11.9 Annuities Due

Annuities Due

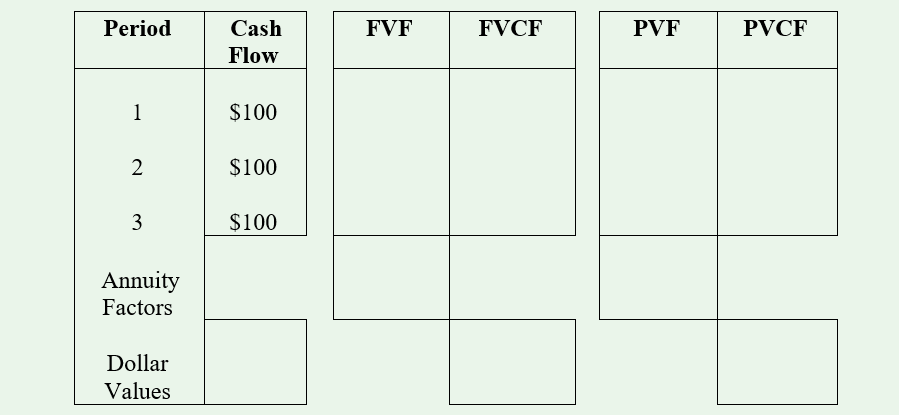

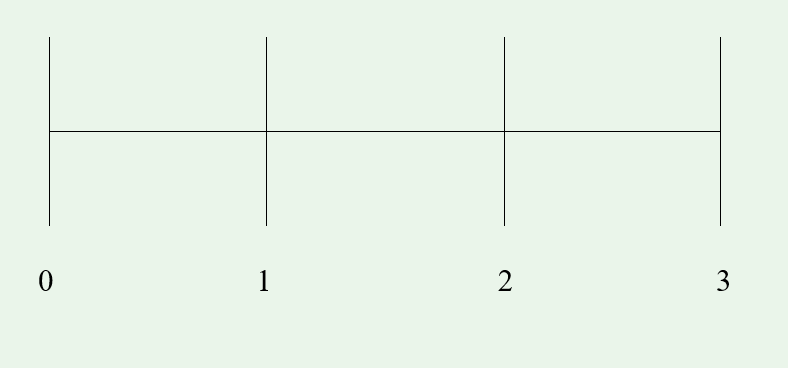

An “annuity due” is a type of annuity whose cash flows occur at the start of each period. To illustrate, we will use the example – and chart – from above. Since the timing of the cash flows is different than in an ordinary annuity, the factors (and exponents) are also different. As you fill in the factors and the dollar amounts, draw the appropriate timeline.

Question: What would be the PV and FV for the $100 three-year annuity at 10%?

Timeline

Questions:

- Notice that both PV and FV annuity due factors (and dollars therefore) are larger than the respective ordinary annuity factors.

- The PV of an annuity due is equal to the PV of an ordinary annuity multiplied by one plus the discount rate (1 + R/P)1 for one period.

- The FV of an annuity due is equal to the FV of an ordinary annuity multiplied by the compound rate for one period. Show this mathematically.