13.9 Credit Spreads

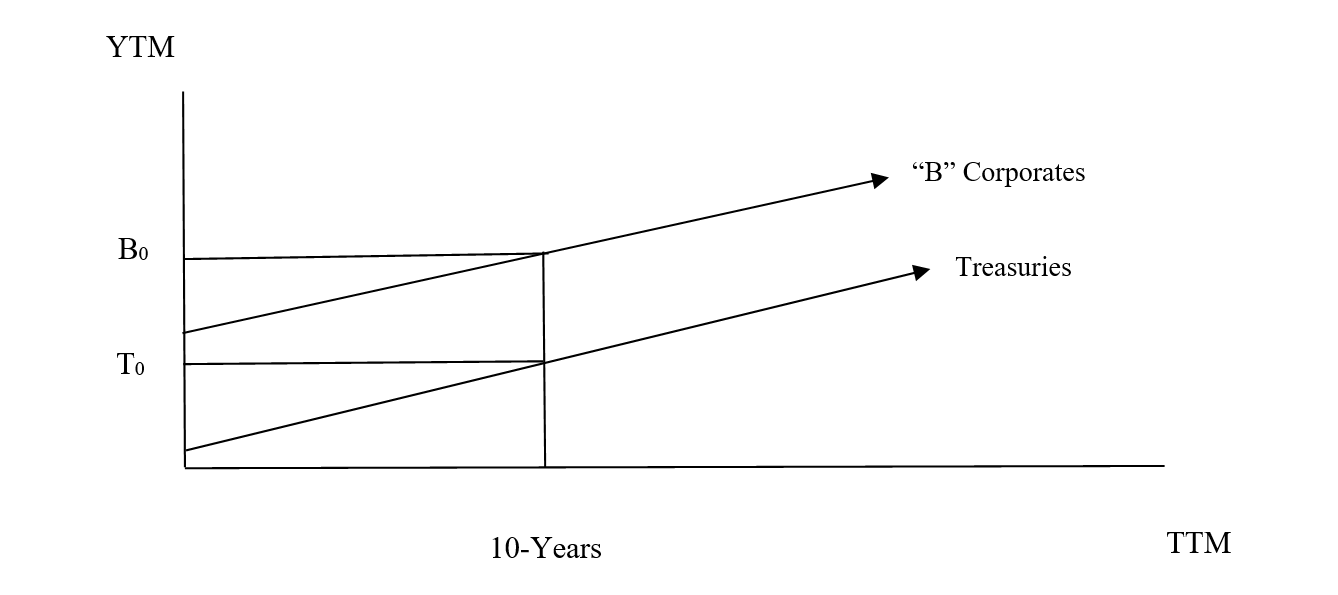

Credit Spreads represent the incremental yield provided to compensate for additional default risk above a no-risk alternative (Treasury Notes), and for a given maturity – usually 10-years. We have drawn in the yield curves for Treasuries and “B”-rated Corporates. The Credit Spread below is represented by the difference in yields between points “B” and “T.” Remember that the lower the credit rating, the higher the default risk. A greater default risk means a lower dollar price, which, in turn, means a higher yield.

Remember that that the lower the credit rating, the higher the default risk. A greater default risk means a lower dollar price, which, in turn means a higher yield.

Questions:

Which companies issue credit ratings?

What are the important credit ratings?

What do “Investment Grade” and “Junk” or “High-Yield” Bonds mean?

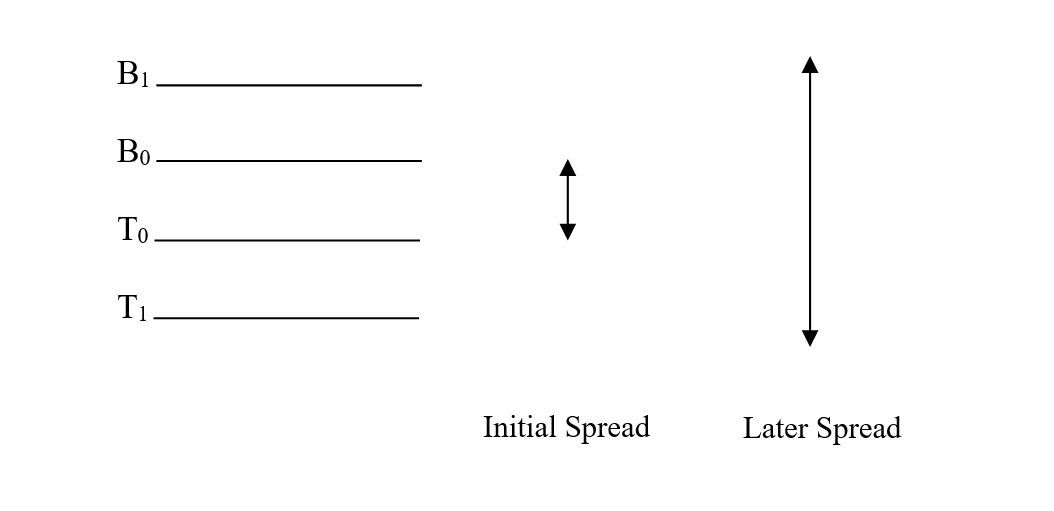

Reality Check: Credit spreads are not constant. During weak economic periods, credit spreads widen, in response to fear – but not necessarily the reality – of the perceived risks associated with lower-rated bonds. In fact, default rates themselves may not worsen, but still, people get nervous. In such times, people demand more premium return versus Treasuries than before.

How exactly does this happen? Many will sell their lower-rated bonds and buy safer Treasuries with the sale proceeds. Lower-rated bonds’ prices therefore fall and their yields rise; Treasury prices will thus rise, and yields will go down. Credit spreads widen. Remember that price and yield (i.e., discount rates) are inversely related. This does not say that actual credits, i.e., default risks, have worsened; that may or may not eventually happen. A bond may be considered a “credit.” This phenomenon – whereby credit spreads widen – is referred to as a flight to quality.

Below we illustrate the flight to quality.

The Flight to Quality

Yields

Above, in anticipation of weak times ahead, Credit Spreads widen from B0 less T0 to B1 less T1. That does not imply that default rates have worsened in reality, although, in time, as conditions worsen, that could happen as well.

When rates increased between 1978 and 1982, the spread between (Ten-Year) Treasuries and Baa Corporate Bonds widened. Baa and BBB bondholders lost money in part due to increased rates and, in addition, due to a widening of the spread (such bondholders would have lost less in Treasuries).

Credit spreads were wide when the technology “bubble” burst in 2000-2001. Greater credit spreads reduce corporations’ ability to borrow and thus serve to dampen economic growth.

Just prior to the Banking Crisis of 2007-2008, Credit Spreads were very narrow by historical standards. To some prognosticators, the optimism implicit in such narrow spreads boded ill for near-term economic conditions. They were right.

Many things can happen that may interact with credit spreads, including moves up or down in the entire yield curve. What is important to recognize, at the base level, is that lower grade bonds – and their yields – are (usually) priced relative to Treasuries, i.e., at some premium to Treasury yields. The lower the credit rating, the greater the impact of “nervousness” on yield.

For a graph of historical credit spreads, click on: Bond Yield Credit Spreads – 150 Year Chart | Longtermtrends