9.3 Free Cash Flow Exercises

Free Cash Flow: Exercise #1

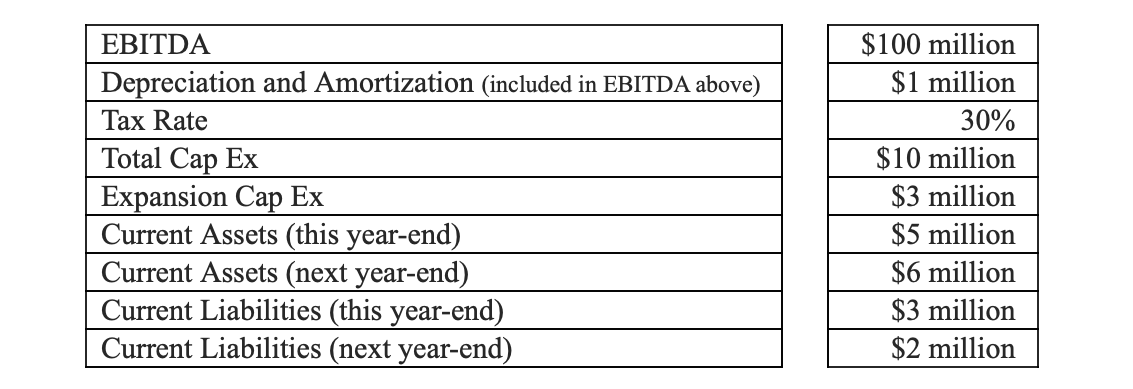

That covers the formula. Let us work up a quick, all inclusive, example. You are given the following: solve for “free cash flow.” Assume that there is no amortization.

[(EBITDA) (1 – T)] + [(Depreciation) (T)] – [Necessary Capital Expenditures] – [Increase in Net Working Capital]

FCF (Formulation) = $100 (1 – .30) + $1 (.30) – $7 – $2

(Calculation) = $70 + $0.30 – $7 – $2 = $61.3 million

Working Capital next year versus this year increased by $2 million: (6-2) – (5-3). Alternatively, one might say that current assets increased by $1 million, a use of funds; current liabilities decreased by $1 million, also a use of funds. The net use of funds was therefore $2 million, which accordingly reduces free cash flow.

To summarize, free cash flow may be thought of as the firm’s after-tax cash flows less any spending on either the maintenance or replacement of fixed assets, and in acquiring working capital. The free cash flow left over may be used either to pay down debt, pay dividends, buy back stock, for discretionary growth investments and more. The firm will (should) choose investments that further maximize FCF.

This discussion has, so far, assumed that we, financial analysts, are perfectly capable of making accurate, numerical projections about matters that have not yet occurred. In reality, projections are virtually always going to be somewhat incorrect – when all is said and done. Projections “under uncertainty” are beyond this manual’s scope.

This example is generic in the sense that it may represent either the view of an external analyst looking at a corporation’s most recent financial report, and, based on the report, making an assessment of the corporation’s growth prospects and equity investment merits based on its FCF; or it could be a projection that an internal analyst makes for a potential corporate investment project.

Projecting Free Cash Flow: Exercise #2

We have already projected net income and earnings per share (see above under the heading “Corporate Forecasting and Strategic Planning”). We also understand the implications of depreciation, a non-cash expense, on income and cash.

