10.8 Liberalizing Credit Policy (A Last Look)

A company may decide to liberalize its credit policy, e.g., by extending collection terms, in order to expand into new product or geographic markets, or to increase sales in its current market. In doing so, it may have to put up with a higher percentage of late- and non-payers. The firm should do business with new credit accounts “iff” (i.e., “if and only if”) profits increase after accounting for increased bad collections. Let’s look at an example.

| Current Posture (Per Unit) |

| Sales | 5,000 u. |

| Price | $120 |

| Variable Cost | $80 |

| Fixed Cost | $15 |

| Total Cost | $95 |

| Terms | 30 days |

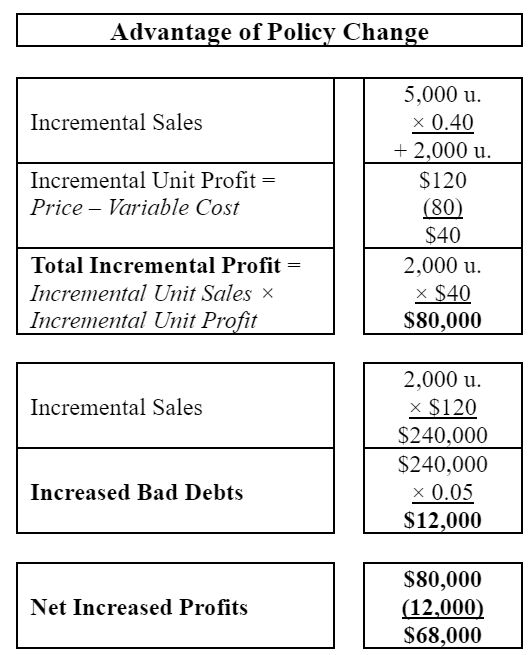

Due to the liberalization of Credit Policy, the company projects that its sales volume will increase by 40% and its bad debts by 5%. Assuming the firm is operating at less than full capacity, no additional fixed costs will be required.

This analysis ignores the opportunity cost of incremental resources tied up in accounts receivable.