3.16 Comparative Summary of Depreciation Methods

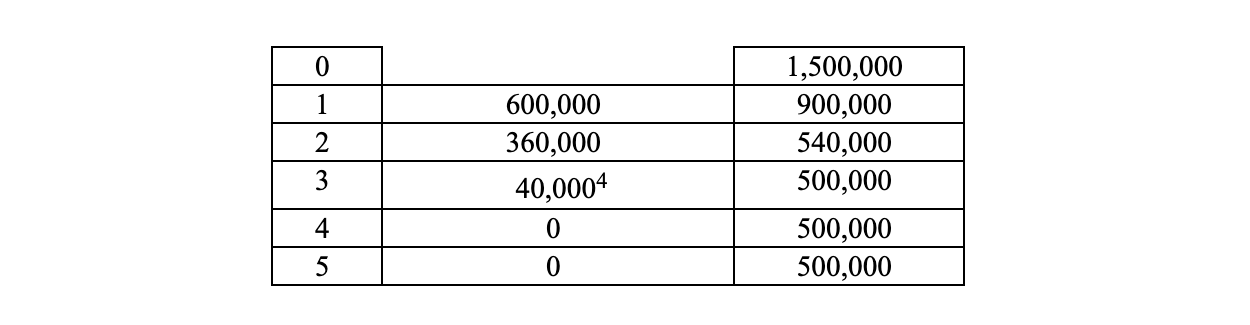

Given:

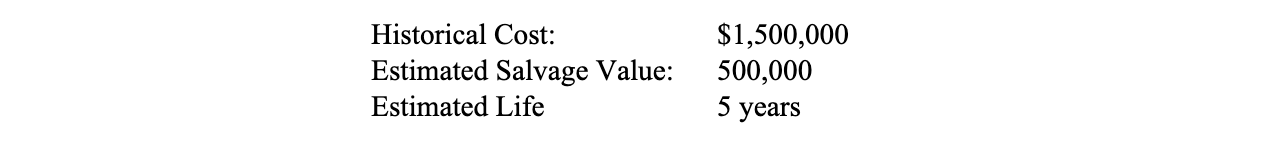

Straight Line:

Accelerated Depreciation Methods:

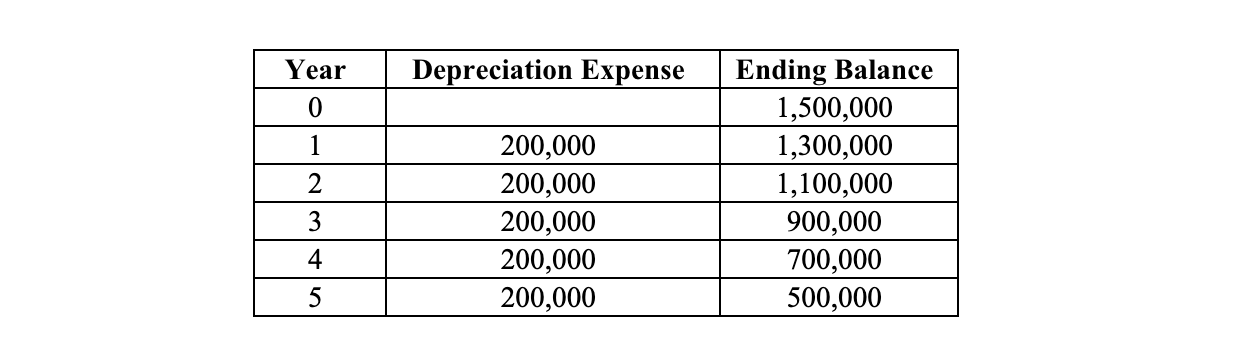

- Sum-of-the-Years’ Digits:

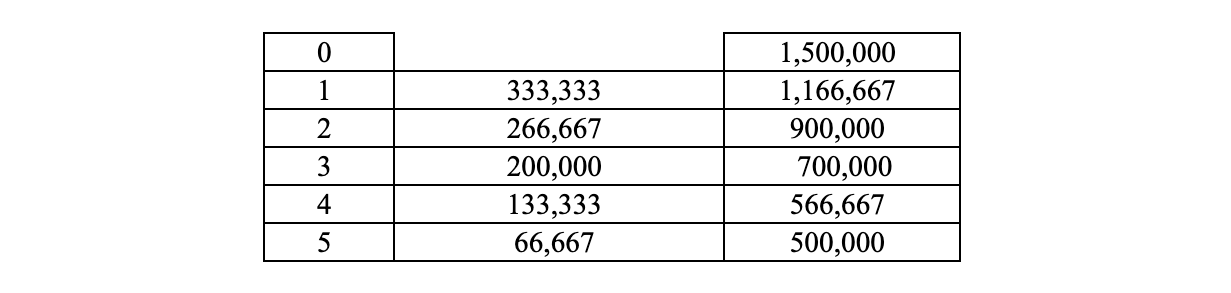

- Double/Declining Balance:

Again, D/DB is the most accelerated of the various methods. The finance student needs to have some sense of the “distortions” that accounting data present to him as a result of (management and the accountants’) “choice,” and its impact on financial analysis. In addition to the alternate depreciation methods presented in this example, we may also note that the salvage value is an estimate. These arbitrary choices and estimates present alternative “looks”for the financial statements – and interpretative difficulties for the analyst.

Final Note: The three methods covered in the last pages are NOT acceptable for Tax Accounting. There, a wholly different system must be implemented by dint of a 1986 law. The tax system is called “Modified Accelerated Cost Recovery System,” or simply “MACRS.” This method will not be covered here.