5.11 The Impact of Financial Leverage on Valuation or Price

The impact of financial leverage on a firm’s valuation or stock price is, in fact, unclear.

On the one hand, if leverage increases, a firm’s default risk may also increase (but then again maybe not!). This increased risk would make the company’s equity riskier as well because the shareholders get paid only after the creditors do. There can be no dividends if interest on bonds is not paid; there can be no internal growth in investment and thus no capital gains if interest is not paid.

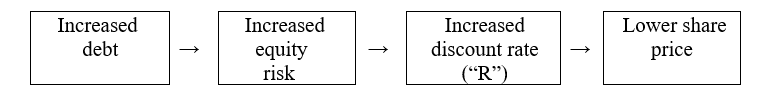

In turn, the firm’s required return, i.e., the dependent “R” variable in the CAPM, would also rise since the CAPM formula embodies equity risk (β). (The firm’s slope, as represented in the CAPM diagram, would steepen.) Finally, with a higher “R,” which is also the discount rate in the DDM, the stock price would go down.

The table below summarizes the steps emanating from increased leverage, according to this argument. The relationships isolate the effect of debt on share price only, ceteris paribus.

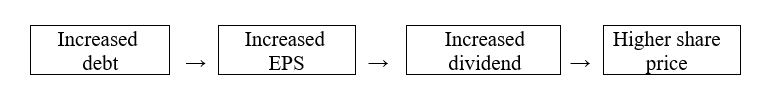

Alternatively, increased leverage may provide greater EPS – when new debt-sourced funds are employed profitably, when the company institutes good capital budgeting decisions, or when EBIT is to the right of the crossover point. That is in fact, the reason for employing leverage – to increase EPS and ROE! Assuming a constant payout ratio, a ceteris paribus condition, the dividend would also increase and, via the DDM, the price will rise. In fact, both scenarios occur simultaneously and in varying degrees; the results depend on how well the firm employs its invested capital.

The table below summarizes the steps emanating from increased leverage, according to this argument. It is assumed that the borrowed funds are invested well so that EPS increases.

Whether we have one or the other outcome depends on how profitably the firm invests its (external and marginal) debt, which is a function of the efficiency of its capital budgeting process.

So, once again, does capital structure matter? It seems that it all depends – on the soundness of your Capital Budgeting decisions and on the volatility of EBIT!