15.2 Network Planning

Network planning in warehousing is a critical exercise in balancing two key aspects of logistics: enhancing customer service and managing costs. This balance determines the number and distribution of warehouses within a country, directly impacting both the efficiency of deliveries and the operational expenses of a business. To understand this balance, it’s essential to consider several factors and how they interplay with the warehousing network, ultimately affecting the company’s objectives:

- Customer Service: The proximity of warehouses to customers is a crucial factor in determining the speed of service. A greater number of warehouses in a region generally reduces the average distance to customers, leading to faster deliveries. This increase in delivery speed can significantly boost customer satisfaction and, as a result, potentially increase revenues. The ability to provide quick service is often a competitive advantage in today’s fast-paced market.

- Warehouse Infrastructure Costs: These costs escalate with the number of warehouses. More warehouses mean higher expenditure on establishment, maintenance, and operation of each facility. This includes costs associated with building or leasing warehouse space, staffing, utilities, and warehouse management systems.

- Inbound Transportation Costs: These costs are associated with transporting goods to the warehouses. When the network has fewer warehouses, it’s possible to move goods in larger, more cost-effective shipments. Conversely, a network with many warehouses may necessitate smaller, more frequent shipments to multiple locations, which can increase the per-unit transportation cost.

- Last Mile Transportation Costs: This term refers to the final leg of a product’s journey from the last warehouse in the network to the final consumer. Typically conducted using smaller vehicles, this phase of transportation often constitutes one of the largest components of logistics costs. The proximity of warehouses to customers can significantly impact these expenses, as shorter distances generally translate to lower last mile costs. However, it’s important to note that these costs are inherently high due to the nature of last mile delivery, involving smaller shipment sizes and potentially complex urban delivery environments.

The decision on the number of warehouses in a network is thus a complex one, requiring a comprehensive analysis of these various costs. Businesses must aggregate and weigh these factors to devise a warehousing network that aligns with their customer service goals and financial constraints. This involves an intricate understanding of logistics dynamics, customer distribution, and cost structures, all aimed at optimizing the supply chain to meet both immediate and long-term business objectives.

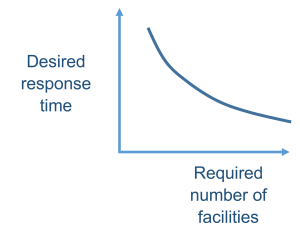

Long response time require only a few locations that may be far from the customer. These companies can focus on increasing the capacity of each location.

Short response times need to locate facilities close to customers. These firms must have many facilities, each with a low capacity.

A decrease in the desired response time increases the number of facilities required in the network.

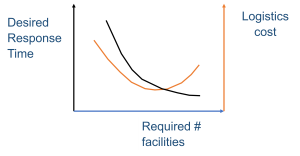

Additionally, changing the distribution network design affects the following supply chain costs:

- Inventories

- Transportation

- Facilities and handling

- Information

More facilities > more inventory > fewer turns

Total Logistics Costs are the sum of inventory, transportation, and facility costs for a supply chain network.

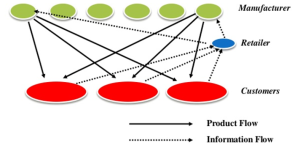

MANUFACTURER STORAGE WITH DIRECT SHIPPING

In this option, product is shipped directly from the manufacturer to the end customer, bypassing the retailer (who takes the order and initiates the delivery request). This option is also referred to as drop-shipping.

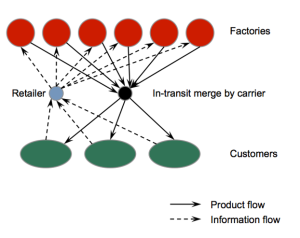

MANUFACTURER STORAGE WITH DIRECT SHIPPING AND IN-TRANSIT MERGE

Unlike pure drop-shipping, under which each product in the order is sent directly from its manufacturer to the end customer, in-transit merge combines pieces of the order coming from different locations so the customer gets a single delivery.

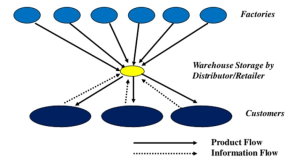

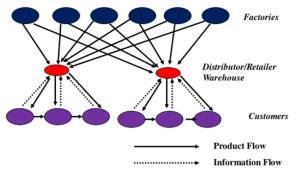

DISTRIBUTOR STORAGE WITH CARRIER DELIVERY

Under this option, inventory is held not by manufacturers at the factories, but by distributors/ retailers in intermediate warehouses, and package carriers are used to transport products from the intermediate location to the final customer as single shipments (postal systems, express mail, private currier companies and LTL shipping carriers).

Amazon and industrial distributors such as W.W. Grainger and McMaster-Carr have used this approach combined with drop-shipping from a manufacturer (or distributor).

DISTRIBUTOR STORAGE WITH LAST-MILE DELIVERY

Last-mile delivery refers to the distributor/retailer delivering the product to the customer’s home instead of using a package carrier. AmazonFresh, Peapod, and Tesco have used last-mile delivery in the grocery industry. Companies such as Kozmo and Urbanfetch tried to set up home-delivery networks for a variety of products, but they failed to survive.

The automotive spare parts industry is one in which distributor storage with last-mile delivery is the dominant model.

RETAIL OR DISTRIBUTOR WITH CUSTOMER PICKUP

In this approach, inventory is stored at the manufacturer or distributor warehouse, but customers place their orders online or on the phone and then travel to designated pickup points to collect their merchandise. Orders are shipped from the storage site to the pickup points as needed.