6.2 Purchase to Pay

Purchasing operations and the manner in which purchasing transactions are executed play a pivotal role in all organizations. The significance of this process is underscored when we consider the potential vulnerabilities that can arise if not managed meticulously. For instance, between 2013 and 2015, tech giants Meta (formerly Facebook) and Google fell victim to a sophisticated invoice fraud, losing more than $100 million combined. The fraud involved impersonation of a known hardware manufacturer, leading to the companies being deceived with fake invoices and making substantial erroneous payments.

Such incidents involving Meta and Google are not isolated cases. The FBI’s Internet Crime Complaint Center has issued advisories indicating a staggering 1,300 percent increase in such Business Email Compromise frauds since January 2015, estimating that companies have been defrauded of more than $3 billion in recent years.

These incidents underscore the importance of a robust purchasing operations process. At the heart of these operations lies the Purchase to Pay (P2P) process. Typical concerns associated with an ineffective P2P process include:

- Incorrect orders: Companies may buy too much of components that they do not need and also not buy what they need.

- Late or Incorrect Payments: Invoices might be paid late or inaccurately, potentially damaging relationships with suppliers and incurring late fees or penalties.

- Duplicate Payments: There’s a risk of making duplicate payments, which not only wastes money but can also tarnish the company’s reputation.

- Fraudulent Invoices: Companies might end up paying fraudulent invoices, leading to financial losses and reputational damage.

- Lack of Spending Insight: Without a streamlined P2P process, a company might lack a clear understanding of its spending patterns, making it challenging to control costs and formulate informed budgeting decisions.

- Supply Chain Vulnerabilities: A poor grasp of the P2P process can make a company more susceptible to supply chain disruptions due to a lack of understanding of its supplier relationships and the associated risks.

This process is not just a series of transactional steps but is a critical operational flow that involves multiple organizational functions. For the P2P process to function effectively, there needs to be a seamless data flow between departments. This ensures that every stakeholder, from the procurement team to the finance department, has access to accurate and timely information. Such inter-departmental coordination is vital for avoiding discrepancies, ensuring timely payments, and maintaining healthy supplier relationships.

Given its significance, it’s imperative to delve deep into the intricacies of the P2P process, understanding each step, the challenges that might arise, and the best practices to ensure its smooth functioning. In the following sections, we will explore these details, providing a comprehensive overview of the Purchase to Pay process.

6.2.1 Step 1: Generation of Purchase Requisition

The Purchase to Pay (P2P) process commences with the generation of a purchase requisition. A purchase requisition is typically generated by the user department that identifies a need for specific goods or services. For instance, the IT department might generate a requisition for new computer systems, or the marketing team might request promotional materials for an upcoming campaign. In a manufacturing setup, the production department might raise a requisition for specific parts or raw materials that are running low or are required for a new production batch.

In scenarios involving raw materials, the generation of the requisition might not always be manual. Automated material planning systems, equipped with algorithms that monitor stock levels and forecast demand, can trigger the generation of purchase requisitions when stock levels dip below a certain threshold. We will delve deeper into these automated systems in Chapter 8, which focuses on inventory management, and in subsequent chapters that explore the integration of technology in supply chain management.

Before a purchase requisition is forwarded to the purchasing department, it undergoes an approval process. This approval is not merely a formality; it’s a critical checkpoint that ensures alignment with organizational budgets. The approval process ensures that the requested purchase is within the budgetary constraints set for the department or the specific project. In this way, the P2P process is intricately linked to the organization’s budgeting system, ensuring fiscal discipline and preventing potential overspends.

Purchase requisitions also play a pivotal role in spend analysis. By consistently initiating purchases with requisitions, organizations can track and categorize their spending. This data can be invaluable for identifying spending patterns of departments and making informed budgetary decisions in the future. For instance, if an organization notices a recurring monthly requisition for office supplies from one department, they can investigate the cause. This is why it’s imperative that all purchase orders, regardless of their size or frequency, initiate with a well-documented requisition.

6.2.2 Supplier Selection

Once a purchase requisition receives approval, it is forwarded to the purchasing department. In contemporary firms, this transfer of documents predominantly occurs electronically, ensuring speed and accuracy. However, in many small and medium-sized businesses, especially those without advanced IT infrastructure, the transfer might still involve physical documents, requiring manual handling and verification.

For standard items or recurring purchases, the purchasing department typically consults an Approved Supplier List (ASL). The ASL, as the name suggests, is a curated list of suppliers who have been vetted and approved to supply specific materials or services to the organization. In the past, this might have been a physical ledger or file, but in today’s digital age, most firms maintain this list electronically, allowing for easier updates, searches, and integrations with other systems.

