2.9 Capital Budgeting for Mutually Exclusive Projects with Unequal Lives: Replacement Chain Analysis

Up until now, all the mutually exclusive projects we examined had equal lives; they had equal horizons. What if there are two competing projects whose expected lives are not equal, unlike our earlier examples?

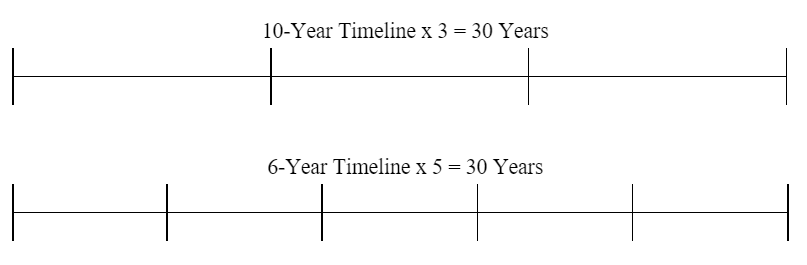

Let us say that one project has a six-year life and another has a ten-year projected life. In order to compare one to the other, we could imagine that as one project’s term ends, it is replaced with an identical project with the same life – and same Free Cash Flow projections; we call this “replication” or “replacement.” This way, we have equalized the horizons of each project, and we could now compare one to the other based on a Capital Budgeting metric. Let’s call this method of analysis the “Replacement Chain Analysis” (“RCA”).

In order to complete the RCA in this case, we would have to project out each investment project over a 30-year timeframe in order to equalize the terms of the projects. This is due to thirty-years’ being the projects’ lowest common denominator. Both can be divided into 30, but nothing smaller than 30 (30 / 6 and 30 / 10). The timelines would be:

If we did not equalize the horizons, we might find that we favor, on an NPV basis, a project simply because of its longer horizon, which provides more cash flows over its greater life.

Let’s say Project A has an NPV of $100,000 over its five-year life versus Project B that has an NPV of $110,000 over a twenty-year life. Given what we know about TVM and returns, would it pay to deploy capital for “B” given its minimally higher NPV?

RCA is based on some very restrictive assumptions:

- That the projects are replicable.

- That the cash flows used in the first iteration can be used for the replications, i.e., the later iterations.

Let’s try another approach.