36

Dr. Kevin Bracker, Dr. Fang Lin and Jennifer Pursley

Question 1

Question 2

A supplier of capital refers to an individual, business, or government that has excess capital at a point in time that they would like to invest. The investment period could be as short as overnight or it could be several years. A couple of examples where I have acted as a supplier of capital in the past year would include investments into my retirement account and deposits into a checking account at my bank.

Question 3

A demander of capital refers to an individual, business, or government that needs additional capital at a point in time. It also includes situations where an individual uses previous capital (acquired as a supplier of capital) for a purchase (or purchases) in this time period. The period for using that capital could be as short as overnight or it could be several years. A couple of examples where I have acted as a demander of capital in the past year would include credit card purchases and obtaining a loan for the purchase of a van.

Question 4

Yes, most of us will act as both suppliers and demanders of capital within a given time period. If you make a deposit into a checking account (supplier of capital) and, within the same period, use a credit card (demander of capital) you are engaging in both activities. If you add money to a retirement plan at work (supplier of capital) and borrow money to purchase a home (demander of capital) you are engaging in both activities. You can probably think of several different situations from your own experience where you operated on both sides of the system within a given time period.

Question 5

First, imagine a situation where there was no financial system in place. If you wanted to borrow money to purchase a new home, you would have to approach friends and family, take out a classified ad, or set up a web page asking to borrow money. Now imagine if you were doing this as a large business needing to raise $50 million for a new production facility. Or consider the flip side. You are working and earning a good salary. You want to set aside some money for retirement. Without a financial system, you can go dig holes in the back yard and start burying your extra money in jars. Or you could go around to local businesses asking if they wanted to borrow money from you or let you invest in their business. Or possibly even hang out at car dealerships seeing if someone needed a loan to buy a new car. Obviously none of these are very attractive options.

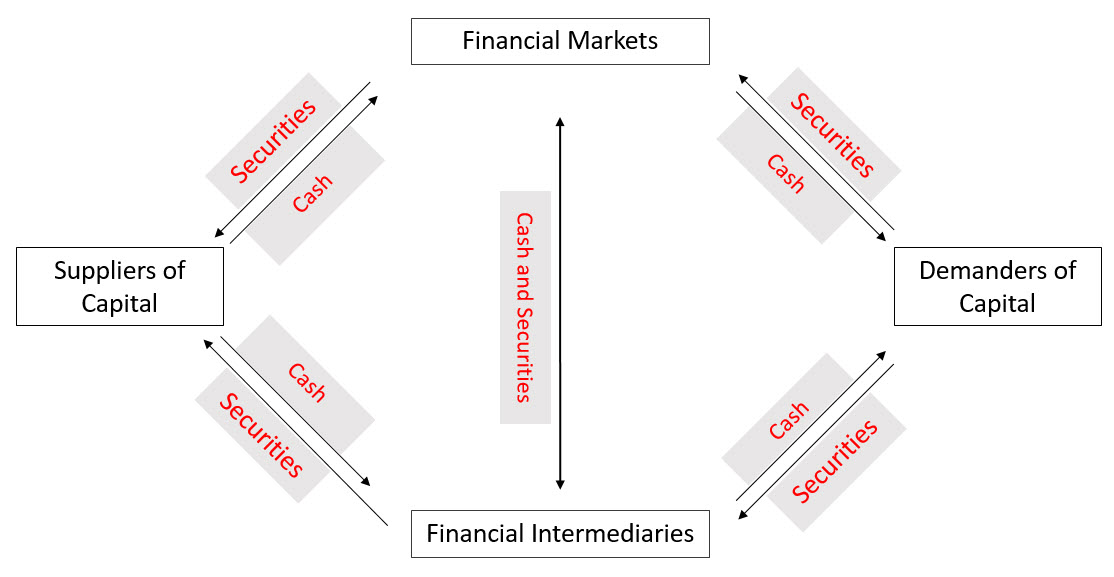

Having an efficient financial system in place allows you to approach a financial intermediary (such as a bank) when you need to obtain a loan. It allows you to pool purchases on a credit card (and if you pay your cards off on time without carrying a balance, you can earn rewards such as cash back). It allows you to become a part owner in attractive businesses by purchasing shares of stock or set aside money for retirement through a mutual fund. Essentially, by having a system in place that allows convenient trading of securities (the financial markets) and processing of transactions that require special structuring or credit evaluation (financial intermediaries), both suppliers and demanders of capital benefit. The reduced costs of finding someone to take the other have of the transaction and the specialization of financial institutions mean that suppliers of capital receive higher effective returns on their investments while at the same time demanders of capital are able to raise money at lower effective rates. This win-win situation is caused by the huge reduction in transaction costs (monetary costs and time costs) along with the availability of far more opportunities provided by financial markets and financial intermediaries.