The existence of an Approved Supplier List is crucial for several reasons:

- Quality Assurance: Suppliers on this list have been pre-evaluated for their ability to meet the company’s quality standards.

- Efficiency: It speeds up the purchasing process as the purchasing department doesn’t have to vet suppliers from scratch for every purchase.

- Risk Mitigation: By dealing with approved suppliers, companies can reduce risks related to fraud, supply chain disruptions, or subpar goods and services.

Once the appropriate suppliers are identified from the ASL, the purchasing department sends out a Request for Quotation (RFQ). It’s worth noting the distinction between different types of requests:

- RFQ (Request for Quotation): This is a formal request for suppliers to submit a price quote for specific goods or services. It’s typically used when the needs are clearly defined.

- RFP (Request for Proposal): Used when the solution to a business problem is not clear-cut. Suppliers propose their solutions, along with pricing.

- RFI (Request for Information): This is a preliminary step used when a company is exploring potential suppliers or services. It’s more about gathering information than seeking specific quotes. **short this

Suppliers respond to the RFQ by submitting their quotes. The purchasing department then undertakes the crucial task of comparing these quotes. At a foundational level, quotes are compared based on landed costs—the comprehensive cost of receiving the goods at the buyer’s facility. This encompasses the base price of the goods, transportation charges, taxes, duties, and any other associated costs. However, a more holistic approach involves considering the life-cycle cost, which accounts for the total expenditure associated with a product or service over its entire life span, from acquisition to disposal. While landed costs provide an immediate picture, life-cycle costs offer a long-term perspective, factoring in maintenance, operational costs, and even disposal or resale value. We will delve deeper into the intricacies of landed and life-cycle costs in subsequent sections.

After a thorough comparison and evaluation, the purchasing department finalizes its decision and places an order with the chosen supplier, marking the next step in the P2P process.

6.2.3 Purchase Order

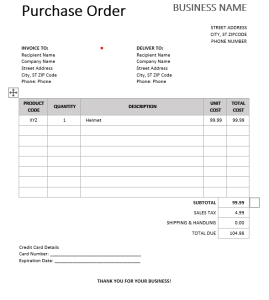

Once the supplier selection process is complete, the purchasing department proceeds to create a Purchase Order (PO). A Purchase Order is a formal document issued by the buyer to the supplier, indicating types, quantities, and agreed prices for products or services. It serves as a legally binding contract, authorizing the supplier to deliver the specified products or services and the buyer to pay for them.

Major Entries in a Purchase Order:

- PO Number: A unique identification number assigned to each purchase order, facilitating tracking and reference.

- Supplier Details: Information about the supplier, including name, address, contact details, and any other relevant identification.

- Buyer Details: Information about the purchasing company or department, including billing and shipping addresses.

- Date of Issue: The date on which the PO is issued.

- Delivery Date: The agreed-upon date by which the products or services should be delivered.

- Item Details: A detailed list of the products or services being purchased, including descriptions, quantities, unit prices, and total prices.

- Terms and Conditions: Any specific terms and conditions related to the purchase, such as payment terms, delivery terms (e.g., FOB, CIF), warranties, or penalties for late delivery.

- Authorized Signatory: The signature or digital authorization of the person in the purchasing department who has the authority to commit to the purchase.

Types of Purchase Orders:

- Standard Purchase Order: This is the most common type of PO and is used for routine, one-time purchases. It details the specific items, quantities, and prices agreed upon. Example: A company orders 50 office chairs for a new branch they are setting up. The order is specific with a one-time requirement, detailing the model, color, and price of the chairs.

- Blanket Purchase Order: Used for repeat orders or when there’s an ongoing relationship with a supplier. It sets the terms and conditions for multiple deliveries over a period of time but might not specify exact item quantities or delivery dates upfront. Example: An automobile manufacturer anticipates the need for 300 tons of steel over the next quarter for car production. While the exact quantities and delivery dates will be determined based on production schedules, the blanket order sets the terms, pricing, and overall quantity for the entire quarter.

- Contract Purchase Order: This type of PO is tied to a larger contract agreement and is used for complex purchases, often involving multiple stakeholders, detailed specifications, or phased deliveries. Example: A city’s municipal corporation enters into a contract with a technology firm to upgrade its IT infrastructure over two years. The contract purchase order outlines the specifications, milestones, and payment terms, with deliveries and installations phased over the contract duration.

Once the appropriate type of Purchase Order is created, it is essential to send it to the selected supplier promptly. However, the process doesn’t end with merely issuing the PO. It’s crucial for the buyer to receive a confirmation from the supplier, signaling their acceptance of the terms outlined in the Purchase Order. This step is not just a procedural formality; in many legal systems, the purchase contract is not deemed to be finalized until the supplier explicitly acknowledges and accepts the PO. This acceptance ensures that both parties are on the same page regarding the terms, quantities, prices, and delivery schedules, minimizing potential disputes or misunderstandings down the line. It’s a testament to the importance of clear communication and mutual agreement in the procurement process.

