8.2 Working Capital

Working Capital (“WC”) is generally defined as Current Assets (“CA”) minus Current Liabilities (“CL”). Financially speaking, and for the present purposes, “Working Capital” may be thought of as consisting of two parts: one part is “permanent,” while the other may be considered “temporary.” (Take note of the definitions below.)

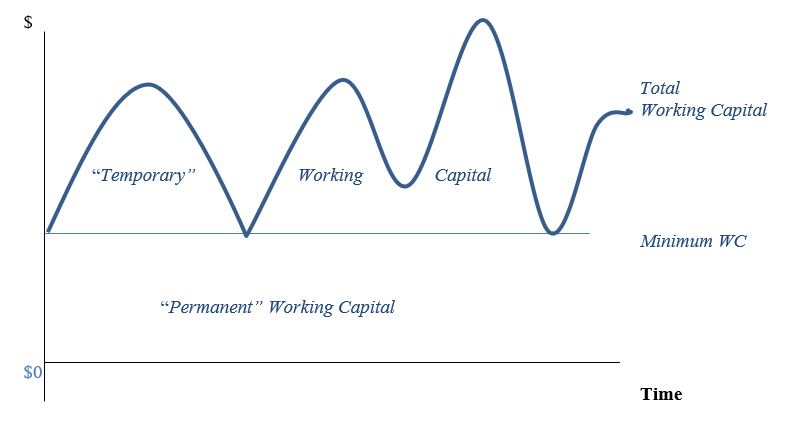

Over time, a firm’s “total” working capital may be said to fluctuate over time – for some firms more than for others. This fluctuation is pictured in the diagram below.

Permanent Working Capital (PWC) is that portion of working capital that is always present, not in a physical, but rather in a financial, or dollar, sense – when WC is at its lowest value the firm still has some funds, or resources, invested in its working capital. The firm cannot allow its cash or inventory, as examples, to go to zero. In other words, the company may be said to always (or “permanently”) have a minimal amount of money invested in working capital regardless of season or business cycle effects; again, this minimal amount must be financed. This minimal amount may be referred to, oxymoronically, as “permanent” working capital. (The term “working capital” connotes short term.)

Some key relationships and definitions:

- Working Capital (WC) = Current Assets – Current Liabilities

- Temporary WC + Permanent WC = Total WC

- Current Ratio = Current Assets ÷ Current Liabilities

- Quick Ratio = (Current Assets – Inventory) ÷ Current Liabilities