9

Dr. Kevin Bracker, Dr. Fang Lin and Jennifer Pursley

Chapter Learning Objectives

After completing this chapter, students should be able to

- Define mutual funds

- Identify advantages of mutual funds

- Identify key types (objectives) of mutual funds

- Define key terms associated with mutual funds

- Calculate the dollar cost of expenses and fees associated with mutual funds

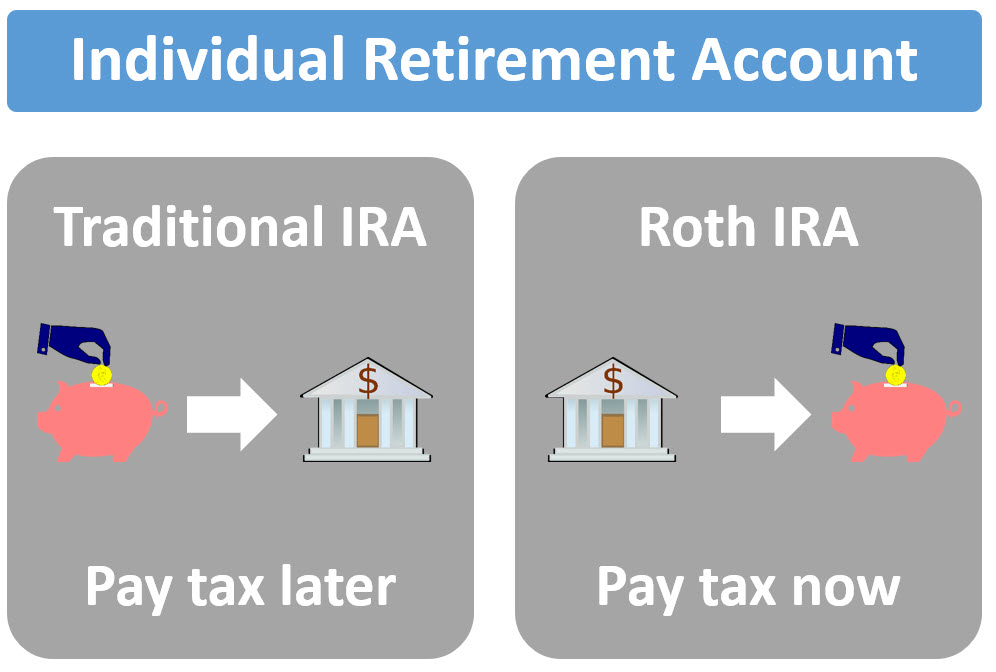

- Compare and contrast a Traditional vs. Roth IRA/401(K)

- Identify maximum contribution to an IRA and 401(K) Plan

- Identify the tax benefits associated with IRAs and 401(K) Plans

- Identify the role of a Rollover IRA

- Differentiate between an IRA and a 401(k) Plan

- Explain the advantage of matching contributions associated with a 401(k) Plan

- Define the concept of vesting and explain its importance

Retirement

In Chapter Three, we introduced the importance of time value of money as a key component of retirement planning. So, how well do we do as a society in preparing for retirement? The article, Good News: You might live to be 100…That’s also the bad news, provides a less than encouraging answer. As life expectancies rise (which is great), it magnifies the importance of being proactive in retirement planning. For people born in 1997, the life expectancy may be as high as 100 years. If someone retires at 65, that means 35 years of retirement income that needs to be planned for. The global retirement savings gap is expected to expand rapidly over the next few decades. This raises the question of how you avoid falling into this widening gap?  Fortunately, there are several tools that can help you with this process. Mutual funds provide easy and convenient ways to invest in a broad asset classes and retirement tax shelters like Individual Retirement Accounts (IRAs) and 401(k) plans help provide tax advantages. Below, we will spend some time talking about these tools to help you meet your personal financial goals, including, but not limited to, retirement.

Fortunately, there are several tools that can help you with this process. Mutual funds provide easy and convenient ways to invest in a broad asset classes and retirement tax shelters like Individual Retirement Accounts (IRAs) and 401(k) plans help provide tax advantages. Below, we will spend some time talking about these tools to help you meet your personal financial goals, including, but not limited to, retirement.

Mutual Funds

A Mutual Fund is a pooled investment portfolio managed by a professional portfolio manager (or management team). Each investor in the mutual fund owns a pro-rated amount of the overall portfolio based on their contributions to the fund over time. The portfolio manager will invest these funds according to specific guidelines.

