5.6 The Income Statement versus the Balance Sheet

It is important to understand how related Balance Sheet and Income Statement numbers may compare with one another, especially when used in a particular ratio.

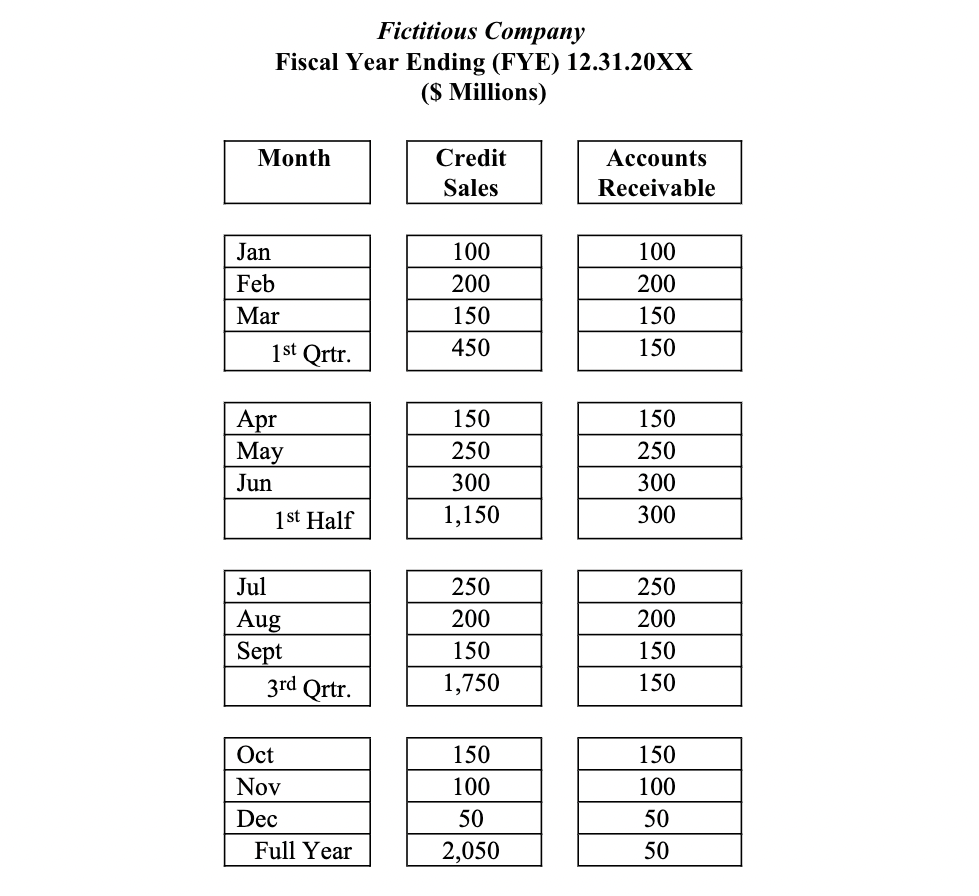

For instance, in the Average Collection Period, we compare MONTHLY credit sales (from the Income Statement) to MONTHLY accounts receivable (from the Balance Sheet). Which number is bigger? Take note that the quarterly data for the Credit Sales are cumulative as reported by the accountant. We are also assuming that the receivables are collected in full at each month’s end. Let’s see.

In the table above, we show credit sales on a monthly basis for the “Fictitious Company” over the course of the fiscal year ended (FYE) 12.31.20XX. We are assuming that credit terms are 30 days and that all receivables are collected on time. Which number is greater – the credit sales or the accounts receivable?

Clearly, after February, Credit Sales, which are cumulative, will exceed accounts receivable. A similar analysis may be applied to the inventory turnover ratio.