7.3 Earnings Retention and Growth

Our working assumption is that the firm has a never-ending appetite for growth. In order to grow its sales, and hopefully its profits thereby, the firm must retain some of its earnings and invest them in productive assets that can be exploited to increase sales in the future.

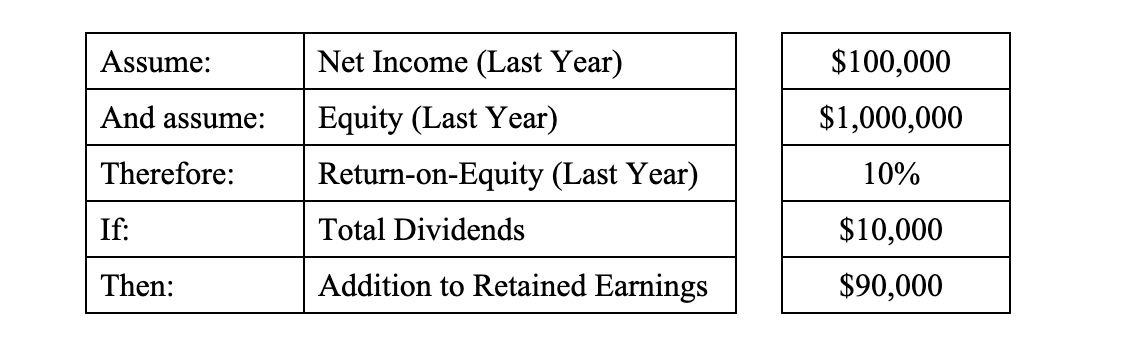

Let’s examine the following company:

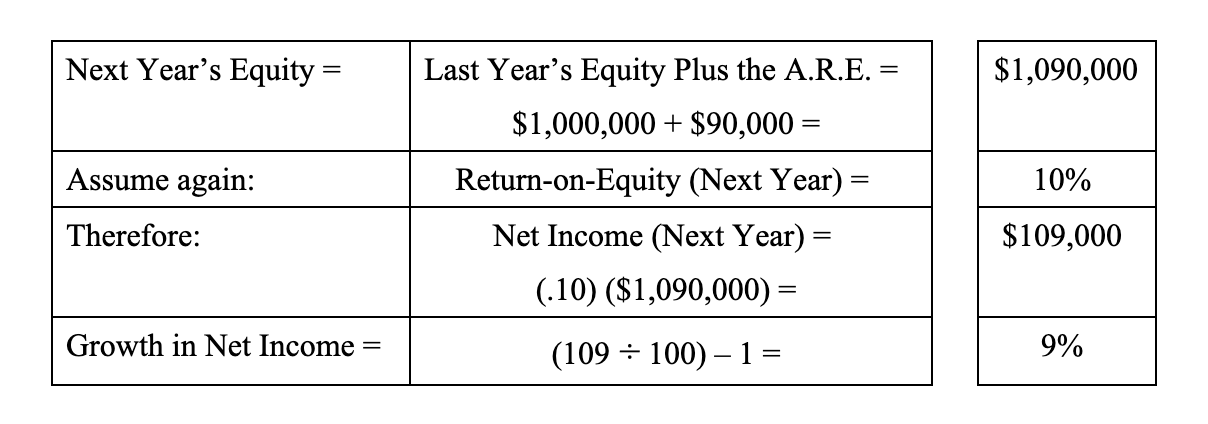

If the company’s ROE is assumed to be constant, i.e., one of those ceteris paribus assumptions, then the numbers next year will be:

So, as we see, earnings retention is helpful for growth. Had the company not invested its A.R.E. in productive assets, its ROE would have declined, as would its prospective growth rate. Companies that have great growth prospects will therefore pay no dividends due to its hunger for using the entirety of its Net Income as Additions to Retained Earnings in order to increase its assets.