Advantages of Mutual Funds

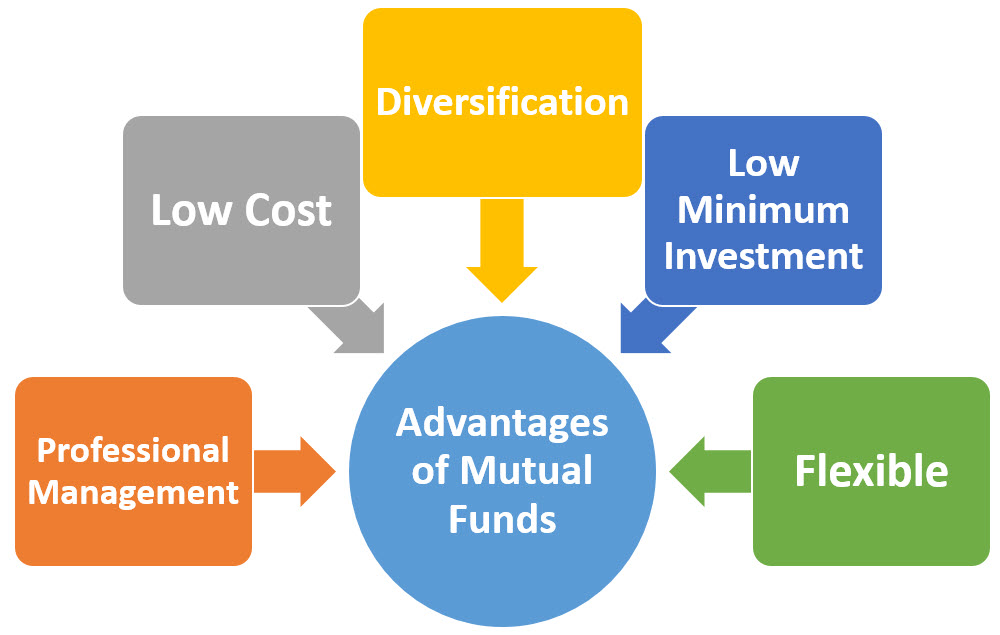

Professional Management

Most people do not want to make investing for their financial goals a full-time career. A mutual fund allows them to hire someone who has significant training, support and resources to make the decisions of which securities to own and when to buy/sell those securities.

Low Cost

While the costs vary dramatically from one mutual fund to the next, most mutual funds are managed at a relatively low cost to investors. The specific costs will be discussed in greater detail below.

Diversification

By pooling the investment dollars from many investors, mutual funds allow individual investors with small amounts of capital to own diversified portfolios usually containing more than 100 individual securities.

Low Minimum Investment

Most mutual funds can be started with investments of $500 – $2500. Also, some mutual funds will allow you to start with even less than that if you agree to contribute a fixed amount each month.

Flexible and Easily Tailored to Your Needs

There are approximately 8000 different mutual funds available with different objectives and risk profiles. With so many options available, it is easy to find a mutual fund or a combination of a few mutual funds to meet your specific goals for risk and performance.

Major Mutual Fund Categories

Money Market Mutual Funds

Money market mutual funds are extremely low risk investments, but also offer low rates of return. It is extremely rare to lose money in a MMMF and most maintain a fixed price of $1.00 per share while offering their investors low interest payments. As of January 2021, most MMMF are yielding less than 1.00% annual rates of return due to the Federal Reserve’s easing of monetary policy to combat the economic impacts of the COVID-19 pandemic. The rates of return will tend to fluctuate with short-term interest rates. Historically, MMMF have averaged returns of 2%-4%, but as of the start of 2021, it has been several years since we’ve been at those levels for any sustainable time frame.

Bond Funds

Bond mutual funds can range from low to moderately high levels of risk. At the low-risk end, the mutual fund will invest in short-term US Treasury bonds. While low risk, these funds will typically offer low rates of return only marginally higher than a MMMF. At the higher-risk end, the mutual fund will invest in junk bonds issued by corporations. In exchange for the higher risk, returns on these funds can be significantly higher than most bond funds. Bond funds can lose money when (A) interest rates increase and/or (B) the bonds suffer from defaults. Funds that focus on Treasury bonds will eliminate the default risk and funds that invest in shorter-term bonds will have less interest rate risk. Historically, bond funds have averaged returns of 4%-9% depending on the level of risk exposure. For the 10 years concluding in 2019, the Vanguard Total Bond Market Fund earned an average return of 3.68%, while their High-Yield Corporate Bond Fund earned 7.10% per year.

