13.1 Warming-up Exercise

Considering the following situation

Endowment Portfolios

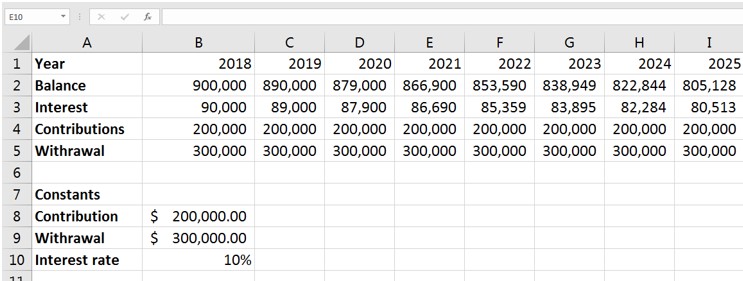

An independent non-profit is concerned about its financial future. The overall rate of return (dividends, interest, and capital gains) on the non-profit’s investment portfolio is 10 percent per year. In order to meet expenses, $300,000 must be withdrawn from the endowment income (and if necessary, from the principal) each year. Contributions to the endowment are $200,000 per year. Under which initial conditions will the endowment be sustainable over time.

A potential approach:

- Build an Excel Model that represents the endowment problem. The model may look like the image below.

Figure 13.1 Excel Model

- Use the model to explore what is the minimum amount of capital to make the endowment sustainable over time (Hint: Producing a line graph could be helpful for the exploration)

Figure 13.2 Graphical Representation of the Model

- Is the scenario in the graph sustainable? How does the balance needs to look like? What is the miminal amount?

Attribution

By Luis F. Luna-Reyes, Erika Martin amd Mikhail Ivonchyk, and licensed under CC BY-NC-SA 4.0.