2.8 Final Words Regarding IRR versus MIRR

At this juncture, you should be able to state the main points characterizing both the IRR and MIRR. Take note of the following summary points comparing the two methods:

The MIRR…

- Utilizes a realistic external reinvestment rate.

That’s why the MIRR is sometimes called the External Rate of Return – ERR as compared to the IRR – Internal Rate of Return! Get it?

-

- Does not yield any quadratic results – ever.

- Negative interim cash flows are discounted to present value, and positive cash flows are compounded to the horizon. Therefore,

(FV / PV) 1 / r -1 = MIRR

- Does not have the issue of iterations.

- The IRR and MIRR will not yield conflicting rankings / preferences when competitive projects are compared. We will not have a situation where one method says: “accept A,” while the other says: “accept B.”

- However, the use of an external reinvestment rate, if low enough, may result in an individual project’s MIRR being below the cost of capital hurdle rate, whereas it may not have been based on the IRR alone.

-

- This is because the terminal value will be lower than when calculated using the higher IRR as the compound reinvestment rate.

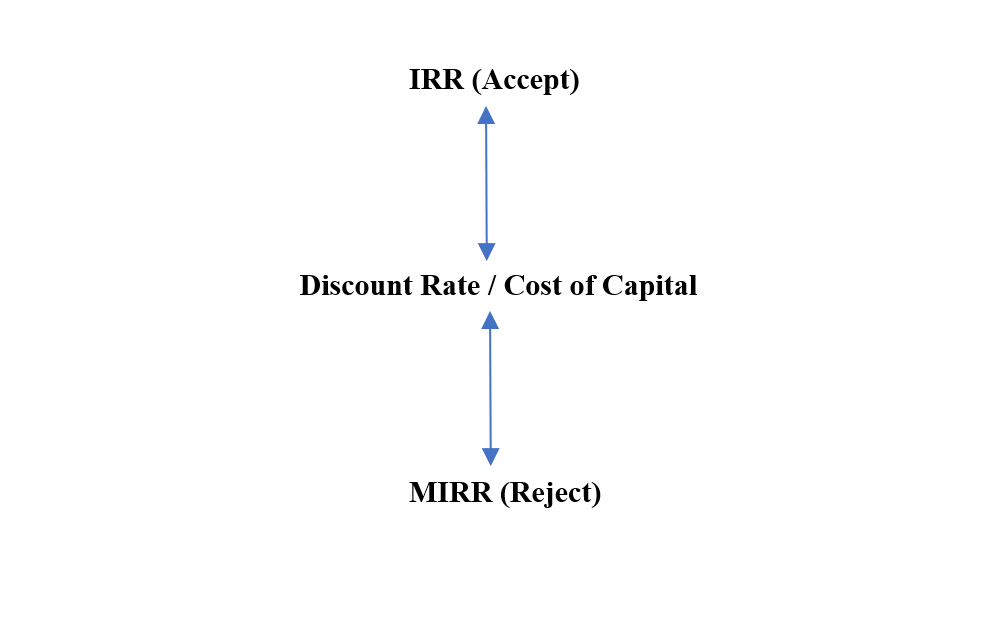

- This, of course, means that you may accept a project based on IRR, but reject it based on MIRR – as below.