4.2 Sustainability Metrics

Traditional business metrics have often been short-term and excessively focused on financial measures. These metrics, while important for assessing financial performance, often overlook the broader impacts of a business on society and the environment. The Balanced Scorecard, as discussed in Chapter 2, partially addressed this issue by incorporating non-financial measures into performance assessment. However, even the Balanced Scorecard does not explicitly focus on sustainability. Therefore, we need frameworks that can effectively measure sustainability performance.

4.2.1: The Triple Bottom Line

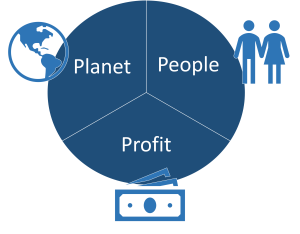

One such framework is the Triple Bottom Line (TBL), which was first coined by John Elkington in 1994. The TBL posits that firms should commit to measuring their social and environmental impact—in addition to their financial performance—rather than solely focusing on generating profit, or the standard “bottom line.”

The Triple Bottom Line can be broken down into “three P’s”: profit, people, and the planet.

Profit: In a capitalist economy, a firm’s success most heavily depends on its financial performance, or the profit it generates for shareholders. Strategic planning initiatives and key business decisions are generally carefully designed to maximize profits while reducing costs and mitigating risk. However, purpose-driven leaders are discovering they have the power to use their businesses to effect positive change in the world without hampering financial performance. In many cases, adopting sustainability initiatives has proven to drive business success. For example, according to an IBM consumer report, half of consumers are willing to pay a premium for sustainable products. Further, purpose-driven consumers—those who choose products and brands based on alignment with their values—represent the largest market segment at 44 percent.

Companies are now also using sustainability-adjusted ROI and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) to measure the financial benefits of their sustainability initiatives. These metrics help in quantifying how sustainability practices contribute to the bottom line.

Sustainability-Adjusted ROI: This is a modification of the traditional Return on Investment (ROI) metric. It incorporates the costs and benefits of sustainability initiatives. The formula is:

Sustainability-Adjusted ROI = [latex]\dfrac{Net\, Profit\, from\, Sustainability\, initiatives - Cost\, of \,sustainability\, initiatives}{Cost\, of\, susstainability \,initiatives}*100[/latex]

Sustainability-Adjusted EBITDA: Similar to EBITDA, this metric adjusts earnings to include the costs and benefits of sustainability efforts. It can be calculated as:

Sustainability-Adjusted EBITDA = EBITDA + Revenue from Sustainable Products − Cost of Sustainable Initiatives

People: The second component of the TBL highlights a business’s societal impact, or its commitment to people. Traditionally, businesses have favored shareholder value as an indicator of success, meaning they strive to generate value for those who own shares of the company. As firms have increasingly embraced sustainability, they’ve shifted their focus toward creating value for all stakeholders impacted by business decisions, including customers, employees, and community members. For instance, companies can ensure fair hiring practices and encourage volunteerism in the workplace.

Social Return on Investment (SROI) and employee engagement scores are becoming popular metrics to measure this aspect. SROI helps in quantifying the social impact created per dollar spent, while employee engagement scores can indicate the level of employee satisfaction and retention.

Social Return on Investment (SROI): This metric quantifies the social impact per dollar spent. It is calculated as:

SROI= [latex]\dfrac{Social\,value\,created-Investment\,in\,social\,initiatives}{Investment\,in\,social\,initiatives}*100[/latex]

Employee Engagement Score: This is often measured through surveys and questionnaires that assess employee satisfaction, loyalty, and advocacy. The score is usually a percentage of highly engaged employees.

Planet: The final component of the TBL is concerned with making a positive impact on the planet. Since the birth of the Industrial Revolution, large corporations have contributed a staggering amount of pollution to the environment, which has been a key driver of climate change and environmental concerns. While businesses have historically been the greatest contributors to climate change, they also hold the keys to driving positive change. Many business leaders are now recognizing their social responsibility to do so. Adjustments like using ethically sourced materials, cutting down on energy consumption, and streamlining shipping practices are steps in the right direction toward long-term sustainability. For example, UPS has been integrating alternative energy sources into their fleets, resulting in cost savings that help their customers and their bottom lines.

Carbon footprint per unit of revenue, water usage per unit of production, and waste recycling rates are some of the key metrics that companies are using to measure their environmental impact. For instance, UPS has been integrating alternative energy sources into their fleets, which not only reduces their carbon footprint but also results in cost savings.

Carbon Footprint per Unit of Revenue: This metric measures the amount of carbon dioxide emissions per dollar of revenue generated. It is calculated as:

Carbon Footprint per Unit of Revenue = [latex]\dfrac{Total \,carbon\, emissions}{Total\, revenue}[/latex]

Water Usage per Unit of Production: This metric quantifies the amount of water used per unit of product manufactured. It is calculated as:

Water Usage per Unit of Production = [latex]\dfrac{Total \,water \,used}{Total \,units \,produced}[/latex]

Waste Recycling Rate: This is the percentage of waste material that has been diverted from traditional disposal and is instead being recycled. It is calculated as:

Waste Recycling Rate = [latex]\dfrac{Total\, waste \,recycled}{Total\, waste\, generated}[/latex]

The TBL doesn’t inherently value societal and environmental impact at the expense of financial profitability. Instead, many firms have reaped financial benefits by committing to sustainable business practices. According to Sustainable Business Strategy, evidence has increasingly shown that firms with promising environmental, social, and governance (ESG) metrics tend to produce superior financial returns. As a result, more investors have begun focusing on ESG metrics when making investment decisions.

To illustrate the practical application of the TBL, let’s consider the example of sustainable sourcing. As per a report on Supply Chain Dive, the gap between sustainable and low-cost procurement is narrowing. Buyers have greater choices in sourcing sustainable products from suppliers with a strong belief in corporate social responsibility. Sustainable efforts often help to simplify and streamline supply chain operations, providing an economic benefit for customers and suppliers alike through lower prices and improved service levels. Now, the green alternative is frequently the low-cost alternative. Positive economics around sustainability has taken hold and the supply chain — and society — are better for it. This example demonstrates how the three Ps of the TBL can be effectively integrated into business operations.