9.2 The Cash Conversion Cycle

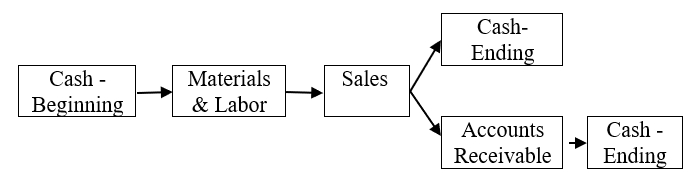

The corporation starts with cash with which it purchases raw materials (to be processed into inventory) and pays labor in order to produce goods and services for sale (see diagram below). Sales are paid for either at the point of sale or converted into accounts receivable, the latter of which are paid off later with cash. At the end of this cycle, the firm, if profitable, should have more cash than at its beginning. The Operating Cash Cycle will look as follows.

When materials are purchased, the firm, most often, will generate an “account payable,” which enables the firm to keep some of its cash as a “free-loan” for up to thirty days, in most cases.

Once the cycle is completed, it starts over again, this time, hopefully, at a higher cash level. Speed is of the essence as well. The faster it can convert cash again into cash, the more rapid the employment of its assets over the course of a period, the greater its return on assets, the greater its profits, the higher its stock price!

Think of speed as a form of “operating efficiency.” In this process, many firms will want to maximize sales revenues by actually charging lower prices and doing more volume, where possible, thus actually increasing sales revenues. Firms will also wish to lower operating expenses. It wants the highest productivity, in the manner of operating efficiency, from its utilization of fixed assets and manpower.

Some cash will go to taxes. Further, in order to maintain the firm’s assets, some cash will be needed for non-discretionary capital- or fixed-asset expenditures. Finally, in order to fuel growth of sales, some cash will be required for discretionary capital expenditures and dividends. These final steps are illustrated below. (Beginning Cash below is equivalent to Cash Ending above.)

In summary, the cycle begins with cash and ends, if profitable, with a higher cash level.