Stock Funds

Stock mutual funds are the most common type of mutual fund. These tend to be the riskiest type of fund as they invest in common stocks. However, the risk can range quite a bit within the stock fund category depending on how aggressive or conservative the style of the fund. Over time, you can expect the average stock fund to earn rates of 7%-13% with quite a bit of variance between funds and across time frames. For the 10 years concluding in 2019, the Vanguard Total Market Index Fund has earned 13.43% as a rate of return. However, during the period from February 19, 2020 to March 23, 2020, it lost 35% of its value. Alternatively, for the entire 2020 year, it was up approximately 20% on the year. This provides a glimpse of the volatility associated with stock funds.

Hybrid Funds

Hybrid funds combine a mix of asset classes and are often a combination of stocks and bonds. This provides less risk and greater diversification, but also lowers expected returns. The average returns for hybrid funds are typically in the 5-9% range. The Vanguard Balanced Index Fund earned an average annual return of 9.54% for the 10 year period ending in 2019.

Lifecycle Funds

A lifecycle fund picks a set “retirement” date and manages the risk exposure accordingly. So, if you plan to retire in 2050 you could buy a fund with that target date. As of 2020, retirement would be about 30 years away so the fund would have higher risk (heavy equity exposure). Over time, the amount allocated to equities would decrease and the amount allocated to bonds and money-market instruments would increase, lowering the risk (and expected return) as you move closer to retirement. For example, as of the summer of 2020, the Fidelity 2050 Freedom Fund had about 51% domestic equities, 40% international equities, and about 9% bonds/money-market securities. Alternatively at that same time, the Fidelity 2015 Freedom Fund had about 23% domestic equities, 21% international equities, 41% bonds, and 15% money market securities. The idea is to create a passive fund that requires little management from investors (saving the investor time and preventing investors from ignoring their asset allocation and ending up taking too much or too little risk than they planned). The downsides include slightly higher expenses, less control over your asset allocation, and the inability to pick specific stock-based or bond-based funds within the mix.

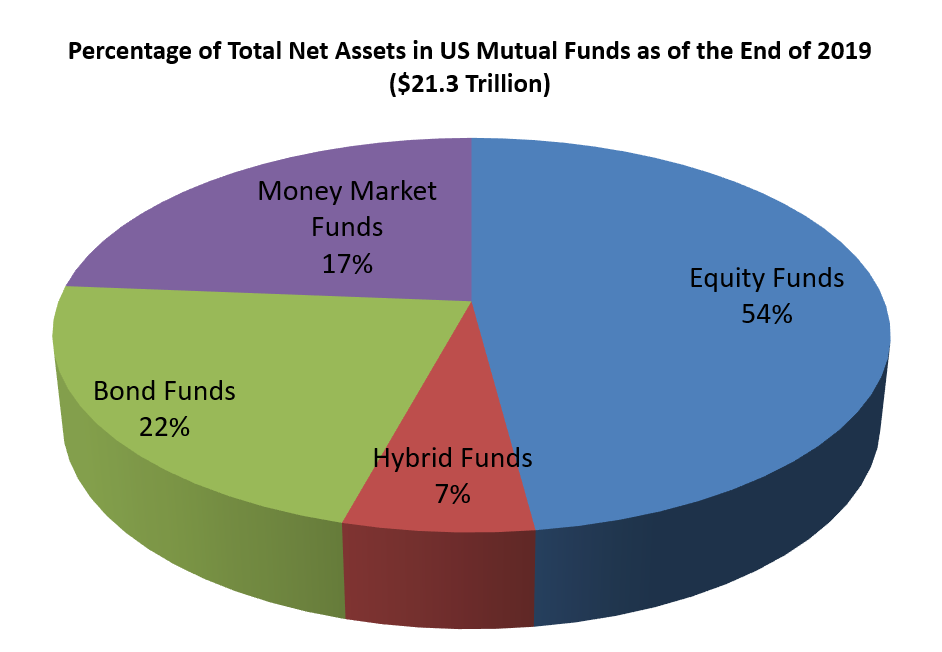

The chart below shows the percent of total net assets held by US mutual funds at the end of 2019.

