3.7 Periodic Inventory Analysis: Ending Inventory and Cost of Goods Sold

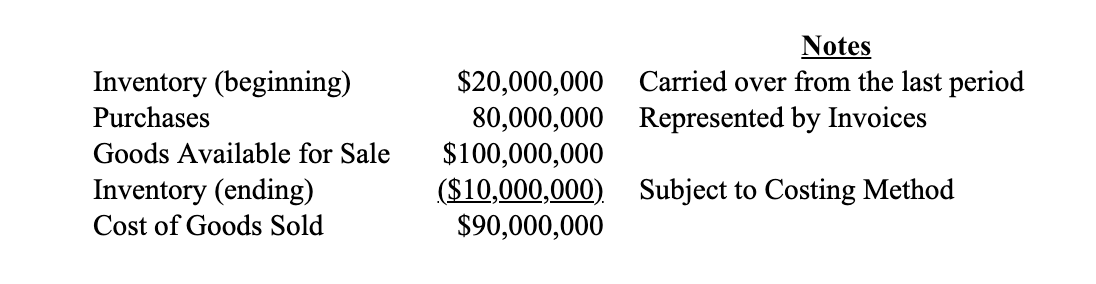

Let’s assume a company’s books reflect the following accounting data:

We know the beginning inventory dollar figure because it is carried over from the prior period’s ending value as noted on the Balance Sheet. The purchasing manager will have loads of invoices (bills) for all the purchases made in the period, so that figure is also known. Adding beginning inventory and purchases together, we get the total amount of goods that were available for sale during the period. If we subtract the ending inventory from the goods available number, we get the “cost of goods sold,” which will be noted on the Income Statement.

How do we know what the dollar value of the ending inventory is if we are not using a specific identification-type inventory accounting system? When the inventory manager conducts a monthly, or periodic, physical audit, s/he counts inventory units and not dollars. How does the accountant translate units into dollars for valuing the ending inventory?

Note: COGS include raw materials, freight-in, electricity, and may also include “imputable” labor and depreciation.

Do not look at the container, but at what is inside.