Question 6

Stocks are what we refer to as homogeneous securities. What that means is that one share of stock in Google is the same as the next. It doesn’t matter which share I buy or who I buy it from. This homogeneity is one of the primary reasons why financial markets are efficient for stock transactions. I do not need to evaluate the quality of the particular share of stock I’m receiving or the creditworthiness of the person selling it to me. All I need to know is (A) what company am I buying stock in, (B) how many shares do I want to buy, and (C) how much am I willing to pay.

The second important characteristic of stocks is that most publicly traded stocks have several million (in some cases billions) of shares outstanding and many different people (both individuals and institutions) willing to buy/sell those shares at any given time. That means that by having a central location (either a physical location or even a network) where buyers and sellers are brought together, I can find someone willing to take the other side of my transaction very quickly.

When we have homogeneous securities and a large number of potential buyers and sellers, we have ideal conditions for financial markets. Give the potential buyers and sellers access to each other and they will collectively determine the optimal pricing.

Question 7

An auto loan is a very specialized security. The borrower (demander of capital) is seeking a loan (typically in the $10,000 – $25,000 range). The appropriate rate of return is dependent on the specific borrower (what is his credit history, employment history, income, other debts, etc.). Remember that one of the characteristics of securities that work well in financial markets is their homogeneity (it doesn’t matter who I am buying the security from). Also, important to financial markets is that there are many buyers and sellers of the identical security. However, since each auto loan is individualized, neither of these characteristics are present. As a supplier of capital, you would need to run a complete credit background on the borrower and prepare a binding, legal note (the document backing the loan) for repayment. As most of us do not engage in these activities on a regular basis, the cost of doing so would eat up most of the return. However, for a financial institution that makes several similar loans each day, the process of credit checks and documentation are relatively low-cost items. Specialization allows the financial institutions to process these loans at a low cost (and diversify some of the risk by holding many different auto loans) so that they can lend the money at a relatively low rate. If the financial intermediary is a bank, it gets the necessary capital from the many depositors at the bank.

Question 8

This was partially discussed in the above question. Consider a bank. Banks obtain capital from hundreds (thousands or even hundreds of thousands depending on the size of the bank) of depositors. These people have checking accounts, savings accounts, certificates of deposits, etc. at the bank. The bank then takes all of this money on deposit and lends it out in the form of business loans, personal loans, mortgage loans, etc. They may also use the money to purchase Treasury bonds. By pooling capital in a financial intermediary, the bank is able to provide securities to the suppliers of capital that have a very different risk/return profile than the securities issued by the demanders of capital. This process helps increase the amount of money available in the financial system and allows both suppliers and demanders to benefit by better matching their needs.

Another example would be mutual funds. Many people invest in stocks and bonds through mutual funds. The mutual fund acts as a financial intermediary. As a supplier of capital, I send money to the mutual fund to invest in stocks and/or bonds. The mutual fund issues me shares of its portfolio. It then pools my money with thousands of other investors and goes into the financial markets to buy stocks and bonds from demanders of capital. The advantage to me as a supplier of capital is I get better diversification, the ability to invest less capital, and professional investment management to pick the stocks and bonds. Without the mutual fund as the financial intermediary, I would have to evaluate each stock and/or bond in my portfolio myself and have enough money to purchase enough different stocks/bonds to be diversified.

Question 9

The mutual fund example above meets this criteria. Another would be a life insurance company. When you purchase life insurance, the insurance company pools the premiums paid by you and the thousands of other customers. Instead of just holding onto this money and waiting to pay our benefits, the insurance company invests those premiums in stocks and bonds purchased in the financial markets. Because the insurance company is able to earn a return on these premiums paid in while they are waiting to pay out benefits, it lowers the cost of the insurance for customers. Many life insurance policies combine the life insurance with an investment policy so that the supplier of capital is buying life insurance and saving for retirement at the same time. (Note – this is not necessarily the best way to save money for retirement for everyone).

Question 10

Money market securities refer to securities that mature in one year or less. These include Treasury Bills (short-term “bonds” issued by the US Federal Government), Commercial Paper (short-term “bonds” issued by corporations), Re-purchase Agreements, and several other types of short-term securities.

Capital market securities refer to securities that mature in more than one year. These include Treasury Notes (“bonds” issued by the US Federal Government that mature in 2-10 years), Treasury Bonds (bonds issued by the US Federal Government that mature in 11-30 years) , Corporate Notes and Bonds, Preferred Stock, Common Stock and many other securities.