Source: 2019 Investment Company Factbook

Mutual Fund Terminology

Prospectus

The prospectus of the mutual fund tells you all the important information you need to know. Here is a link to the prospectus for the Fidelity Magellan Fund. It discusses the investment style of the fund, the risk level of the fund, the various costs of the funds and much more. While some of it can get quite technical, most of the important information in the prospectus is presented in a “friendly” format. Read it before investing!

Load Charge

A load charge is an upfront fee that is taken from your investment. Load charges are usually used to help pay for the sales costs associated with marketing mutual funds. By law, mutual funds can not charge more than 8.5% of a load charge. If a fund charges a 5% load and we invest $1000 into the fund, $50 will be taken out as a load fee and $950 will actually be invested in the fund. Some funds do not charge sales loads (they are called “no-load” funds). The article, No-Load Funds vs Load Funds has a more in-depth discussion on load charges for those interested.

Expense Ratio

The expense ratio is the amount of money taken out on an annual basis to cover the funds operating expenses (pays portfolio manager, customer service reps, overhead, profit, etc.). This can range from around 0.05% at the low end up to over 2% at the high end (the average is right around 1%). If the mutual fund with a 1% expense ratio earns a 12% return before the expense ratio, it will result in a return to investors after expenses of 11%. The article, Definition and Explanation of Mutual Fund Expense Ratios, offers more details on mutual fund expense ratios.

A,B,C Shares

Some funds are sold with various expense packages known as “A”, “B” or “C” shares that are used to pay the brokers/advisors who sell these shares. “A” shares have higher front-end load charges, “B” shares have higher annual expenses and back-end loads (and often convert to “A” shares over time), and “C” shares typically avoid load charges but have higher annual expenses. For short-term holdings, C shares would be better. For longer-term holdings, A shares are best. Investopedia has a discussion on mutual fund share classes that adds more detail.

Fund Families

Many mutual funds are parts of a large “fund family.” For example, Fidelity is one of the largest fund families and they offer well over 100 different mutual funds. Other large fund families include, but are not limited to, Vanguard, American Century Investors, T. Rowe Price, and Blackrock.

ETFs

An Exchange Traded Fund (ETF) is a stock/mutual fund hybrid. It trades like a stock in that you can buy/sell it at any time of the trading day (mutual fund contributions and withdraws are only done based on end-of-the-day pricing), but each share you buy represents a basket (portfolio) of underlying stocks. The underlying portfolio depends on the ETF, but some try to match indices (such as the S&P 500 or Dow Jones Industrial Average), international indices (so you can get exposure to China, India, Brazil or other countries without worrying about picking individual stocks), sectors (such as financials, biotechnology, retail, etc.), or other characteristics (short funds that go up when the market is down and down when the market is up, high dividend yield stocks, etc). ETFs tend to have relatively low expense ratios and tend to use more passive stock selection (not trying to pick the “best” stocks but just hold a basket of stocks meeting the objective). More discussion on ETFs can be found in the article, Exchange-Traded Funds.

Tips for Mutual Fund Investing

Consider Your Goals First

Before picking a mutual fund to invest in, you need to know what you’re trying to accomplish. What time frame are you looking at? What level of risk are you comfortable with? What rate of return do you need to earn? Once you know this, you can start picking mutual funds that meet your needs. Choosing the right mix of exposure to stocks, bonds, international securities, etc. to match your risk-return goals is more important than choosing the “right” fund. With so many funds out there, you can be confident that you won’t choose the best fund without getting very lucky. However, don’t worry about getting the best one and instead focus on a good fund (or funds) that meet your needs.

Before picking a mutual fund to invest in, you need to know what you’re trying to accomplish. What time frame are you looking at? What level of risk are you comfortable with? What rate of return do you need to earn? Once you know this, you can start picking mutual funds that meet your needs. Choosing the right mix of exposure to stocks, bonds, international securities, etc. to match your risk-return goals is more important than choosing the “right” fund. With so many funds out there, you can be confident that you won’t choose the best fund without getting very lucky. However, don’t worry about getting the best one and instead focus on a good fund (or funds) that meet your needs.

Bad Performance Persists

The worst mutual funds tend to stay bad. Part of the reason for being a bad mutual fund this year is having high costs. These costs don’t go away, so eliminate the worst performing 25% of funds over the past few years within a particular category from consideration.

