3.15 Accelerated Depreciation Methods: Double/Declining Balance (For reporting purposes only)

Under Double/Declining Balance (D/DB), we combine two concepts, hence the slash in the name. That’s the way to remember what this method is about. First of all, we depreciate at double the straight-line rate, which in this case, would be 2 × 20%, or 40% per year.

If we do this doubling of the annual rate, we would have depreciated the entire asset in half the asset’s estimated life, rather than in the full five years; or alternatively, we would have depreciated twice the asset’s original cost over the entire five years. Either alternative is clearly incorrect and unacceptable.

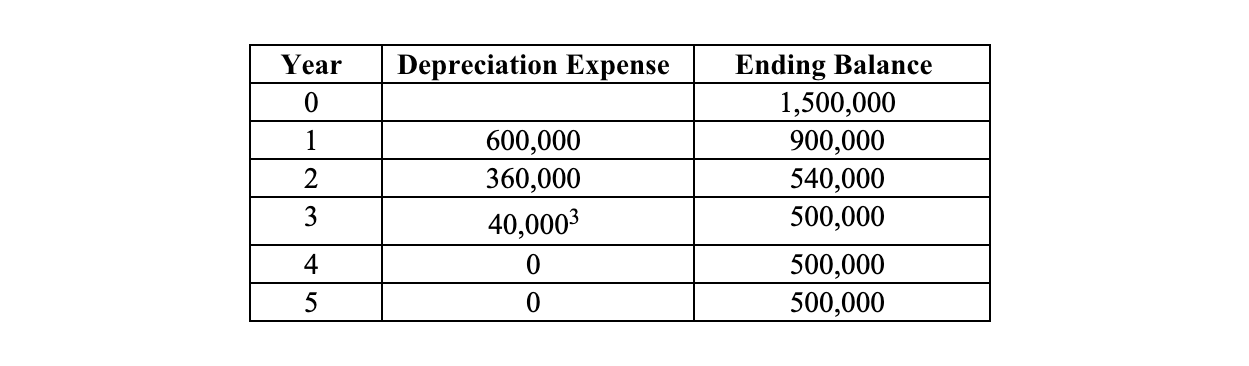

Instead, we depreciate twice the straight-line rate, not against the depreciable amount, but against the declining balance, ignoring salvage value. That’s the second concept: the use of a declining balance. So, in the first year, we depreciate 40% of $1,500,000, or $600,000, leaving a new balance of $900,000. In the second year, we depreciate 40% of the declining balance of $900,000, which is $360,000.

In this example (and not necessarily in all examples), if we continue to depreciate at this rate, we will go below the salvage value in the third year. At this point, the accountant will either depreciate the balance of $40,000 in one-fell swoop, or, more likely, straight-line the $40,000 balance over the remaining three years. (S/he could also adjust the salvage value lower.) In straight-lining the $40,000 remaining balance, rather than deducting $40,000, one may deduct $13,333 ($40,000 ÷ 3) for each of the last three years.

D/DB is even more accelerated than SOYD, as you may have already noticed. The depreciation expense is greater in the early years.

Your income statement and balance sheet will reflect the following: