14.7 Dividend Discount Model (Solutions)

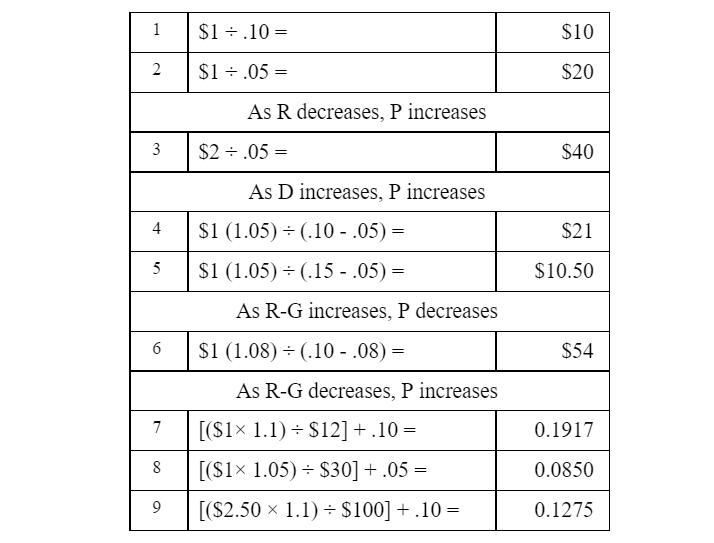

The following table presents the solutions to the problems on the prior page.

- As G increases, R – G decreases, and P increases. G, as the growth rate in dividend, also affects D1 (because D1 = D0 [1 + G]). As G increases, so too does D1.

- So far, we have assumed that P = V, i.e., Market Price = Intrinsic Value. If however, V > P, we then have an unusual opportunity to achieve an excess (“unearned”) return; if the opposite pertains, we should sell the stock – if we already own it, or sell it short – if we are aggressive

Stock prices climb a wall of worry.

-Anonymous