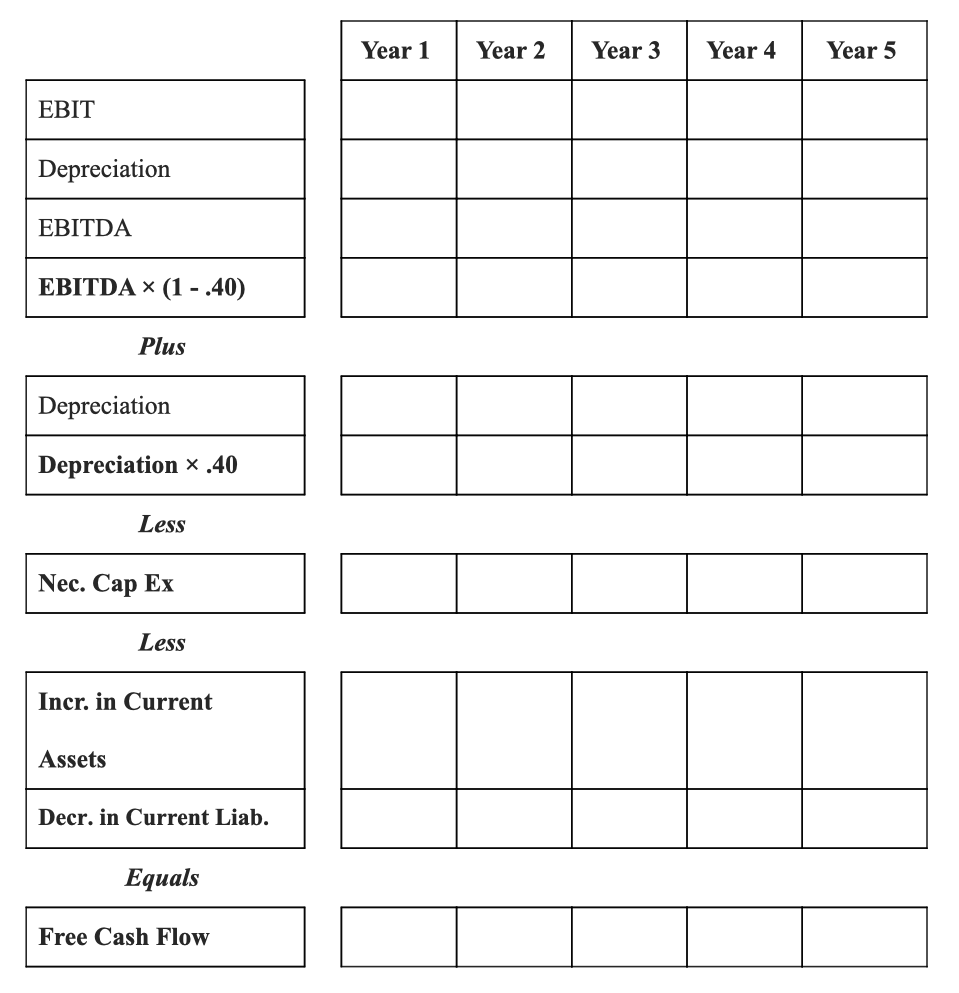

Now, we will conduct an exercise, based on the earlier net income and EPS projections, in which we shall create a pro-forma statement – of a sort – of free cash flows for multiple future years rather than just one year’s net income. The figures for EBIT and Depreciation were calculated and the solutions can be found in Section #8.6; these figures are needed for the FCF problem herewith. This spreadsheet will be useful when, later, we assess such cash flows in present value terms in order to make capital investment decisions. In this connection, take note that interest, for example, is excluded from FCF because it is a capital cost, as discussed earlier. In order to do this, we need to recall the FCF formula. Here, once again, it is:

[(EBITDA) (1 – T)] + [(Depreciation) (T)] – [Necessary Capital Expenditures] – [Increase in Net Working Capital]

In our pro-forma, Five-year income statement, we have many of the elements: EBIT, depreciation, and tax rate (i.e., 40%). Let us assume the following for the missing parts:

- For EBIT and Depreciation figures, use the data calculated earlier – in Section #8.6.

- There is no amortization.

- Replacement and maintenance capital expenditures shall be $1,000 in “Year 1” and grow thereafter at a 5% rate.

- Current Assets will increase in Year 1 by $500 the first year, and each year thereafter at a growth rate of 10%.

- Current Liabilities will increase in Year 1 by $750 and each year thereafter at a growth rate of 5%.

-

- (Hint: an increase in current liabilities is a source of funds.)

- Take note that the differences are incremental.

To make matters simple, a spreadsheet is provided below, which is consistent with the FCF formula. Notice the (horizontal) line breaks, which assist you in separating out the pieces of the formula from their respective sub-parts. Note also that cash outflows should be bracketed, since they are negative. Some of the information in the spreadsheet will be imported from the earlier net income exercise, while some will be derived from the set of four assumptions noted on the prior page.

Until the day when G-d shall deign to reveal the future to man, all human wisdom is summed up in these two words, ‘Wait and hope.’

-Alexandre Dumas

The Count of Monte Cristo

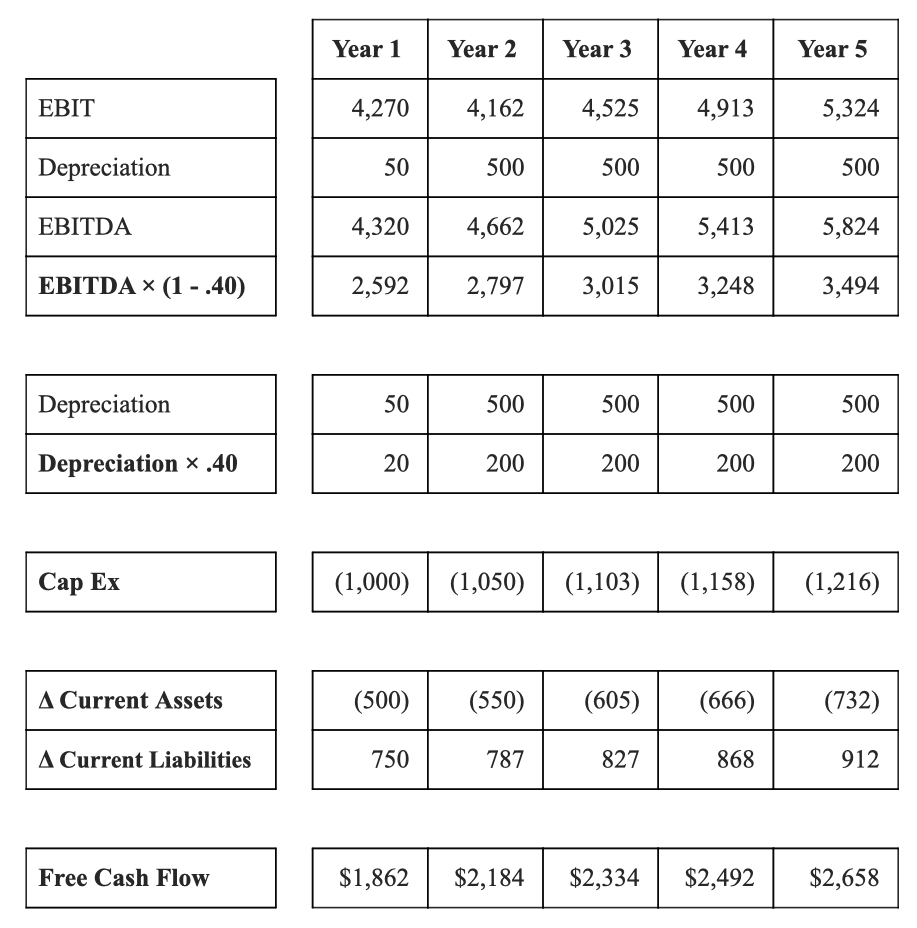

Projecting Free Cash Flow

-Solution-

(Exercise #2)

Here is the solution:

A mensch tracht un Gott lacht.

Man plans and G-d laughs.

-Yiddish expression