Don’t Chase Hot Funds

A big mistake a lot of investors make is trying to invest in whatever last year’s top fund was. While bad performance persists, there is less persistence among the top performers. Usually the top performing funds for a given year are not very diversified and will do poorly when trends change. Here is a brief look at mutual fund performance persistence. Keep in mind that switching funds may also increase your load charges and trading costs.

Focus on Costs

Most mutual funds fail to outperform the averages because of diversification and costs. If we focus on funds that have low costs (loads and expense ratios) we will keep more of the investment return instead of paying it to the mutual fund company. Index funds tend to be the lowest cost type of funds and small-cap or international funds tend to be the most expense. Look closely at the expense ratio. Assuming a 9% pre-expense ratio return, the difference between a mutual fund with a 0.50% expense ratio and one with a 1.25% expense ratio will be $47,993 to an investor that invests $3000 per year over 30 years ($372,644 vs. $324,651). For a long-term investor adding to their mutual fund on a regular basis, load charges are less important than expense ratios. Consider two mutual funds that both charge a 1% expense ratio and earn 9% before any expenses. One fund charges a 5% load while the other is a no-load fund. If we invest $3000 in each fund each year over 30 years, the no load fund will have $339,850 vs. $322,857 for the load fund (a cost of $16,993). Notice this difference is much less than our previous example with different expense ratios.

Think Long-Term

Try to focus on your long-term returns instead of annual fluctuations. Studies have shown that investors tend to underperform the mutual funds that they invest in by about 1.1% per year due to poor market timing (selling low and buying high)

Consider Some International Exposure

While markets are more interconnected than they were 20-30 years ago, there is still some advantage to international diversification. Having some exposure to emerging markets and other global economies will help diversify your portfolio and also offer the opportunity for higher returns.

Calculating Impact of Load Charges and Expense Ratios

Remember that the load charge impacts the amount of your contribution and the expense ratio impacts the rate or return. So, in order to calculate the impact, we can use the 5-key approach on our calculator. Assume you are dealing with a mutual fund that has a 4% sales load and a 1.25% expense ratio. If you invest $10,000 today and $200 per month for 30 years, how much are these costing you if the fund earns 10% before any fees?

Calculate FV without any fees (Calculator set to 12 P/Y):

360 N

10 I/Y

10,000 PV

200 PMT

⇒ FV = $650,471.58

Calculate FV with fees – 1.25% expense ratio and 4% load charge. (Calculator set to 12 P/Y):

360 N

8.75 I/Y

9,600 PV

192 PMT

⇒ FV = $464,984.97

Total Cost ⇒ $185,486.61

Individual Retirement Accounts (2021)

Purpose

The purpose of the IRA is to provide a tax-incentive for personal retirement savings. Theoretically this should increase the savings rate and encourage more people to prepare for their financial future.

Traditional IRA

Each individual can contribute up to $6000 per person per year into an IRA with the following stipulations (for 2021 tax year — some of these numbers will change for future years).

- The contribution cannot exceed a person’s earned income. However, a non-working spouse is eligible to contribute the full $6000, assuming sufficient family income.

- If you are not an active participant in an employer sponsored pension program, you can contribute the full $6000 regardless of income (if you are not covered and your spouse is, there is an income cutoff, but it is higher).

- If you earn (Adjusted Gross Income) less than $66,000 per year (single) or $105,000 (joint), you may contribute the full $6000 even if you are an active participant in an employer sponsored pension program.

- If you earn (AGI) more than $76,000 per year (single) or $125,000 (joint), you can NOT make a tax-deductible contribution to an IRA if you are an active participant in an employer sponsored pension program. Note that at incomes above these limits, you can still contribute, but your contribution will NOT be tax deductible.

- If you are above the lower limits and below the upper limits, you can contribute a portion of the $6000. For example, a single individual earning $69,000 per year is eligible to contribute $4200 per year [($7000/$10,000)*$6000]. A married couple earning $115,000 would each be able to contribute $3000 [($10,000/$20,000)*$6000] per year.

- If you are 50 years of age or older, you can contribute up to $7000 per person per year instead of $6000.

The contributions to the IRA are tax-deductible in the contribution year. For instance, if you had a taxable income (single) of $50,000 prior to an IRA contribution and contributed the full $6000 to an IRA, the IRS would lower your taxable income in that year to $44,000. This level of income places the individual in a 22% marginal tax bracket for taxable income between $40,526 – $86,375 for 2021, so would result in a tax benefit of $1,320 ($6000*0.22) in the year of contribution.

