3.5 The Cost of Capital (Summary of all capital components’ respective costs)

Note that here we shall use “K,” the corporate cost of capital rather than “R” the investor’s return. It is the same thing; you may see either notation out there. As we stated above the corporation must meet the investors’ expectations of returns (“R”); consequently, K and R are the same thing. The return demanded by the investor is the economic cost (“K”) to the corporation.

The After-tax Cost of Debt Capital

K d = i (1 – T)

Example:

I = interest expense = 10%

T = Tax Bracket = 40%

K d = After-tax cost of debt = 0.10 (1 – 0.40) = 0.06

Note: Flotation costs for debt are assumed to be virtually nil and are excluded from the formula. Remember, interest is tax-deductible; it is an expense that reduces taxable income, so the interest cost to the corporation is stated after taxes.

The Cost of Preferred Equity Capital

Kp= Dp ÷ Pnet

For Equities, we shall call upon your knowledge of the Dividend Discount Models.

Example:

Dp = Dividend on the preferred stock = $2.00

Pnet = Preferred Stock Price (net of the immaterial Flotation Costs) = $20.00

KP = Cost of Preferred Stock = 2 ÷ 20 = 0.10

Note: You will note that this is a modification of the no-growth perpetuity model.

The Cost of “Internal” Equity (Retained Earnings)

k RE = (D1 ÷ P0) + G

= Dividend Yield + Growth Rate of the Dividend

Example:

D1 = Next Year’s Dividend = D0 (1 + G). Assume D1 = $1

G = Dividend Growth Rate = (D1 ÷ D0) – 1. Assume 5%

P0 = Current Stock Price. Assume $10.

K RE = Cost of (internal) Retained Earnings = (1 ÷ 10) + 0.05 = 0.15

Notes:

- k RE represents the investors’ “opportunity cost.” Management should be able to return to investors – in the manner of dividends and/or additions to Retained Earnings – at least as much as the investors could earn on their own.

- You will also note that common equity has two components to its economic costs:

-

- the explicit cost of the dividend payment (if there is indeed any dividend paid), and

- the more implicit economic cost of growth in the dividend, and thus growth in the price of the shares (according to the basic notion of the Dividend Discount Model). Both costs are economic costs (rather than accounting “expenses”), while only the dividend involves any cash outflow. Dividends, remember, are not expenses. Dividend Growth is an “opportunity cost,” as the investor demands it.

The Cost of “External” Equity (Common Stock)

We said that common stock is sold in smaller allotments and therefore has greater Flotation Costs, which we must take into account (while we ignored the flotation costs for Debt and Preferred Stock discussed above due to the costs’ immateriality).

Here’s how it works. Let’s say common stock is offered, for the first time, by a corporation to the public in an “Initial Public Offering” (“IPO”) at $10 per share, and that the investment bankers take a fee of $0.50 per share. The company will keep just $9.50 even though the shareholder paid $10. The bankers’ fee, or the Flotation Cost (“F” in the formula below) to the issuing corporation is 5%, i.e., $0.50 ÷ $10. Take careful note that “F” in the formula is expressed in percentage terms.

| IPO Price | $10.00 | 100% | |

| Fee (“F”= 5%) | (0.50) | 5% | F |

| Net Proceeds to Company | $9.50 | 95% | 1-F |

In other words, the net proceeds to the company =

[(P0) (1 – F)] = [($10) (1 – 0.05)] = $9.50.

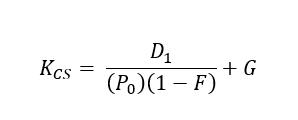

Using, again, the same model we used for Internal Equity (and the same numbers), and adjusting for ”F.” we get a modified formulation:

Example:

F = Flotation Costs expressed as a percentage of the IPO Price

K CS = Cost of (External) Common Equity =

($1) ÷ [($10) (1 – 0.05)] + 0.05 = 0.1552

The Common Shareholder has a claim on both the Internal (Retained Earnings) and External Equity (Common Stock). External Common Equity is more expensive to the corporation (0.1552) because of Flotation Costs, which are absent with Internal Common Equity [($1) ÷ ($10) + 0.05 = 0.1500], i.e., Retained Earnings.

Notice that in comparing costs, debt is the cheapest capital component, followed by preferred, retained earnings, and last, common equity. Debt is paid first and is least risky to the investor (lender). Additionally, interest on debt is also a tax-deductible expense. Preferred gets paid next. Common Equity, including Retained Earnings, is paid last, and is most risky. Common Stock investors share in the profits, i.e., dividends and retained earnings, and thus have the most to gain. “The more risk, the more the reward.” External Common Equity is more costly to the firm than are retained earnings due to Flotation Costs.

| Capital Component | Cost of Capital |

| After- Tax Debt | 0.0600 |

| Preferred | 0.1000 |

| Retained Earnings | 0.1500 |

| Common Stock | 0.1552 |

| Weighted Avg. Cost Capt’l (WACC) | TBD |

There are two more things, which we did not yet cover:

1. We must calculate the overall Weighted Average Cost of Capital or “WACC,” which is the Capital Budgeting discount rate we have assumed until now.

2. We must also define project risk, which is implicit to the discount rate. We will get to them forthwith.