14.13 A Qualitative Look at The Discount Rate

The discount rate, or “R,” for the market (RM) or for a company’s stock (RS) is a variable, which itself is determined by general market levels of interest rates, the default risk of the company’s bonds, and credit spreads.

R = f (general levels of interest rates, default risk, credit spreads)

General levels of interest rates: All interest rates are interrelated. In general, if rates go up for a base rate, such as Treasuries, other rates will follow.

Default risk: If a company’s bond default risk increases, the dividend on preferred stock will also be less secure. Discount rates on “Preferreds” will go up and prices will go down. So too will the discount rate and price of common equity follow. The company’s ability to pay common stock dividends and to retain additional earnings will be reduced. Remember: Default risk, essentially, has to do with the chance that a corporate borrower, or issuer of bonds, will not pay the interest on its borrowings in full and on time.

Credit Spreads: We know that credit spreads reflect rate differentials between, typically, 10-year Treasury Notes and 10-Year B-rated Corporates. However, we can create spreads between Notes and anything, such as discount rates on “Preferreds.” Thus, spreads may be observed between T-Notes, Preferred-, and Common-Stock Returns. And we already know that spreads narrow or widen according to economic circumstances and outlooks. If spreads widen, required stock returns will go up and prices will go down.

These three variables, when aggregated, will constitute the stock’s risk (β). “R” can be stated (again) formulaically:

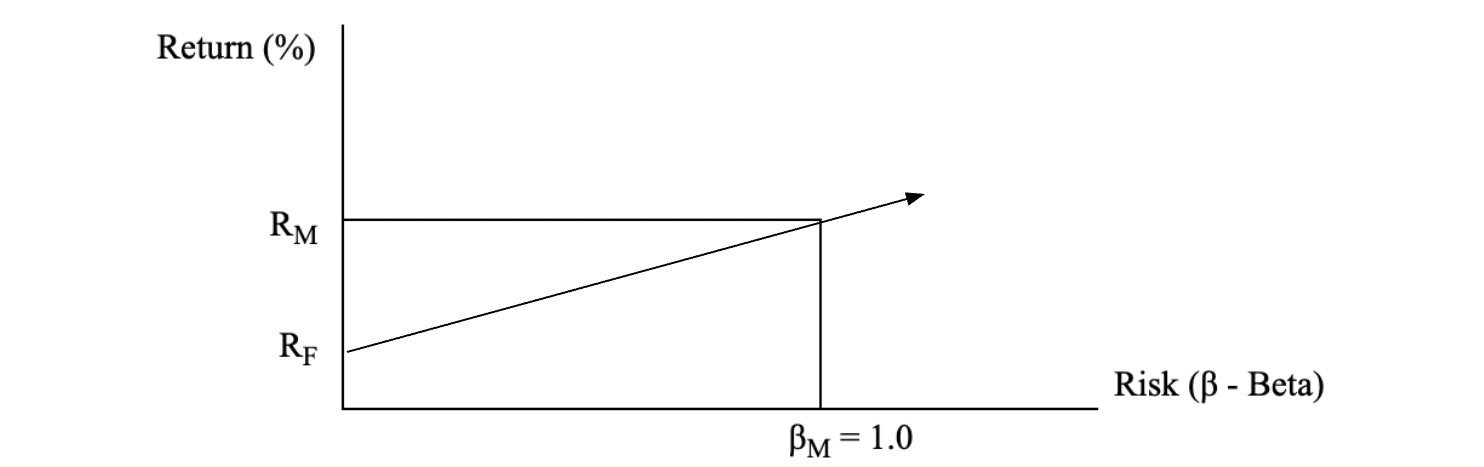

RM = RF + MRP

MRP = Market Risk Premium = RM – RF

RM = RF + (RM – RF) βM

The Market Return (RM) equals the Risk-free Rate (RF) plus a Market Risk Premium.

A specific portfolio’s or security’s return (RP or RS) will equal the Risk-free Rate (RF) plus a Market Risk Premium (RM – RF), adjusted for the relative risk (βS) of the portfolio. βP (portfolio risk) or βS (individual security risk) can be equal to, greater than, or less than the Market’s Risk level (βM). Thus, we can also speak of a “Portfolio Risk Premium” (RP – RF). We can substitute “RS” for “RP” at the individual stock level and use “RS” as the discount rate in the DDM.