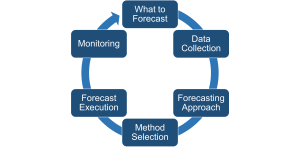

9.2 Demand Forecasting Process

Building on our understanding of the significance of forecasting, it becomes evident that a structured approach is essential to ensure accuracy and relevance. Forecasting is not just about predicting numbers; it’s about making informed decisions that can shape the future of a business. Having a systematic process for forecasting not only provides a clear roadmap but also ensures consistency, reduces errors, and allows for continuous improvement.

Step 1: What to Forecast

The nature of what we forecast is primarily determined by the specific needs and objectives of the business. Forecasts can be categorized into:

- Long-term forecasts: These are typically for a period beyond three years and are used for strategic planning, such as entering a new market or launching a revolutionary product. For instance, a tech company might forecast the adoption rate of a new technology over the next decade.

- Medium-term forecasts: Spanning from one to three years, these forecasts often guide budgeting decisions or expansion plans. An airline might use medium-term forecasts to decide on adding new routes or purchasing new aircraft.

- Short-term forecasts: These are for periods less than a year and are crucial for operational decisions like inventory management or staffing. Retailers, for example, would use short-term forecasts to determine stock levels for the upcoming holiday season.

Different forecasting methods are suited for these varying time horizons, and it’s crucial to match the method with the forecast’s purpose. For example, in sales, we can apply the time horizon as:

| Horizon | Long-Term | Medium-Term | Short-Term |

| Forecast Quantity | Total Sales | Sales of Product or

Service Families |

Sales of Individual Services or Products |

Step 2: Data Collection

The foundation of any good forecast is reliable data. The types of data required include:

- Historical Data: This encompasses past demand data and factors that influence demand, such as advertising campaigns, promotions, or price changes.

- Economic Indicators: Both historical and prospective data on GDP growth, money supply, inflation rates, and other economic factors can influence demand patterns.

- Demographic and Trends Data: Information on population growth, age distribution, urbanization trends, and other societal patterns can be pivotal, especially for consumer goods and services.

- Expert Knowledge: Sometimes, the best insights come from individuals with deep industry knowledge or those who have a pulse on market sentiments.

Step 3: Forecasting Approach

Broadly, there are two primary approaches to forecasting: qualitative and quantitative.

- Qualitative or Judgmental Forecasting: This is often employed when historical data is either unavailable or deemed irrelevant. It’s especially useful for long-term forecasts where past patterns might not provide clear insights into future trends.

- Quantitative Forecasting: This approach is rooted in the belief that past patterns will reoccur. It’s particularly effective for short and medium-term forecasts where historical data can provide a clear picture of future demand.

Step 4: Method Selection

Once the broader approach is chosen, the next step is to select a specific forecasting method.

- For qualitative forecasting, the choice hinges on the nature of the decision, the available expertise, and the forecast’s horizon. Each qualitative method has its strengths and weaknesses, which we’ll delve into later.

- For quantitative forecasting, the method is often chosen based on its fit with historical data. The ideal method would be the one that most accurately predicts past demand patterns.

Step 5: Forecast Execution

With the method in hand, the actual forecasting can commence. However, forecasting is not a one-time activity. It’s vital to continuously measure forecast accuracy, comparing predictions with actual outcomes. This ongoing evaluation ensures that the chosen method remains relevant and effective, prompting changes when necessary.

Step 6: Monitoring

Merely selecting a model and generating forecasts is not enough. A model that was once suitable within an organization may become inadequate over time due to evolving conditions. Hence, continuous monitoring of forecasts is essential to implement necessary adjustments as circumstances change.

To maintain accuracy, monitoring tools like the tracking signal are employed. These tools can indicate the necessity to either alter the method itself or revise model parameters.

To truly grasp the intricacies of the demand forecasting process, it’s beneficial to delve into real-world scenarios. Let’s explore three distinct case studies that span different industries and time horizons, each illustrating the application of the five-step process we’ve outlined.

Case Study 1: Long-Term Forecasting in Banking

Imagine a leading bank looking a decade into the future. Recognizing the impending demographic shifts, the bank anticipates a younger, more tech-savvy customer base. This demographic, accustomed to digital interfaces and instant services, will have different banking needs. The bank also acknowledges the rapid technological advancements, from blockchain to artificial intelligence, that could redefine banking operations. Following our five-step process:

Imagine a leading bank looking a decade into the future. Recognizing the impending demographic shifts, the bank anticipates a younger, more tech-savvy customer base. This demographic, accustomed to digital interfaces and instant services, will have different banking needs. The bank also acknowledges the rapid technological advancements, from blockchain to artificial intelligence, that could redefine banking operations. Following our five-step process:

- The bank determines its need to forecast the potential demand for innovative banking products and services.

- It gathers data on demographic trends, technological advancements, and evolving customer preferences.

- Given the long-term nature and the lack of exact historical parallels, a qualitative approach is chosen.

- Expert panels, including tech experts and market researchers, are convened to select the best forecasting method.

- The bank then forecasts the potential demand for new banking products, continuously revisiting and refining these predictions as more data becomes available.

Case Study 2: Medium-Term Forecasting in Retail

Consider a major retailer preparing for the upcoming year. The retailer recognizes the seasonality in demand, with peaks during holiday seasons and lulls in between.

Consider a major retailer preparing for the upcoming year. The retailer recognizes the seasonality in demand, with peaks during holiday seasons and lulls in between.

- The primary forecast is the demand for various products throughout the year.

- Historical sales data, promotional calendars, and market trends are collected.

- Given the medium-term horizon and available historical data, a quantitative approach is deemed suitable.

- Time series analysis, which considers seasonality, is chosen as the forecasting method.

- The retailer then predicts product demand for each month, adjusting inventory and marketing strategies accordingly, while continuously monitoring forecast accuracy.

Case Study 3: Short-Term Forecasting in Call Centers

A bustling call center aims to optimize its operations for the upcoming week. The center knows that call volumes can fluctuate hourly, influenced by factors like marketing campaigns or service outages.

A bustling call center aims to optimize its operations for the upcoming week. The center knows that call volumes can fluctuate hourly, influenced by factors like marketing campaigns or service outages.

- The center decides to forecast hourly call volumes.

- Data on past call volumes, scheduled marketing activities, and potential service disruptions are gathered.

- Given the short-term nature and ample historical data, a quantitative approach is selected.

- Methods that can capture short-term fluctuations, like exponential smoothing, are employed.

- The call center then predicts hourly call volumes, adjusting staffing levels to ensure optimal service. Regular accuracy checks are conducted to refine the forecasting method.

Through these case studies, we see the versatility and applicability of the demand forecasting process across varied scenarios. Each business, while unique in its challenges and context, follows a structured approach to make informed predictions, ensuring they’re well-prepared for the future.