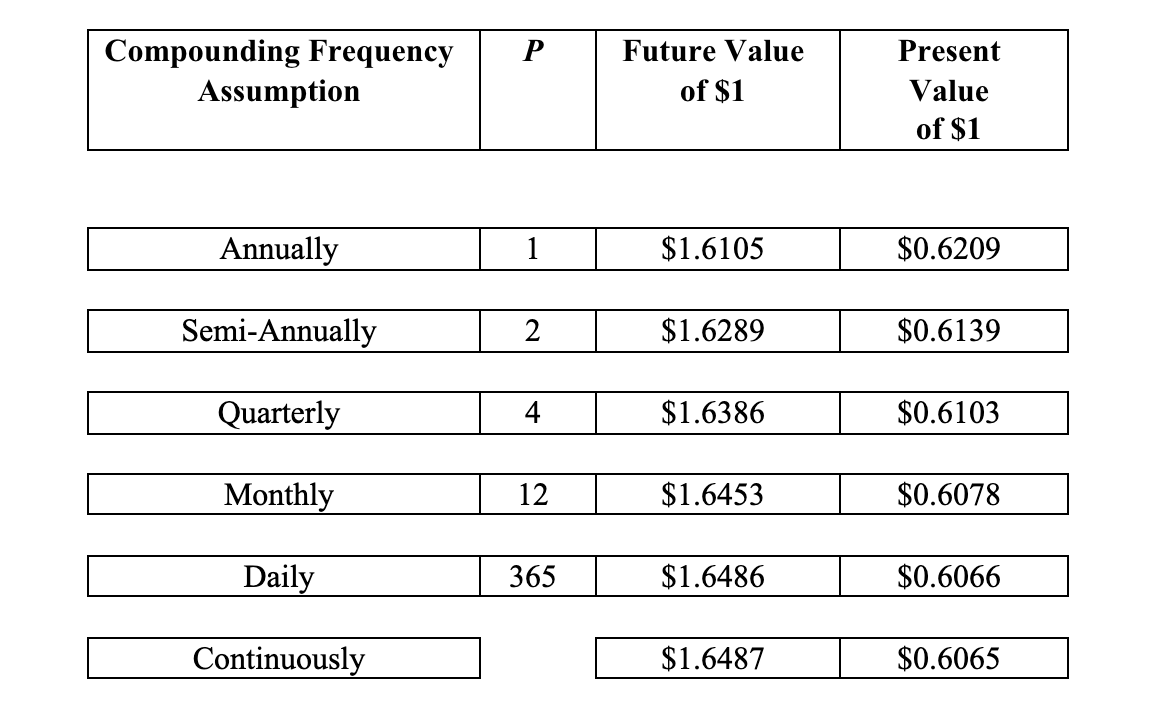

10.6 Compounding Frequency Assumption

Let’s examine the effect of changing the compounding (or discounting) frequency on both the Present- and Future-Values. Assume that we earn 10% for five years (R = 0.10; n = 5). Assume that we are given $1 of Present- and Future-Values respectively.

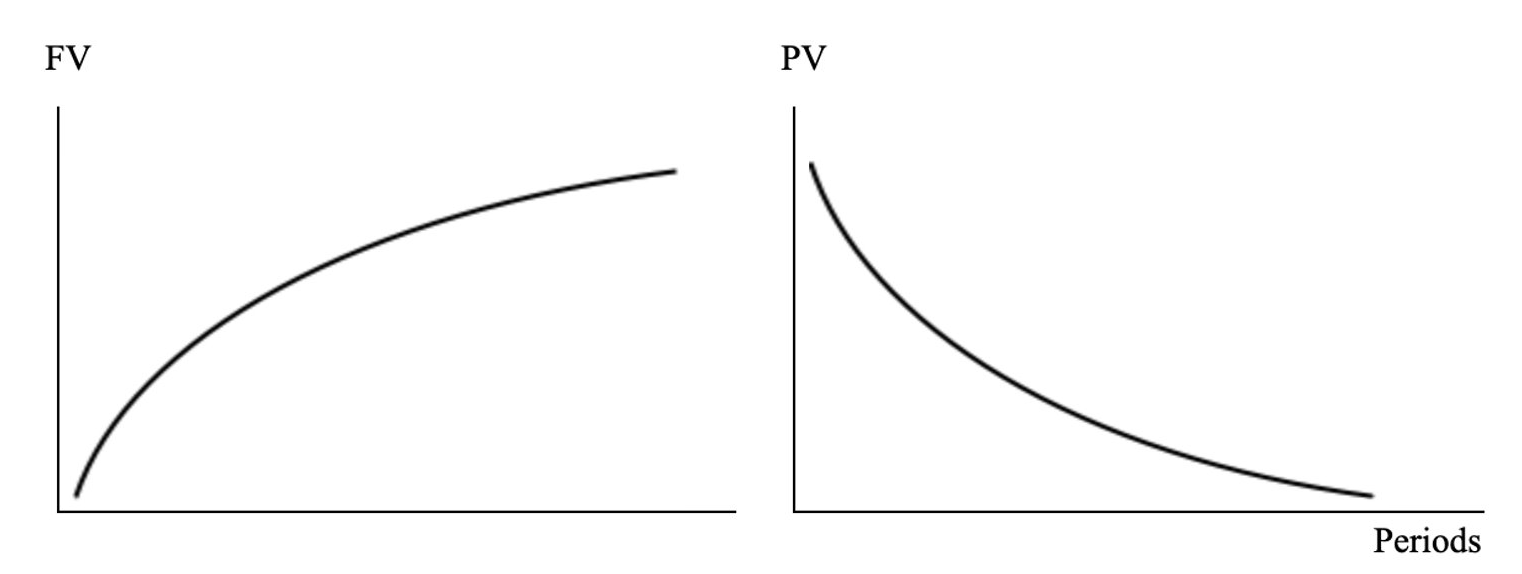

Notice how, as “P” increases, FVs increase, and PVs decrease – both at decreasing rates!

The mathematics for continuous compounding and discounting follow on the next page. You will note that the difference between daily and continuous compounding and discounting is very small. Today, we don’t often – if ever – see instruments that exhibit continuous compounding.