Question 11

The primary markets are where firms (or governments) issue securities to raise capital. For instance, Initial Public Offerings (IPOs) refer to situations where a corporation “goes public”. When a firm has an IPO, it is selling its stock to the public for the first time (prior to this, the corporation was typically owned by the founders and venture capitalists). In the IPO, the firm works with investment bankers to set the initial price and find investors that want to buy the shares. It is common for a firm to have more interested buyers than shares available. When this happens, the investors that were able to participate in the IPO often can sell their shares in the secondary markets later in that same day for 10%-100% more than they paid in the IPO. Consider the Snap (parent company of Snapchat) IPO from 2017. On March 2nd, 2017, Snap became a publicly traded company through an IPO. The stock was issued through the IPO at $17. Because the demand for the stock was so high on the IPO, not everyone that wanted to buy at the initial offering price of $17 could buy. When shares started trading in the secondary market, the price was $24 (about 40% above the IPO price). By the end of the day, the stock closed at $24.48 after trading as high as $26.05 during the day. Note that the increase in price beyond the IPO price of $17 was a return to the investors in the IPO and did not raise any additional capital for LinkedIn. LinkedIn’s capital raised was based on the $17 IPO price.

Another type of primary market activity is referred to as a secondary (or “seasoned equity”) offering. The secondary offering is NOT TO BE CONFUSED with the secondary market. A secondary (“seasoned equity”) offering refers to a company that already is publicly traded, but issues additional shares of stock to raise money. Typically when firms issue additional shares in a secondary offering, the price of the stock will fall by a small amount (1-3%).

A third type of primary market activity occurs when corporations and/or governments issue new bonds. The US Treasury auctions new bonds on a regular basis where investors engage in an auction process to determine the price that they are willing to pay the US Treasury for these bonds. Corporations and State/Local governments will typically use investment bankers to help them price and sell their bonds in the primary markets instead of the auction process used by the Treasury.

Question 12

There are multiple ways in which the secondary market benefits firms. First, without an active secondary market, the primary market would be much more limited. When investors buy stocks and bonds from the issuers in the primary market, the investors want to have the option to resell those stocks and bonds later on in the secondary markets. If there was no secondary market, many investors would be less willing to participate in the primary markets. Would you want to buy a 30-year Treasury bond if you knew there was no convenient way to sell it before maturity? How about buying stock in a new company? Without the liquidity provided by the secondary market, very few firms would be able to find investors to purchase primary market transactions. Even those that were able to still find investors in the primary markets would likely need to pay those investors much higher rates of return.

The second way the secondary markets benefit firms is through information. When bonds are actively traded in the secondary markets, we get information about what investors are demanding for interest rates. When stocks are actively traded in the secondary market, firms get information about the health of their company and their competitors (a falling stock price indicates perceived problems while a rising stock price indicates perceived strength).

Secondary markets also provide sources of acquisitions (allowing companies to grow), ways to reduce agency costs (through stock-based compensation) and many other benefits.

Question 13

Part 13a

k = krf + IP + DRP + LP + MRP + SCP

k = 2% + 3% + 0% + 0% + 0% + 0% = 5%

Part 13b

k = krf + IP + DRP + LP + MRP + SCP

k = 2% + 2.5% + 0% + 0% + 0.6% + 0% = 5.1%

Part 13c

k = krf + IP + DRP + LP + MRP + SCP

k = 2% + 3.5% + 0.3% + 0.1% + 0.15% + 0.6% = 6.65%

Part 13d

k = krf + IP + DRP + LP + MRP + SCP

k = 2% + 2.5% + 1.2% + 0.2% + 0.5% + -0.8% = 5.60%

Question 14

Part 14a

Part 14b

Part 14c

Part 14d

In Yield Curve A, we have an upward-sloping yield curve (longer-term securities offer higher returns). The differences in yields are based on two factors – the inflation premium and the maturity premium. We know longer-term bonds are riskier and have a higher maturity premium. This is likely accounting for some of the upward slope. However, it is also likely that inflation expectations are slightly higher over the long-term than the short-term.

In Yield Curve B, we have a downward-sloping yield curve. As the maturity premium should increase with longer-term securities, the only way for a long-term bond to offer a lower yield than a shorter-term bond is if inflation expectations are higher for the short-term bonds. This typically will occur when the economy is expected to enter an economic slowdown in the near future.

Part 14e

Yield Curve B is based on Treasury bonds while Yield Curve C is based on BB-rated corporate bonds. Since the yield curves are taken at the same point in time, the inflation premiums should be the same in both curves. This means that the difference (the higher yields at every level in Yield Curve C) are based on the higher levels of default risk premium associated with BB-rated bonds and (to a lesser extent) the slightly higher liquidity premium on the corporate bonds (Treasury bonds tend to be more liquid than corporate bonds).