20

Dr. Kevin Bracker; Dr. Fang Lin; and jpursley

Most of TVM analysis on your Financial Calculator can be done with the 5-key approach. The five keys are as follows

N ⇒ This key refers to the number of periods

I/Y ⇒ This key refers to the interest rate (do not enter as a decimal ⇒ 10% would be 10 not 0.10). Sometimes this interest rate is referred to as a discount rate or rate of return.

PV ⇒ This key refers to the Present Value

PMT ⇒ This key refers to the Annuity Payment

FV ⇒ This key refers to the Future Value

When entering values into your financial calculator you press the value you are entering first, then the key. For example, if we want to put in 10 periods, we would enter this as 10 N. Sometimes you will need to enter a negative value. To do this, you must use the “+/-“ key on your calculator instead of the “–“ key. The order that you enter the variables doesn’t matter as long as you enter the four that you know first, and then solve for the fifth. To solve, you just press the key representing what you are trying to find. Now let’s go through several examples.

EXAMPLE ONE – Future Value of a Single Cash Flow

You are investing $10,000 today and want to know how much you will have after 6 years if you earn a 7% rate of return over the 6-year time frame. Since you are starting with $10,000, that is your present value. You have 6 years, so the number of time periods is 6. The 7% rate of return means you have a 7% interest rate. In this example we are not using an annuity, so we are going to set the Annuity Payment to zero.

6 N

7 I/Y

10,000 PV

0 PMT

FV -15,007.30

Thus, you will have $15,007.30 at the end of the 6th year. Notice that the answer came out negative instead of positive. This is due to the way the calculator “thinks” when it is solving TVM problems. The calculator needs to keep track not only of the dollar amounts, but which way the money is flowing. Because you entered the Present Value (PV) as $10,000, the calculator assumed you were receiving $10,000. If you receive $10,000 today, the only way for the problem to “balance out” is for you to give back $15,007.30 at the end of the 6th year. In a problem like this you can just ignore the negative sign in front of the $15,007.30. However, there are certain problems where this is important. Specifically – IF YOU ENTER NON-ZERO VALUES FOR TWO OR MORE OF THE CASH FLOW KEYS (THE CASH FLOW KEYS IN THE 5-KEY APPROACH ARE THE PV, PMT, AND FV KEYS), YOU MUST BE CAREFUL OF CASH FLOW SIGNS. In our example, we only entered 1 non-zero value for a cash flow (the $10,000 PV), so the sign doesn’t matter. We will reintroduce this in a little bit.

PRACTICE PROBLEM ONE

You are investing $400 today and want to know how much you will have after 45 years if you earn a 9.5% rate of return over the 45-year time period. The solution to this and other practice problems can be found at the end of this tutorial.

EXAMPLE TWO – Present Value of a Single Cash Flow

You are going to receive $6000 in 5 years. Assuming a 9% discount rate, what is this worth to you today?

5 N

9 I/Y

0 PMT

6000 FV

PV -3899.59

Again, we can ignore the negative sign in the answer (since the only non-zero cash flow that we entered was the $6000 Future Value). Thus, $6000 received in 5 years is only worth $3899.59 today (assuming a 9% discount rate). In other words, we are indifferent between receiving $3899.59 today and receiving $6000 in 5 years – they both are worth the same to us. Alternatively, we would be willing to pay $3899.59 or less to receive $6000 in 5 years, but we would NOT be willing to pay any more than $3899.59. The reason for this is that if we invested $3899.59 today and let it compound for 5 years at 9%, it would grow to $6000 at the end of the 5th year. Present value will be an important concept in valuation because most investments are structured in a manner that we pay a set amount today to receive cash flows in the future. Once we know what those future cash flows are worth to us today, we can evaluate the investment.

PRACTICE PROBLEM TWO

You are offered an opportunity to make an investment today that will pay you $100,000 in 20-years. Assuming a 5% discount rate, what is the most you would be willing to pay for that investment today?

ANNUITIES

An annuity is a sequence of equal, periodic cash flows. Many financial situations can be modeled as an annuity. For instance, calculating a mortgage payment on a home is an annuity. Simple retirement analysis can be structured as an annuity. Also, bond valuation is partially modeled as an annuity since we receive a fixed coupon payment each year. With annuities, we assume cash flows come at the end of each period. Note that there is a variation referred to as an “Annuity Due” that assumes cash flows come at the BEGINNING of the period. We will not work with Annuity Due situations in this text, however it is relatively simple to do so by making a simple adjustment to your calculator. We will include a sample example to illustrate this, however, in this textbook we will assume cash flows come at the end of each period in all of our annuity problems.

