made during quarterly earnings announcements, and pay attention to all aspects of the companies. Good financial statement analysis involves a lot of digging and attention to detail, not just number crunching.

When dealing with large, dominant firms, it is difficult to compare them to industries because they may dominate the industry and/or operate in many different industries. This is why it may be better to compare Wal-Mart to Target rather than industry averages. If I compare Wal-Mart to the industry average, those numbers are going to be heavily influenced by Wal-Mart’s numbers as Wal-Mart makes up a large portion of the industry.

Numbers can be difficult to interpret

Consider the low current ratios for Wal-Mart (and Target as well). They appear to be struggling to meet their liquidity demands when looking at the current ratio. However, one of the reasons for a low current ratio is that they have high inventory turnovers and they know that they will quickly be able to generate the cash necessary to pay off their current liabilities. Another issue is that they are a very profitable company with predictable cash flows, so they don’t need much of a cash “cushion” to keep them safe from downturns. This allows them to move more cash into long-term assets which earn a higher return or to return that cash to investors through dividends and stock buybacks. What appears to be a liquidity problem, is likely more of a strategic decision to keep current assets low and invest more capital into long-term assets which can be more productive.

Rear view mirror

Finance focuses on future expectations and financial statements describe past performance. This does not mean that financial statement analysis is meaningless. It is hard to understand where you are going if you don’t know where you have been. Financial statement analysis can help us see potential problems as they are developing so we can correct them (if we are management) or avoid them (if we are investors). However, we must be aware that things can change quickly in the business world. What was a strength six months ago when the financial statements were prepared may very well be a weakness today. Always be digging for new, updated information to avoid being blindsided by major, unexpected changes when new financial statements are released.

Companies change management and corporate strategies. New competitors enter the industry or existing competitors leave the industry. Technology and legal aspects change. Economic conditions change. All of these things can make it hard to use past financial statements to make forecasts about the future. Again, it doesn’t mean that we ignore financial statement analysis. Instead it means we must be aware of the limitations and recognize that the numbers are a part of the story and not the story itself.

Context is critical

Any financial ratio without the proper context is close to meaningless. Think of the following analogy. Imagine you go into a doctor for a health checkup. One important piece of information for the doctor is your weight. However, if the doctor were to see a chart of “Patient X” and find out that the patient is 150 pounds, that information by itself is not very valuable. Is the patient a 6’6” 30-year old male or a 4’2” 12-year old female? Did the patient weight 135 pounds, 150 pounds, or 200 pounds 6-months ago? All of the vital information that the doctor collects (temperature, allergies, symptoms, blood pressure, etc.) are used together to help diagnose the health of the patient. Any one of these pieces of information without context is not very useful by itself. Financial ratios are very similar.

Ratios and Common Size Statements are INITIAL diagnostic tools

Similar to the item above regarding context, a medical analogy is helpful. When you go into a doctor with a set of symptoms, the doctor gathers information on you and your symptoms to get an idea of what MIGHT be wrong. Then, unless it is something common, the initial diagnosis is used as the basis for further testing and examination to find out what is really wrong. Ratios and common size statements are similar. They can be used to raise “red flags”, but we want to be careful to remember that they identify areas that need further investigation more than they clearly identify strengths and weaknesses.