All interest, capital gains, and dividend income are allowed to compound tax-free during the investment period.

Withdrawals taken after age 59½ are taxed as ordinary income at the time they are withdrawn.

Any withdrawals taken prior to age 59½, are subject to a 10% tax penalty unless they are (note – regular taxes are still due, just not the penalty):

- To purchase a primary residence for yourself, your parents, grandparents, spouse, child or grandchild. You can withdraw up to $10,000 (total during your lifetime). The distribution generally is available if you have not owned a primary residence for two years. Home-buying funds must be used within 120 days for expenses such as settlement charges, financing fees and closing costs.

- For qualified college expenses, such as tuition, fees, books, supplies, equipment, and room and board.

- If distributed in “substantially equal” payments, such as an annuity, based on your life expectancy.

- Due to death or permanent and total disability.

- To pay certain medical expenses if your medical bills exceed 7.5 percent of your adjusted gross income.

- For health insurance premiums if you’ve received unemployment compensation for 12 weeks or longer.

- Being called up to active military duty.

Withdrawals must be initiated by the time an individual reaches age 72

Typical investment options include mutual funds, individual stocks, bank CDs, and bonds. Some investments such as derivatives with potentially unlimited loss, collectibles, life insurance, etc. are not permitted in IRAs.

Roth IRA

Each individual can contribute up to $6000 per person per year into a Roth IRA with the following stipulations (for 2021 Tax Year).

- The contribution cannot exceed a person’s earned income. However, a non-working spouse is eligible to contribute the full $6000, assuming sufficient family income.

- If you earn (AGI) less than $125,000 per year (single) or $198,000 (joint), you may contribute the full $6000.

- If you earn (AGI) more than $140,000 per year (single) or $208,000 (joint), you can NOT make a contribution to a Roth IRA.

- If you are above the lower limits and below the upper limits, you can contribute a portion of the $6000. For example, a single individual earning $128,000 per year is eligible to contribute $4800 per year [($12,000/$15,000)*$6000]. A married couple earning $207,000 would each be able to contribute $600 per year [($1000/$10,000)*$6000].

- If you are 50 years of age or older, you can contribute up to $7000 per person per year instead of $6000.

Contributions to a Roth IRA are NOT tax-deductible in the year of the contribution. For example, if your taxable income was $40,000 prior to making a $6000 contribution to a Roth IRA it would remain $40,000 after your contribution. There is no tax benefit at the time of contribution.

All interest, capital gains, and dividend income are allowed to compound tax-free during the investment period.

Withdrawals taken after age 59½ (and minimum 5 years) are NOT taxed. This is one of the primary benefits of the Roth IRA.

Early withdrawals are subject to penalty unless special situation (see traditional IRA). Note that withdrawals of contributions are not penalized or taxed. Only early withdrawal of investment income is penalized/taxed. While there may not be a penalty associated with withdrawing your contributions, it is not recommended as this greatly limits the ability of the Roth IRA to take advantage of the power of compounding.

Withdrawals do NOT need to be initiated by the time an individual reaches a specific age. This is because withdrawals are not taxed and therefore, there is no tax revenue to be generated by requiring investors to withdraw capital at a certain point.

Typical investment options include mutual funds, individual stocks, bank CDs, and bonds. Some investments such as derivatives with potentially unlimited loss, collectibles, life insurance, etc. are not permitted in IRAs.

Rollover IRA

Rollover IRAs are designed to allow individuals to move their pension plan into a tax-sheltered account when they switch jobs, essentially turning the old pension plan into a traditional IRA. If the rollover is done directly (so that the previous employer handles the transaction directly with the institution offering the IRA), the full amount is transferred. If the previous employer transfers the money to the individual, allowing the individual to then set-up the rollover IRA, there will be a 20% withholding charge. If the new account is established (for the full amount) within 60 days, the IRS will return this withholding.

How Much Benefit Can an IRA Make?

This answer varies based on time horizons, tax rates, and rates of return. Also, if you use a traditional IRA, it depends on whether you reinvest your tax savings each year or spend them. I am going to run through a scenario with several assumptions to give you an idea of the financial benefits of an IRA. Note that your specific benefits will vary – these results are specific to this example, but are designed to provide a realistic look at how much you can gain from choosing an IRA over an ordinary taxable account. Typically, you can expect greater benefits for using an IRA when you have

Longer time horizons (starting in your 20’s vs. starting in your 40’s)

Higher tax rates (because the IRA is a tax shield)

Higher rates of return (the compounding effect is bigger)

However, to give you an idea, consider the following scenario

Let’s assume you are 22 years old and want to start saving for retirement.

