8.5 Corporate Forecasting and Strategic Planning

A financial analyst will collect reliable financial data from internal numerous sources, if possible, which s/he will cite in his/her forecast, list the assumptions as part of the report, and “spread the numbers” accordingly. Interpretation and strategy then will follow.

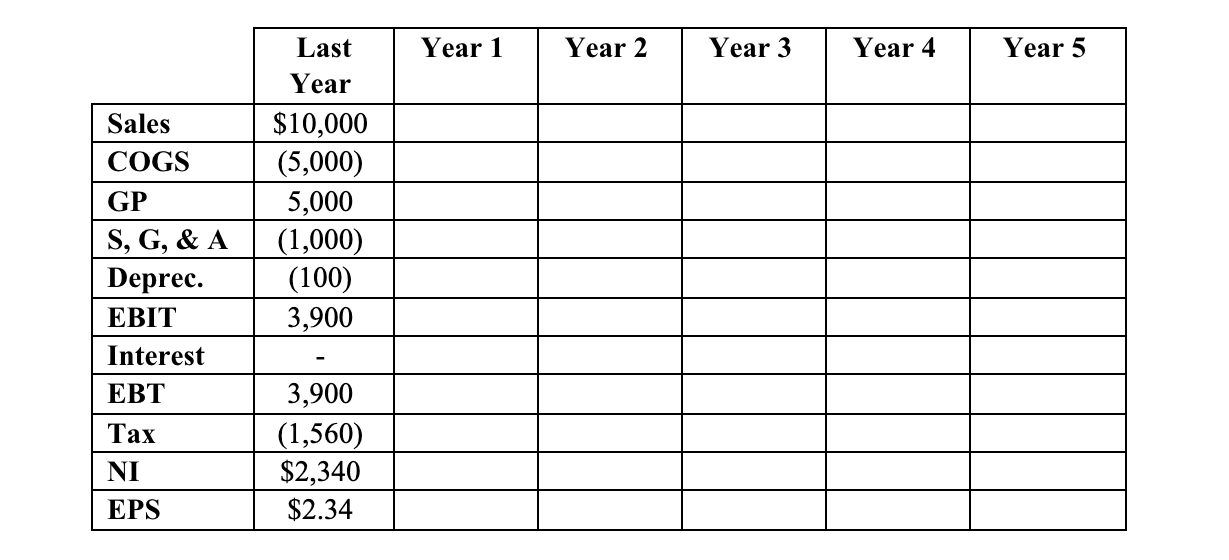

The following is an exercise in creating a pro forma (accounting-based) income statement. Later, we will see some analytic techniques, which may be implemented to convert “profits” to “cash flow,” if the latter is deemed more desirable. A “strategic plan” involves forecasting financial data for multiple future years.

Pro forma Financial Statements

Complete the pro forma I/S based on the following assumptions:

- Marketing projects sales growth at 10% p.a.

- “Purchasing” projects inventory costs to rise at a rate of 12% p.a. – due to scarcities.

- S, G, & A will grow at a rate of 8% p.a.

- For depreciation, see information below.

- Interest costs will rise due to acquisition of new property, $10,000 of which will be financed entirely via a 20-year, “non-amortizing” mortgage (i.e., interest-only) bond at a rate of 7.5%. The other $1,000 will be financed via retained earnings. The present property is fully paid for.

- Taxes are charged at a flat 40% rate.

- Calculate NI.

- Calculate EPS – There are 1,000s outstanding – no new shares will be issued.

Depreciation

- Next year’s (“Year 1″) depreciation expense will be $50. Thereafter the (old) building will be scrapped.

- At the end of Year 1, a new building will be in use (the cost of scrapping the old building will be included in the cost basis of the new building). At that time, a mortgage will be in place. The new building will cost $11,000 and will have a twenty-year life. It will be depreciated on a straight-line basis; a salvage value of $1,000 is assumed.