6.2 “Homemade” Leverage Illustrated: An Introduction to Modigliani & Miller (“M&M”) The Financing Decision

In this section, we shall focus on issues related to the firm’s financing decision, i.e., the extent to which the firm relies, alternatively on debt or equity in order to finance its capital investments.

We shall now challenge the statement that debt may positively affect company value via EPS. M&M’s argument shall be that leverage does not affect the shareholders’ equity claim nor alter the overall firm’s risk. All it does is shift risk between lenders and shareholders. We shall show that a shareholder can create his own investment leverage regardless of the investee company’s leverage. Debt matters to EPS, but does it really matter to price? The following illustration is drawn from the earlier “financial leverage” illustration; here, we will use “Case B” with an EBIT of $40,000. We shall compare the two cases of no leverage versus 50/50 leverage.

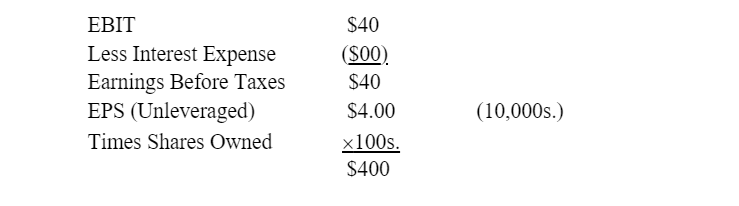

1-B. Unleveraged Structure, Absent Taxes (“Case 1-B”)

The investor has a kind of interest (or “claim”) in $400 of the firm’s profits (EPS). The common stock investor “owns” the EPS, which will be either, in part, paid out as dividends, or retained. In both cases, the common stock investor has an interest in the EPS and what is done with it.

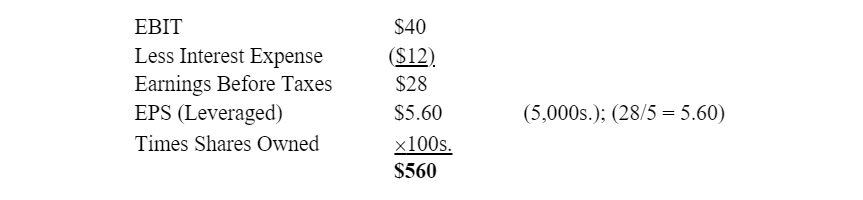

2-B. Leveraged Structure, Absent Taxes (“Case 2-B”)

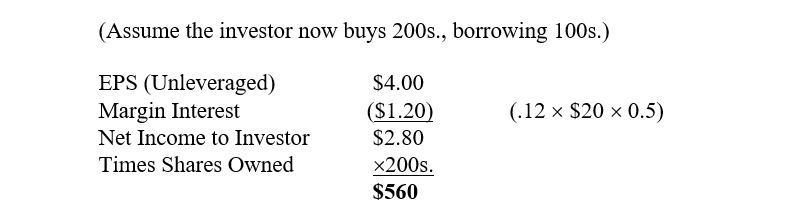

1-B2. Homemade Leverage, Absent Taxes

An investor may purchase stock with 50% down and borrow – or margin – the balance. Thus, by borrowing, an investor can emulate a leveraged company, should his risk-profile so require, even though he may have chosen to invest in an un-leveraged company. (We concede the ceteris paribus simplification of utilizing the same borrowing rate – 12% – for both the company and the individual. Remember, however, that the individual’s margin loan is collateralized thus making it less risky to the lender.)

By investing in an un-leveraged company (i.e., one with no debt) and borrowing money at, in this case, 50/50 leverage, the investor can emulate a cash investment in a leveraged company! Therefore, capital structure, given this thought, ought not matter to the firm’s valuation! It can also be shown (but we will not) that the reverse, i.e., “de-leveraging,” can be accomplished as well.

Follow-up Question:

Summary Activities:

Let’s say the investor has $1 million to invest.

- S/he can choose a company that has less leverage than she wants for him/herself, purchase $1 million dollars’ worth of stock and borrow another million on margin, to achieve a, say, personal leverage 50/50 ratio. We did just this in “1-B2.”

- Alternatively, if s/he chooses a firm to purchase with too much leverage for his/her own risk profile, s/he can invest a portion of his/her money and lend the rest. This reduces his/her leverage. One lends simply by purchasing Treasury securities; this is equivalent to lending money to the US’ Treasury / government.