10.8 Characteristics of the Time Value of Money: FV and PV

The following summarizes and reviews some key characteristics of the Time Value of Money about which we already learned.

- As the interest rate increases, Future Value also increases.

- As the number of years (n), periods per year (p), or total periods (n × p) increases, the Future Value increases.

- As the compounding frequency per year increases, the Future Value increases.

- Restate each of the above statements for Present Values.

- FV and PV factors – or multipliers – are reciprocals of one another.

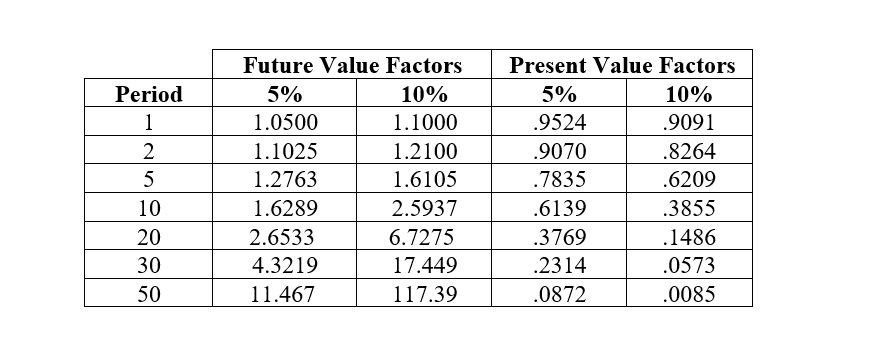

You will find below a partial interest rate table. If you use such tables properly, you will be able to locate the correct multipliers – or “factors” – for a given situation. You will note that the PV factors are expressed as the reciprocals of their corresponding FVs. In order to arrive at the FV or PV of a specified dollar amount, one need only choose the correct cell and multiply the specific dollar amount by the factor.

For example, the FV of $1 at 5% for ten years is $1 × 1.6289. The PV for 10% compounded semi-annually for five years is $1 × .6139.

In cases where we have more than one compounding or discounting period per year, we would need to make the same adjustments that were made mathematically earlier. For example, the multiplier for 10% and 5 years semi-annually would be found under the 5% column and 10-period row. “Period” in the tables would be equivalent to “n × p” in our, more mathematical, nomenclature.