10.2 Decision Trees

To illustrate the analysis approach, a decision tree is used in the following example to help make a decision.

Example 10.1

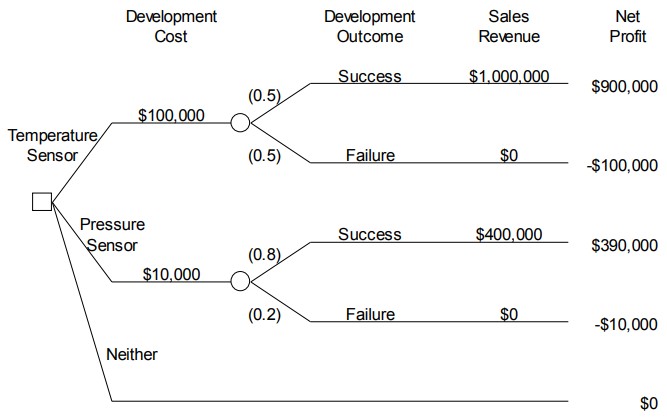

Figure 10.1 Special Instrument Products decision

Question 10.1: Which, if either, of these products should Special Instrument Products attempt to develop?

To answer Question 10.1 it is useful to represent the decision as shown in Figure 10.1. The tree-like diagram in this figure is read from left to right. At the left, indicated with a small square, is the decision to select among the three available alternatives, which are 1) the temperature sensor, 2) the pressure sensor, or 3) neither. The development costs for the develop temperature sensor and develop pressure sensor alternatives are shown on the branches for those alternatives. At the right of the development costs are small circles which represent the uncertainty about whether the development outcome will be a success or a failure. The branches to the right of each circle show the possible development outcomes. On the branch representing each possible development outcome, the sales revenue is shown for the alternative, assuming either success or failure for the development. Finally, the net profit is shown at the far right of the tree for each possible combination of development alternative and development outcome. For example, the topmost result of $900,000 is calculated as $1 000 000 ¡ $100 000 = $900 000. (Profits with negative signs indicate losses.)

The notation used in Figure 10.1 will be discussed in more detail shortly, but for now concentrate on determining the alternative Special Instrument Products should select. We can see from Figure 10.1 that developing the temperature sensor could yield the largest net profit ($900,000), but it could also yield the largest loss ($100,000). Developing the pressure sensor could only yield a net profit of $390,000, but the possible loss is limited to $10,000. On the other hand, not developing either of the sensors is risk free in the sense that there is no

possibility of a loss. However, if Special Instrument Products decides not to attempt to develop one of the sensors, then the company is giving up the potential opportunity to make either $900,000 or $390,000. Question 10.1 will be answered in a following example after we discuss the criterion for making such a decision.

You may be thinking that the decision about which alternative is preferred depends on the probabilities that development will be successful for the temperature or pressure sensors. This is indeed the case, although knowing the probabilities will not by itself always make the best alternative in a decision immediately clear. However, if the outcomes are the same for the different alternatives, and only the probabilities differ, then probabilities alone are sufficient to determine the best alternative, as illustrated by Example 10.2.

Example 10.2

However, the possible outcomes are often not the same in realistic business decisions and this causes additional complexities, as illustrated by further consideration of the Special Instruments Product decision in Example 10.3.

Example 10.3

Figure 10.2 Special Instrument Products decision tree

The resolution of this decision dilemma is addressed in the next section, but before doing this, Definition 10.1 clarifies the notation in Figures 10.1 and 10.2.

Definition 10.1: Decision tree notation

Attribution

By Craig W. Kirkwood, Chapter 1 of Decision Tree Primer, January 11, 2013, licensed under a Creative Commons Attribution License CC BY-NC-SA 4.0.