9.4 External Funds Needed Formula (EFN)

A company needs additional “capital” (i.e., financial resources) in order to grow and to maintain its existing plant and equipment, and to acquire additional inventory. It cannot achieve a sales increase (“growth”) without adding on productive “capital assets” (not to mention maintaining existing assets) in order to produce more goods for sale.

Some further internal funds will be generated by accounts payable, also in the normal course of business conduct. Payables are, essentially, free, short-term loans provided by the firm’s suppliers for, usually, 30 days. Payables are, financially speaking, (interest-) free sources of funds. We call these funds, including payables and retained earnings, by numerous names: “spontaneous, automatic,” or “internal.” Some of the company’s capital needs will be met “spontaneously,” in the normal course of doing business by retaining some, or all, of its earnings. Such funds may be thought of as having been generated “internally.”

For the balance of its capital requirements, the corporation will need to go “outside” the firm’s normal venues – to bank lenders, and/or to bond and stock investors for its EFN or external requirements. The extent to which the company will use either debt or equity, and in what proportions, is the subject of the “Capital Structure” topic; this topic will be discussed later. The EFN projection is an essential component to of the corporation’s capital planning.

The EFN Formula: The formula, which we shall develop, consists of three parts. The first part tells us how much additional assets the firm will require in order to support a stated sales growth objective. This part is based on the firm’s required ratio of assets to sales. It will need more assets in order to produce more sales. We shall refer to this amount as the “gross requirement,” for lack of a better phrase.

The next two parts indicate the extent to which first, accounts payable, and second, retained earnings may reduce the gross requirement. After having reduced the gross requirement by the two internally generated or spontaneous sources of funds, we are left with a figure, which tells us how much additional, external financing the firm will have to arrange for itself in order to achieve its pre-set sales growth objective. External financing will take the form of new debt and/or equity.

EFN Model’s Restrictive Assumption:

We shall assume that Financial Ratios remain the same over time, i.e., we will conduct “static analysis.” In practice, projections may not conform to past relationships precisely, for reasons known to, or assumed by, the analyst. Here, for simplicity, we shall dispense with this complication.

In order to focus on the nature of the EFN formula – and not on dynamic financial ratio matters – we will assume, in the exercise to come, static ratios. “Static” means unchanging in time.

The EFN Formula – The Math

Terminology:

Funds – this refers to any and all financial resources that the firm may call upon, including cash, various forms of debt or borrowings, and equity, the latter two of which, like cash, also enable the firm to invest in any proposed corporate investment project.

Internal Funds – these may also be referred to as either “spontaneous” or “automatic.” These funds are automatically or spontaneously generated in the normal course of doing business. An example of this is accounts payable. When a producer orders raw materials, a free loan for usually thirty days is created by the supplier. Over the course of the year, and as the thirty days continually “roll over” over the course of the entire year, the producing firm is supplied with a free source of “internal” funds. The company will also internally generate funds as it earns and retains a portion of its earnings – “retained earnings.”

External Funds – This refers to any “additional” funds the firm may need to raise beyond any funds that are generated in the normal course of doing business in order to finance a proposed corporate investment project. For external funds the firm will have to go, so to speak, outside the confines of its ordinary business by calling upon bank lenders, debt and equity investors, and possibly others. External funds are required to the extent that internal funds are insufficient.

The EFN Formula:

EFN = [(A0/S0) ΔS] – [(AP0/S0) ΔS] – [(M0) (S1) (RR0)]

OR

[(A0) (S1/S0 –1)] – [(AP0) (S1/S0 – 1)] – [(M0) (S1) (RR0)]

EFN = Required increase in assets [(A0/S0) ΔS]

Less: “spontaneous” increase in Liabilities [(AP0/S0) ΔS]

Less: “spontaneous” increase in Retained Earnings [(M0) (S1) (RR0)]

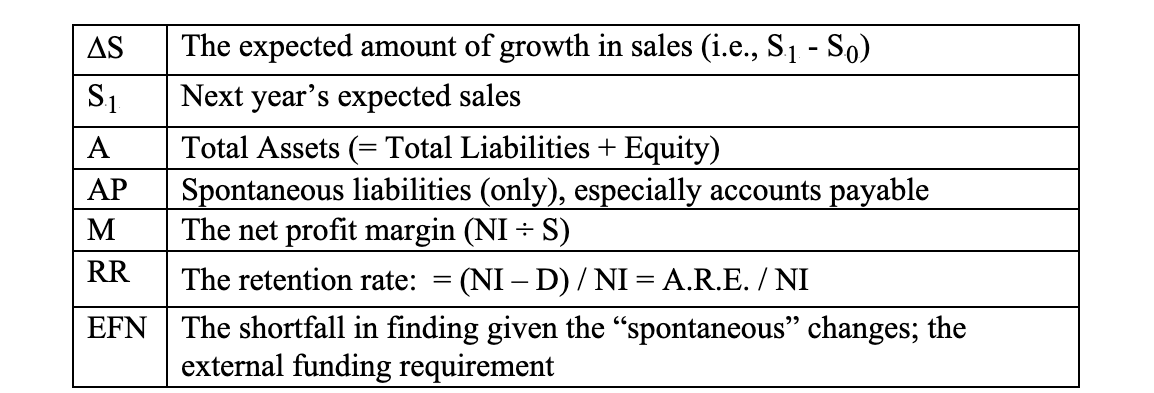

Key: