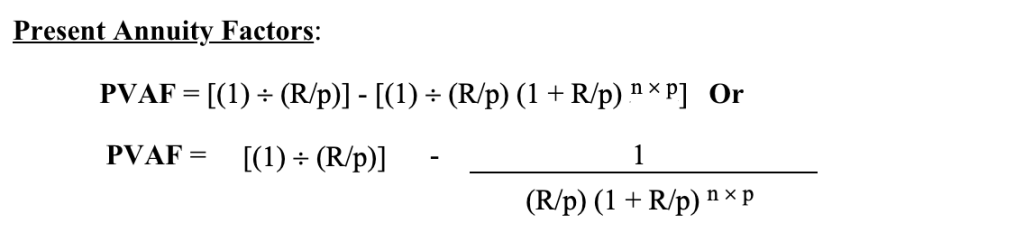

0.7 Future and Present Annuity Factors: Mathematical Formulas

Let’s “put on the table” the formal mathematical formulas for ordinary annuities’ factors. Remember: a “factor” is a multiplier (for the given cash flows). These formulae will be useful when your tables do not have a certain interest rate that you need, and especially when you need to calculate a fractional rate, e.g., 10.23%.

Key: PVAF: Present Value Annuity Factor AND FVAF: Future Value Annuity Factor

Example 1: R = 0.10; N = 5; P = 2

Solution 1: [(1) ÷ (0.10/2)] – [(1) ÷ (0.10/2) (1 + 0.10/2) 5 × 2 ] = 7.72173493

*This multiplier should be the same as in your Present Value Annuity Table

Example 2: R = 0.095 N = 5 P = 2

Solution 2: [(1) ÷ (0.095/2)] – [(1) ÷ (0.095/2) (1 + 0.095/2) 5 × 2 ] = Fill in your answer

*This multiplier is not in your Present Value Annuity Table. Compare the two answers.

Future Annuity Factors:

FVAF = [(1 + R/p) n × p – 1] ¸ R/p

Example 3: R = 0.10; N = 5; P = 2

Solution 3: [(1 + 0.10/2)5 x 2 – 1] ÷ 0.10/2 = 12.57789253554883

*This multiplier should be the same as in your Future Value Annuity Table

Example 4: R = 0.1012; N = 5; P = 2

Solution 4: [(1 + 0.1012/2)5 x 2 – 1] ÷ 0.1012/2 = Fill in your answer

*This multiplier is not in your Future Value Annuity Table. Compare the two answers.