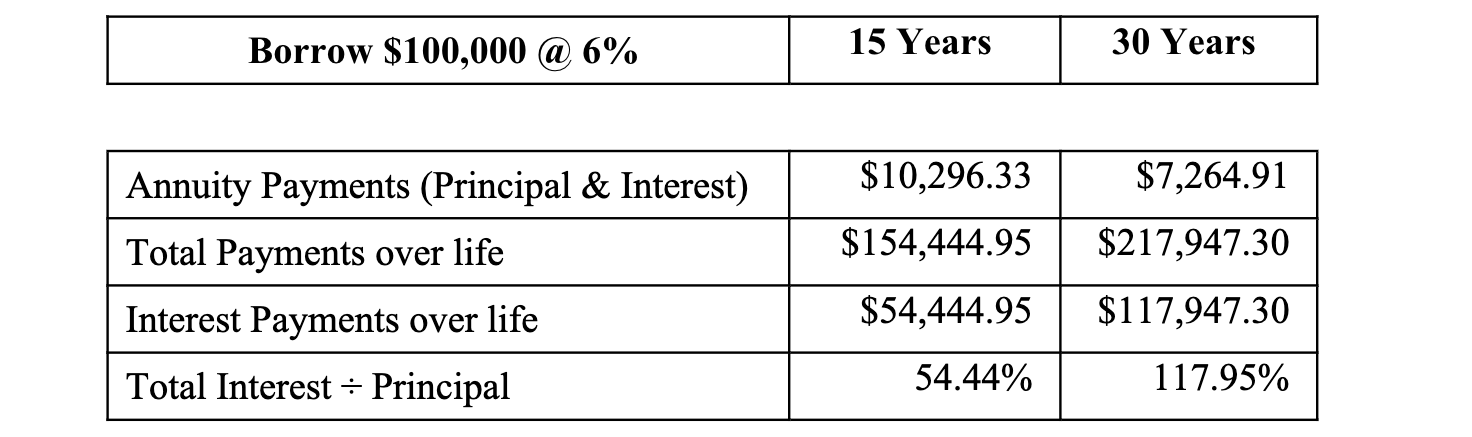

11.24 Summary Comparison of 15- and 30-Year Mortgages

The following table presents a comparison of the $100,000 annual pay mortgage (above) at 6% interest for 15- and 30-years.

Notes and Questions:

- The shorter-term mortgage presents a higher periodic payment requirement but entails less overall interest payments over time.

- The longer-term mortgage presents a much higher total interest payment requirement but requires a lower periodic outlay.

- Question: Under what conditions does it pay to take out the shorter-term mortgage?

- Answer: It pays if the mortgagee has sufficient cash flow, and wishes to minimize total payments, especially interest, over time.

- Question: Under what conditions does it pay to take out the longer-term mortgage?

- Answer: It pays if one does not have sufficient cash flow, is unwilling to settle for a less-costly home, and is relatively unconcerned about the long-term, larger amount to be paid; perhaps he does not intend to stay for the full thirty years.

- In most circumstances, a 15-year mortgage will bear a lower rate than a 30-year mortgage – unlike this illustration. Here we focused on a single variable – time – which greatly impacts the scenario depicted relative to the minimal impact that a small premium interest rate would have for the increased term to maturity.

- Taxation will also have an effect. Recall that interest payments on mortgages are, under current law, tax-deductible.

The mortgage formula is important to master as it will be used again in three additional contexts: 1. Leasing; 2. Bond Accounting; and 3. Capital Budgeting: The Annual Annuity Approach.

Mortgages in the New Millennium

Innovation has brought about a multitude of new products, such as sub-prime loans and niche credit programs for immigrants… Unquestionably, innovation and deregulation have vastly expanded credit availability to virtually all income classes. Access to credit has enabled families to purchase homes, deal with emergencies, and obtain goods and services. Home ownership is at a record high, and the number of home mortgage loans to low- and moderate-income and minority families has risen rapidly over the past five years.

-Dr. Alan Greenspan (2005)

Chairman of the Federal Reserve Bank

http://www.federalreserve.gov/BOARDDOCS/Speeches/2005/20050408/default.htm

Following an extended boom in construction driven in large part by overly loose mortgage lending standards and unrealistic expectations for future home price increases, the housing market collapsed – sales and prices plunged and mortgage credit was sharply curtailed. Tight mortgage credit conditions are continuing to make it difficult for many families to buy homes, despite record-low mortgage interest rates that have helped make housing very affordable… the contribution of housing investment to overall economic activity remains considerably below the average seen in past recoveries.

-Dr. Janet Yellin (2013)

Chairman of the Federal Reserve

http://www.federalreserve.gov/newsevents/speech/yellen20130211a.htm