1.5 Capital Structure

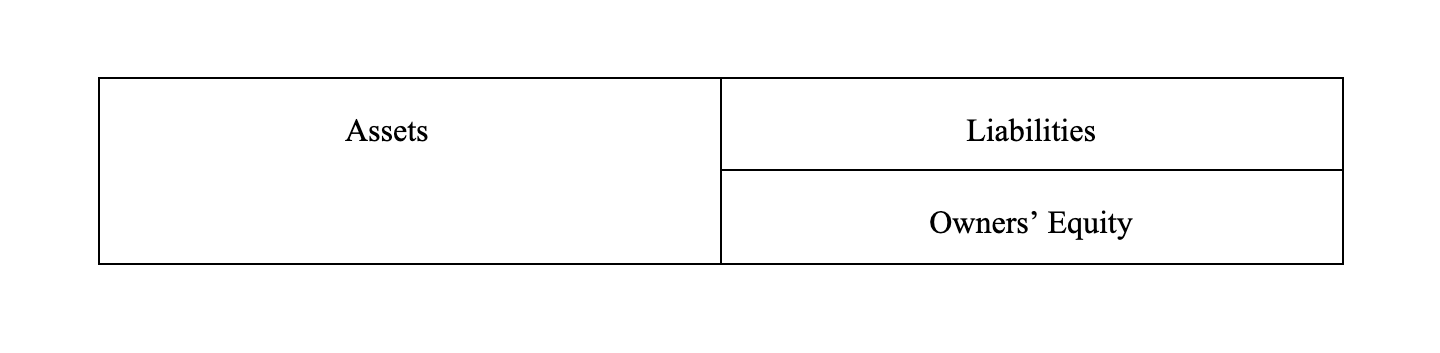

Above, we discussed the firm’s organizational structure. This is how corporations operate. The firm will also have a “Capital Structure,” which will be represented on its Balance Sheet. The Balance Sheet will consist of Assets, Liabilities and Owners’ Equity.

Assets are what the company owns, including inventory, plant and equipment, among other items. Liabilities are what the company owes to others including suppliers and lenders. Equity is the value of what the owners have invested in the company.

Companies acquire Capital (Liabilities + Equity) in order to, in turn, “finance” (i.e., pay for) the acquisition and maintenance of its assets. Assets, in turn, are exploited to produce sales, which will – hopefully – deliver profits and a return to the shareholders, who are the owners of the corporation.

The basic “accounting equation” is: Assets equals Liabilities plus Equity, or A = L + E. A Balance Sheet must, well, balance, as noted here. Assets will be on the left and Liabilities plus equity will be on the right – like the Ten Commandments! In general, the word “Capital” will refer to the right side of the Balance Sheet. The firm’s Capital is not free; it has an economic cost; lenders expect interest on its loans to the company and shareholders expect dividends and the growth of dividends of their equity investment in the firm. The economic cost of the firm’s capital represents the return to lenders and stock investors. Where there is a return to investors (lenders and owners), there must be a cost to the corporation who provides the return. Two sides to the same coin.

Assets will be on the left and Liabilities plus equity will be on the right – like the Ten Commandments! In general, the word “Capital” will refer to the right side of the Balance Sheet. The firm’s Capital is not free; it has an economic cost; lenders expect interest on its loans to the company and shareholders expect dividends and the growth of dividends of their equity investment in the firm. The economic cost of the firm’s capital represents the return to lenders and stock investors. Where there is a return to investors (lenders and owners), there must be a cost to the corporation who provides the return. Two sides to the same coin.

In order to be competitive, a corporation must also cover its “Opportunity Cost.” If an investor in the corporation can earn a better return in an equivalent alternative investment, s/he will choose the better alternative. This is a basic principle of Economics. The corporation, in order to be able to attract investment, must therefore cover its Opportunity Costs, i.e., the alternative return an investor gives up when making an investment in this corporation.

We will discuss the Balance Sheet further in depth on the pages to follow. For now, let’s re-wire our brains so that we think like Financial Economists.