1.38 The Modified Internal Rate of Return (MIRR) (Problem)

Illustration of MIRR: Uneven Cash Flows

Given:

1. Initial Outlay = $1,000

2. Net nominal expected cash inflows as below

3. Reinvestment Rate = .10

Question: What is the MIRR? [Warning: Be sure you get the exponents correct!]

| Year | Nominal Cash Inflows | FVF @ 10% | Future Values |

| 1 | $500 | ||

| 2 | $400 | ||

| 3 | $300 | ||

| 4 | $100 | ||

| Terminal Value= |

Note:

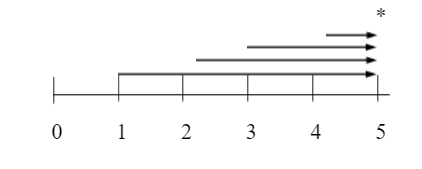

The correct directionality of the respective future value factors and the correct number of periods in completing the FVF column. Remember that you are “bumping up” the nominal cash flows to the horizon. A timeline may be useful. Below is a five-year timeline; do your own for this (four-year) problem.