6.2.4 Material Delivery

Material delivery is a pivotal phase in the Purchase to Pay process. While the creation of a Purchase Order sets the expectations for the transaction, the material delivery phase ensures that these expectations are met in practice. For a Standard Purchase Order, the delivery schedule is typically outlined within the PO itself, specifying when the buyer expects to receive the goods or services. In the case of a Blanket Purchase Order, while the overarching terms and conditions are set, a separate material delivery schedule is often established, detailing specific delivery dates based on evolving needs and production schedules.

However, the buyer’s responsibility doesn’t conclude with merely setting these delivery dates. Proactive follow-up with suppliers is essential to ensure adherence to the agreed-upon delivery timelines. Delays or inconsistencies in delivery can have cascading effects on production schedules, inventory management, and overall operational efficiency.

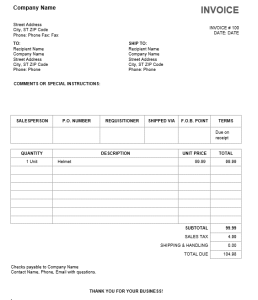

Upon dispatch of the goods, the supplier generates an invoice, which typically accompanies the material during delivery. This invoice is a detailed document capturing essential information such as:

- Description of the material or service

- Quantity delivered

- Cost of the material or service

- Applicable taxes and other charges

- Reference to the associated Purchase Order

Accuracy in the invoice is paramount. As we will explore in the subsequent sections on the three-way match process, any discrepancies between the PO, the invoice, and the actual goods received can lead to complications, delays, and potential financial discrepancies.

Upon the arrival of the material and the associated invoice at the buyer’s facility, the material stores or the inward administration department undertakes an initial inspection. This visual check serves to verify the quantity and condition of the goods. Following this inspection, a Goods Receipt Note (GRN) is generated. The GRN serves multiple purposes:

- It confirms that the quantity of the material received aligns with the quantity mentioned in the invoice.

- It provides a record of the physical condition of the goods, noting any damages, discrepancies, or potential quality issues.

Once the GRN is generated and the material is deemed satisfactory, the next steps involve inventorying the material in the material stores, delivering it immediately to the production line if required, or sending the material for further inspection. Assuming the material meets the required quality standards, it is now available for use in the organization’s operations.

6.2.5 Making Payment

In the realm of business transactions, there are various mechanisms through which payments can be made, each tailored to the specific dynamics of the buyer-supplier relationship and the nature of the transaction.

Some dominant suppliers, especially those with a unique product or significant market power, might demand an advance payment before delivering goods or services. In other scenarios, especially for international transactions or when dealing with new business partners, a Letter of Credit (LC) might be required. An LC is a bank guarantee that ensures a buyer’s payment will be made to the seller, provided that the terms of the sales contract are met. Other payment mechanisms include bank transfers, electronic funds transfers, and even digital or cryptocurrency payments in some modern contexts.

However, the most prevalent form of payment in business-to-business transactions is trade credit. Under this arrangement, suppliers allow buying businesses a specified period, post-delivery, to make the payment. For instance, terms like “Net 30” or “Net 60” indicate that the buyer has 30 or 60 days, respectively, from the invoice date to make the payment. Such arrangements benefit buyers by providing them with flexibility in managing their cash flows.

Upon receipt of goods or services, buying businesses record an “accounts payable” entry, signifying an obligation to pay the supplier. The payment is then planned to align with the trade credit due date. This payment process is often facilitated through a procedure known as the three-way match. This involves verifying and matching three essential documents:

-

- The Purchase Order (PO) – which outlines what was ordered.

- The Goods Receipt Note (GRN) – which confirms what was received.

- The Purchase Order (PO) – which outlines what was ordered.

- The Invoice – which details what is being charged.

A robust three-way match process offers several advantages:

- Minimization of Invoice Frauds: By ensuring that the invoice matches both the PO and the GRN, businesses can significantly reduce the risk of paying for goods not ordered or received.

- Accurate Financial Reporting: Ensures that financial obligations are correctly recorded and settled.

- Enhanced Supplier Relationships: Timely and accurate payments foster trust and can lead to better terms in future transactions.

However, the accuracy of these three documents is paramount. Even minor discrepancies between them can complicate the payment process, leading to delays, disputes, and potential financial implications. Ensuring precision in each document and during the matching process is crucial. Typically, the responsibility of conducting the three-way match and processing payments falls on the accounts payable department, underscoring their critical role in the procurement process.