You plan to save

$100 per month at the end of each month for the next 5 years

$200 per month for the following 10 years

$300 per month for the remaining 23 years until you retire at age 60.

Assume you will earn a 9% rate of return over the entire 38-year time frame.

Also, assume that you pay an average tax rate of 18% on your investment income and an average tax rate of 25% on your ordinary income (note that these are different because dividends and long-term capital gains are currently taxed at lower rates than ordinary income).

You want to take out your money at the start of each month for 35 years

You will earn a 6% rate of return during retirement (the lower return is because you plan to move to less risky investments in retirement).

If you use a traditional IRA, you will reinvest your tax savings each year.

Given all these assumptions, here is how much you will have at retirement and to spend each month during retirement if you (A) don’t use an IRA, (B) use a traditional IRA, or (C) use a Roth IRA. Note that you can’t easily do this with your financial calculator because of all the assumptions. I used a spreadsheet to generate these values. Also, note that while you have more money at retirement with the traditional IRA, because you have to pay tax on each $1 you withdraw, you actually have a higher after-tax monthly income with the Roth IRA. In this scenario, using a Roth IRA generates an additional $1670.69 every month over your 35-year retirement compared to just an ordinary taxable account – a very substantial benefit.

Don’t Use an IRA (Ordinary Taxable Account)

Retirement Wealth $490,127.93

Monthly Income $2438.67

Traditional IRA

Retirement Wealth $846,835.17

Monthly Income $3691.68

Roth IRA (Ordinary Taxable Account)

Retirement Wealth $724,303.18

Monthly Income $4109.36

401(k) PLANS

A 401(k) plan is a retirement savings plan offered through an employer that allows employees to put away a portion of their paycheck each period on a pre-tax basis into an investment plan. Typically, the employer will have a selection of different accounts into which employees can allocate their investment. The accounts will usually have a mix of low risk to higher risk alternatives such as a money market fund, a couple different types of bond funds, and a couple of different types of stock funds so that you can match the risk/return profile you are searching for. Some employers will match (or partially match) an employee’s contribution. The money in the 401(k) plan compounds tax-free during the employee’s working life and withdraws are taxed as ordinary income. The tax structure is similar to the traditional IRA. Roth 401(k) plans were introduced in 2006 and are offered by some employers. A Roth 401(k) will have a tax structure similar to the Roth IRA (no tax deduction on contributions, withdraws are tax-free). The maximum contribution to a 401(k) plan for an employee in 2020 is $19,500 ($26,000 for 50+ years of age) per year.

If you leave the company prior to retirement, you can have several options.

Leave your money with the company

Most firms will allow you to leave the money in the plan and then access it when you retire. The downside of this is that you have less control and if you change jobs frequently you will have several accounts to keep track of.

Move your money to your new employer’s 401(k) plan

Most employers will allow you to transfer your money to your new company’s plan. The downside of this is that you are limited to the options available in your new plan.

Use a Rollover IRA

You can set up a special account called a “rollover IRA” (discussed above), which allows you control over your investment decisions. If you put your money in a rollover IRA it is important that your old employer transfer the money directly to the IRA account to avoid a 20% withholding penalty.

Cash Out

This will result in significant tax penalties and should only be done as a last resort if you desperately need the cash.

Vesting

Vesting refers to the concept that your retirement benefits belong to you even if you leave the firm before retirement. Every company has different vesting requirements, but there are minimum vesting standards that require you to be fully vested in 3-6 years. If you are 60% vested, then 60% of your retirement benefits belong to you if you leave the firm early. Note that your contributions and the return on those contributions always belong to you. It is only the matching contributions and the return on those contributions that need to be vested.

401(k) Tips

Consider employer’s retirement plan when choosing a job

Look at your employer’s retirement plan as a key benefit when considering a job. The quality of plans varies dramatically from employer to employer with regard to matching, investment options, and vesting. Take a look at this web page for some general information on common 401(k) benefits.

