11.10 Annuities Due (Solutions)

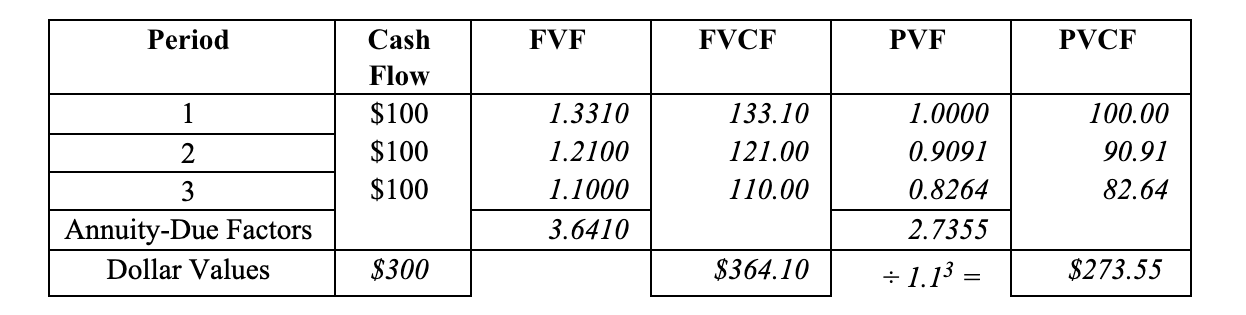

Question: What would be the PV and FV for a $100 three-year annuity due at 10%?

Note:

The PV and FV for an ordinary annuity with the same term (time), rate of interest, and dollar amounts, were calculated at $248.68 and $331 respectively. Since an annuity due provides each of its cash flows one period earlier than the ordinary annuity, the PV and FV of the annuity are both equal to the ordinary annuity multiplied by (1 +R/p)1. In this case, that would be:

$248.68 (1.10)1 = $273.55

$331.00 (1.10)1 = $364.10

Due to the fact that the cash flows come in sooner there are both more compounding periods and fewer discounting periods. The fewer number of periods leads to more compounding and less discounting, hence greater future- and present-values.

This is handy to know because most interest rate tables provide ordinary annuities factors, but not annuities due.