EXAMPLE THREE – Lottery Jackpot

Assume you have just won a $10 Million Lottery Jackpot. However, instead of paying you the $10 Million up front, you have the choice of receiving $5 Million today or $400,000 per year at the end of each year for the next 25 years. Assuming a 6% discount rate, which would you prefer? In order to answer this, you need to find the PV of the $400,000 per year for 25 years. This is done as follows:

25 N

6 I/Y

400,000 PMT

0 FV

PV 5,113,342.46 (Note that we dropped the negative sign)

Since the annuity is worth more than $5 Million to us, we would prefer to take the $400,000 per year for the next 25 years.

EXAMPLE THREE A – Lottery Jackpot Annuity Due (OPTIONAL)

Since many lotteries actually give you your first installment TODAY if you take the installment plan, we could make the example more realistic by assuming the prize was paid as $400,000 per year at the BEGINNING of each year for the next 25 years and leave everything else the same. To adjust your calculator for this, you need to set it up to work with beginning of period payments. To do so, do the following:

SHIFT BEG/END

When you do this, you should see the word “BEGIN” show up on the bottom of your calculator screen to show you that your calculator is set for beginning of period payments. Now repeat the calculation from the Example Three

25 N

6 I/Y

400,000 PMT

0 FV

PV 5,420,143.01 (Note that we dropped the negative sign)

So, with beginning of period payments the jackpot is worth more to us (since we start receiving our money earlier). Now, set your calculator back to end of period payments so that you don’t end up with the wrong answer on all your other problems. To set it back, just toggle the BEG/END mode again as follows:

SHIFT BEG/END

PRACTICE PROBLEM THREE

You are offered an investment that pays you $1000 per year for the next 30 years. Assuming a 10% discount rate, what is this investment worth to you today?

EXAMPLE FOUR – I want to be a Millionaire

You want to become a millionaire and plan to do so through a savings/investment plan. Assuming you want to reach your goal in 20 years and anticipate earning a 10% rate of return, how much must you save at the end of each year in order to reach your goal?

20 N

10 I/Y

0 PV

1,000,000 FV

PMT $17,459.62

This means you will need to save $17,459.62 per year in order to achieve your goal.

PRACTICE PROBLEM FOUR

Since saving $17,459.62 per year is not realistic for most of us, let’s try some adjustments. Calculate how much you would need to save under the following conditions

- 30 years at 10%

- 40 years at 10%

- 30 years at 7.5%

- 30 years at 5%

Note the large difference that time and rate of return make on savings. Having a short savings horizon or earning a low rate of return mean you must save considerably more each year to reach the same goal. This is especially important for retirement planning.

EXAMPLE FIVE – Changing Periods per Year

Now assume that you want to accumulate $1 million in 30 years, but instead of saving each year, you are going to save every two weeks (we will earn a 10% annual rate of return). There are 26 2-week periods in each year, so now you have to adjust your calculator to work with 26 periods per year. You can do this as follows:

26 SHIFT P/YR

Now your calculator will recognize that you are not making annual contributions to your savings plan, but instead making a contribution every other week. Another issue when you change the number of periods per year is to recognize that the N key stands for periods and not necessarily years. Since all of our previous examples were done using 1 P/YR, the number of periods and years were the same. However, now 1 year will have 26 periods. Therefore, 30 years is equivalent to 780 periods (calculated by taking 26 times 30). Now that our adjustments have been made, we are ready to enter the problem into our calculator.

780 N

10 I/Y

0 PV

1,000,000 FV

PMT $202.75

If we save $202.75 every two weeks for the next 30 years and earn a 10% rate of return, we will have $1,000,000 at the end of the 30th year.

PRACTICE PROBLEM FIVE

Repeat the above example, but now assume weekly payments (52 weeks per year) instead of payments every two weeks. Once you are done, figure out how much you are saving per year under both the once per week and once every other week alternatives and compare this to the answer we got in Practice Problem Four-1. Why are the answers different? (NOTE – Remember to reset your calculator to 1 period per year after you finish this problem).