Diversify

Don’t use the stock of the company you work for as your primary investment choice! If the company matches in company stock, transfer it out as soon as possible. Don’t get “Enroned.” Don’t let company stock represent more than 20% of your retirement assets (and 20% is way on the high side – less than 10% is even better)

Be careful about being too safe

If you choose the safest investment option you likely won’t ever lose money, but you won’t make much either. If you have a low return, it will be hard to accumulate much wealth. The person that puts away $300 per month (note that with a 50% match from your employer, this is only $200 out of your pocket and $100 from your employer) for thirty-five years and earns 10% will have $1,138,991 whereas the person that puts away $300 per month for thirty-five years and earns 5% will only have $340,828 (or would need to put away about $1000 per month to get the same amount as the person who saved $300 per month at 10%). As you get closer to retirement, you should start to reduce your risk exposure. Don’t worry too much about stock market crashes during your first 10-20 years of savings. They mainly create opportunities for your monthly contributions to buy more.

Participate

The biggest mistake many people make is they say “I’ll start participating next year” and next year never comes. The person that saves $250 per month for thirty-five years at 9% will have $735,446 whereas the person that saves $250 per month for twenty years at 9% will only have $166,972.

Key Takeaways

Retirement planning is a major issue facing most people in the United States. Between the looming challenges facing Social Security (can you fix them?) and the decline in traditional defined-benefit pension plans, more individuals are going to need to save for their own retirement. While we have introduced the concepts of time value of money, bonds, stocks, and risk-and-return over previous chapters, the purpose of this chapter is to provide students with information on the principal tools available for meeting retirement goals – mutual funds, Individual Retirement Accounts, and 401(k) plans. Mutual funds provide a simple, potentially low-cost method for investors to easily invest their potential retirement savings. These can be used inside tax-advantaged retirement accounts (such as IRAs and 401(k) plans) or outside of tax-advantaged retirement accounts. IRAs and 401(k) plans are not investments, but tax shelters to protect investment income from taxes in order to help individuals better prepare for retirement. Unfortunately, the state of retirement savings in the US is in poor shape with the average (mean) retirement savings for families in the 56-61 age bracket being a mere $163,577 as of 2013. To put that in perspective, that would provide a couple with $956.25 per month in retirement income (or less than $12,000 per year) for 25 years if they could earn a 5% return over that 25 years. While that is not good, the picture is actually much worse. Because of the skewed nature of retirement wealth (if one family has $1,000,000 and 9 families have $70,000 each, that will provide a mean of $163,000 even though 90% of the families have less than half of the average amount), the mean likely overstates the retirement health of most families. If we instead turn to the median (half of the families have more and half have less) instead of the mean, half of families in the 56-61 age bracket have less than $17,000 saved for retirement. For the same 25 years with a 5% return, they would have just under $100 a month in retirement income. Using the tools covered in this chapter and the discipline to develop a savings plan, your chances of having a much healthier retirement is highly probable. Saving $200 per month and getting a $100 match from your employer from age 25 through age 64 (40 years) at 8%, will generate $1,047,302 available for retirement. This requires neither aggressive savings or unrealistic return assumptions.

Exercises

Question 1

Explain the difference between an expense ratio and a load charge? Which is more important for short-term investors? Which is more important for long-term investors?

Question 2

What kind of information would one find in the prospectus?

Question 3

What is an ETF? How is it similar to a traditional mutual fund and how is it different?

Question 4

What is a Lifecycle fund? What are advantages/disadvantages to this type of fund?

Question 5

When looking for a mutual fund (or funds), what should you look for?

Question 6

Evidence suggests that mutual funds do not outperform the broader market on a risk adjusted basis (they actually slightly underperform). Why might this be and does it mean that mutual funds are a poor investment tool?

Question 7

Explain key differences and similarities between a Roth and a Traditional IRA.

Question 8

What rate of return should I expect to earn on an IRA?

Question 9

What is the maximum contribution you can make to an IRA each year?

Question 10

Why would we say that more people are eligible to take full advantage of a Roth IRA compared to a Traditional IRA?

Question 11

What types of assets are typically held in Roth IRAs?

Question 12

What is a 401(k) plan?

Question 13

What do we mean by vesting with a 401(k) plan?

Question 14

What is a guideline for how much of your firm’s stock you should put in your 401(k) plan?

Question 15

If you leave your employer before retirement, what options are typically available to you for your 401(k) plan assets?

Solutions to CH 9 Exercises

Student Resources

The Investment Company Institute Guide to Understanding Mutual Funds

Attributions

Image: Mixed from Food-Eggs by Tookapic licensed under CC0

Image: Mixed from Stickynote by J_O_I_D licensed under CC BY 2.0