EXAMPLE SIX – Solving for Interest Rates

Let’s keep working with the goal of becoming a millionaire. However, instead of calculating how much you must save, we’ll assume you can save $3000 per year and want to find the rate of return you will need to earn to reach your goal. This time we will give ourselves 35 years of saving $3000 per year.

35 N

0 PV

-3000 PMT

1,000,000 FV

I/Y 10.89%

If we can save $3000 per year at the end of each year for the next 35 years, we will need to earn a 10.89% rate of return in order to become a millionaire. There is a very important step in this that must be done in order to get the right answer. Note that we made the annuity payment equal NEGATIVE 3000 instead of 3000. This is because we are now entering 2 non-zero values into our cash flow keys (PV, PMT, FV). When enter 2 or 3 non-zero values into our cash flow keys, we need to be careful with the signs of the cash flows. The signs indicate the direction of the cash flow. A negative sign indicates that the cash flow is flowing away from us. In this case, we are saving $3000 per year so we are giving up that amount and making it negative. At the end of the 35 years, we will receive back $1,000,000 so that is positive.

PRACTICE PROBLEM SIX

What rate of return would you need to earn if you were able to save $4500 per year each year for the next 35 years in order to become a millionaire?

EXAMPLE SEVEN – Combining PMT, FV, and PV

Here is one last variation on our millionaire example. This time, instead of starting with nothing, let’s assume that we already have $40,000 and plan to save an additional $3000 per year over the next 35 years. Now, what rate of return must we earn in order to accumulate $1,000,000 at the end of the 35th year?

35 N

-40,000 PV

-3000 PMT

1,000,000 FV

I/Y 7.63%

Note that here, we must make both the Present Value and the Annuity Payment negative as they both are flowing away from us into the savings plan. The Future Value will flow back to us at the end of the time period so it is positive.

PRACTICE PROBLEM SEVEN

You want to retire a millionaire and have accumulated $20,000 which you are putting into your retirement plan. In addition, you plan to earn a 9% rate of return. How much must you save PER MONTH over the next 35 years in order to reach your goal?

Video: Introduction and 5-Key Approach (HP10BII)

EXAMPLE EIGHT – Uneven Cash Flow Stream – Present Value

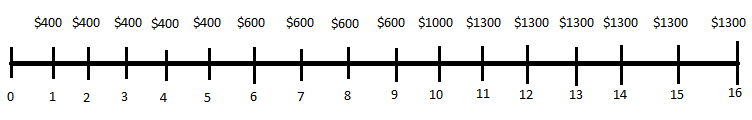

Assuming a 6.5% discount rate, solve for the present value of the following cash flow stream.

Here we can no longer use the 5-key approach (technically, we CAN…it would just be a lot more tedious). Instead we want to move to the cash flow worksheet on our financial calculator. The cash flow worksheet for the HP10BII follows a basic 4-step process:

- Clear out any previous values in your cash flow worksheet

- Enter the cash flows and frequencies in your cash flow worksheet starting with year 0

- Enter the discount rate

- Solve for present value

Let’s walk through this process with keystrokes using the example above:

- SHIFT C ALL (this clears out the previous values from the worksheet)

- 0 CFj (this enters the CF0 which in this example is 0. Note that it will not always be zero and could have either a positive or negative value)

- 400 CFj (this enters the first cash flow sequence )

- 5 SHIFT Nj (this enters the first cash flow frequency. The default value for this variable is 1, so you only need to enter an Nj value when the frequency is something other than 1.)

- 600 CFj (this enters the second cash flow sequence)

- 4 SHIFT Nj (this enters the second cash flow frequency)

- 1000 CFj (this enters the third cash flow sequence. Note that there is no need to enter an Nj value here as the default frequency value is 1 – which is what we want – so we can skip the Nj and just go onto the next cash flow sequence.)

- 1300 CFj (this enters the fourth cash flow sequence)

- 6 SHIFT Nj (this enters the fourth – and final – cash flow frequency)

- 6.5 I/YR (this is where you put in the discount rate of 6.5%)

- SHIFT NPV (this calculates the answer. Your final answer here should be $7,047.87.)

Note that the sum of your frequencies should add up to the length of the timeline (5+4+1+6 = 16). If not, you miscounted somewhere along the way.

EXAMPLE NINE – Uneven Cash Flow Stream – Future Value

We can use a similar process to solve for the future value of an uneven cash flow stream. However, we will start by doing the exact same steps we did to get the present value. The reason is that to get the future value of an uneven cash flow stream we first (A) solve for the present value of the cash flow stream and then (B) figure out what that value will grow to over the time horizon. So, if the problem would have given you the same cash flow stream as above, but instead asked what it would be worth as of year 16 (the end of the time horizon). As we found above, the present value of the cash flow stream (what is worth today) is $7047.87. So, if we want to know what the cash flow stream is worth in year 16, we just bring the present value ($7047.87) forward 16 years at the 6.5% rate of return using the 5 key approach as follows:

16 N

6.5 I/Y

7047.87 PV

0 PMT

FV -19,304.19

This tells us that the value of the cash flows will grow to $19,304.19 at the end of the 16 year time horizon if we can invest them to earn a 6.5% rate of return. Note that the PV of an uneven cash flow stream will always be less than the sum of all the individual cash flows ($13,200 in this example) and the FV of an uneven cash flow stream will always be more than the sum of all the individual cash flows.

EXAMPLE TEN – Uneven Cash Flow Stream – Rate of Return

Assume you could buy the cash flow stream in this example for $6000 today. Based on this, what would your rate of return be? To do this, we will use the IRR function on the calculator with the cash flow worksheet. This is similar to what we did above for NPV with two major changes. First, our CF0 is now the initial investment (-6000) and is negative because it is a cash flow. Second, instead of entering the discount rate and then solving for NPV, we solve for the discount rate by press the IRR/YR button. So, it looks like this:

- SHIFT C ALL

- 0 CFj

- 400 CFj

- 5 SHIFT Nj

- 600 CFj

- 4 SHIFT Nj

- 1000 CFj

- 1300 CFj

- 6 SHIFT Nj

- SHIFT IRR/YR (this calculates the answer. Your final answer here should be 8.39%.)

One of the most common mistakes we see on this type of problem is people putting the CF0 in as a positive value which will result in an error (no solution). The 8.39% represents the average annualized rate of return we earn over the 16 year time horizon on our $6000 investment.

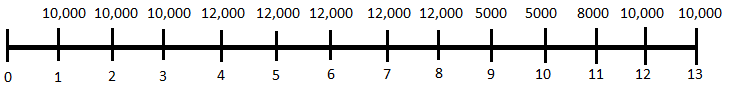

PRACTICE PROBLEMS EIGHT, NINE AND TEN

Assuming a 12.5% discount rate, solve for the present value and future value of the following time line. Also, assuming you could buy the cash flow stream for $80,000, what would your rate of return be?

Video: Uneven Cash Flows (HP10BII)

EXAMPLE ELEVEN – Effective Annual Rate

You are offered the choice of 7.8% compounded quarterly or 7.6% compounded daily. Which is a better investment (assuming both have the same risk)? In order to address whether we are better with the higher interest rate compounded less frequently or the lower interest rate compounded more frequently, we need to make them stable comparison by converting both to their annual compounding equivalent. We do this with the effective annual rate. It can be done with a formula or your financial calculator. If we use the formula, it looks like this:

[latex]k_{eff}=\Big(1+\frac{k_{nom}}{m}\Big)^m-1[/latex]

where

keff represents the annual equivalent

knom represents the nominal or stated interest rate

m represents the number of compounding periods per year

Plugging in our values for the 7.8% compounded quarterly we would get:

[latex]k_{eff}=\Big(1+\frac{0.078}{4}\Big)^4-1[/latex]

[latex]k_{eff}=(1.0195)^4-1[/latex]

[latex]k_{eff}=1.0803-1[/latex]

[latex]k_{eff}=0.0803[/latex]

[latex]k_{eff}=8.03\%[/latex]

And for the 7.6% compounded daily we would get:

[latex]k_{eff}=\Big(1+\frac{0.076}{365}\Big)^{365}-1[/latex]

[latex]k_{eff}=(1.000208219)^{365}-1[/latex]

[latex]k_{eff}=1.0790-1[/latex]

[latex]k_{eff}=0.0790[/latex]

[latex]k_{eff}=7.90\%[/latex]

In this case, the 7.8% compounded quarterly is better. If using the formulas, be sure to (A) carry out your calculations to several decimal places (or better yet, don’t round at all until you are done), (B) plug in rates into the formula as decimals, and (C) round your final answer to 2 decimal places in percentage terms. You can also do this with the financial calculator as follows:

4 SHIFT P/YR (this sets your periods per year to 4 for quarterly compounding. Be careful here as this means all your time value of money calculations will use 4 periods per year until you change your P/YR again…just like if you changed the P/YR for a 5-key problem.)

7.8 SHIFT NOM% (this enters the 7.8% nominal rate)

SHIFT EFF% (this solves for the effective annual rate to generate your final answer of 8.03%)

For the 7.6% compounded daily it is:

365 SHIFT P/YR

7.6 SHIFT NOM%

SHIFT EFF%

This will give you your answer of 7.90% indicating that it is better to take 7.8% compounded quarterly than 7.6% compounded daily.

PRACTICE PROBLEM ELEVEN

You are offered investments of 12% compounded annually, 11.75% compounded quarterly, or 11.5% compounded weekly. Assuming the same risk, which would you prefer?

Video: Effective Annual Rate (HP10BII)

Practice Problem Solutions

Practice Problem 1

45 N

9.5 I/Y

400 PV

0 PMT

FV $23,751.74

Practice Problem 2

20 N

5 I/Y

0 PMT

100,000 FV

PV $37,688.95

Practice Problem 3

30 N

10 I/Y

1000 PMT

0 FV

PV $9,426.91

Practice Problem 4A

30 N

10 I/Y

0 PV

1,000,000 FV

PMT $6,079.25

Practice Problem 4B

40 N

10 I/Y

0 PV

1,000,000 FV

PMT $2,259.41

Practice Problem 4C

30 N

7.5 I/Y

0 PV

1,000,000 FV

PMT $9,671.24

Practice Problem 4D

30 N

5 I/Y

0 PV

1,000,000 FV

PMT $15,051.44

Practice Problem 5

Set Calculator to 52 Periods Per Year ⇒ 52 SHIFT P/YR

Calculate Number of Periods ⇒ 52 x 30 = 1560

1560 N

10 I/Y

0 PV

1,000,000 FV

PMT $101.07

*Remember to set your calculator back to 1 period per year when you finish the calculation.

Annual Savings Required to Accumulate $1,000,000 in 30 years at 10%

A) Saving at the end of each year ⇒ $6,079.25

B) Saving at end of every 2 weeks ⇒ $202.75 x 26 = $5,271.50

C) Saving at end of each week ⇒ $101.07 x 52 = $5,255.64

The more frequently we make contributions, the less we have to save each year. This is because of the compounding effect. When we make annual contributions, we earn no return the first year. With weekly contributions we start earning a return during the second week.

Practice Problem 6

35 N

0 PV

-4500 PMT

1,000,000 FV

I/Y 9.13%

Practice Problem 7

420 N

9 I/Y

-20,000 PV

1,000,000 FV

PMT $183.13

Practice Problem 8

SHIFT C ALL

0 CFj

10000 CFj

3 Nj

12000 CFj

5 Nj

5000 CFj

2 Nj

8000 CFj

10000 CFj

2 Nj

12.5 I/YR

SHIFT NPV ⇒ $63,878.58

Practice Problem 9

Step 1: Solve for Present Value (See solution to 8) ⇒ $63,878.58

Step 2: Bring forward to end of year 13

13 N

12.5 I/Y

63,878.58 PV

0 PMT

FV $295,350.73

Practice Problem 10

SHIFT C ALL

-80000 CFj

10000 CFj

3 Nj

12000 CFj

5 Nj

5000 CFj

2 Nj

8000 CFj

10000 CFj

2 Nj

SHIFT IRR/YR ⇒ 7.93%

Practice Problem 11

Since the 12% compounded annual is already annual, there is no need for an effective annual rate.

The 11.75% compounded quarterly is

4 SHIFT P/YR

11.75 SHIFT NOM%

SHIFT EFF% ⇒ 12.28%

The 11.5% compounded daily is

365 SHIFT P/YR

11.5 SHIFT NOM%

SHIFT EFF ⇒ 12.17%

Making the 11.75% quarterly the best deal.