2.3 The Balance Sheet

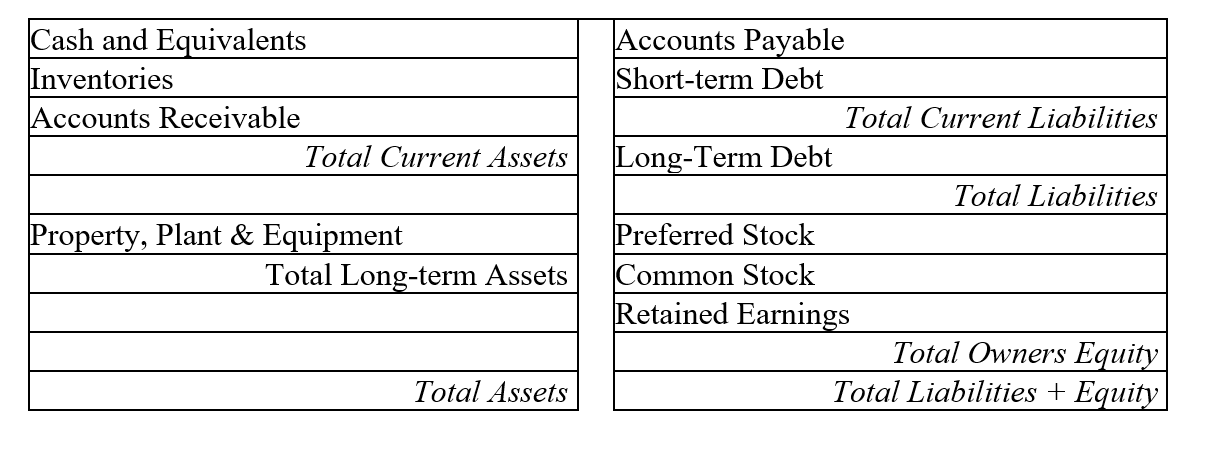

The Balance Sheet presents a static, unchanging, still-photograph of a company’s financial position at a moment in time, i.e., “as of” a certain date, often December 31st. In theory, any of the figures on the balance sheet would be different, either larger or smaller, on the very first day following (or before) the statement date. The Balance Sheet is usually issued every quarter, i.e., every three months. A very simple balance sheet will look something like the following (with the numbers filled in). Take note that any actual Balance Sheet you may examine may differ from this simple example.

XYZ Corp. Balance Sheet as of 12.31.XX

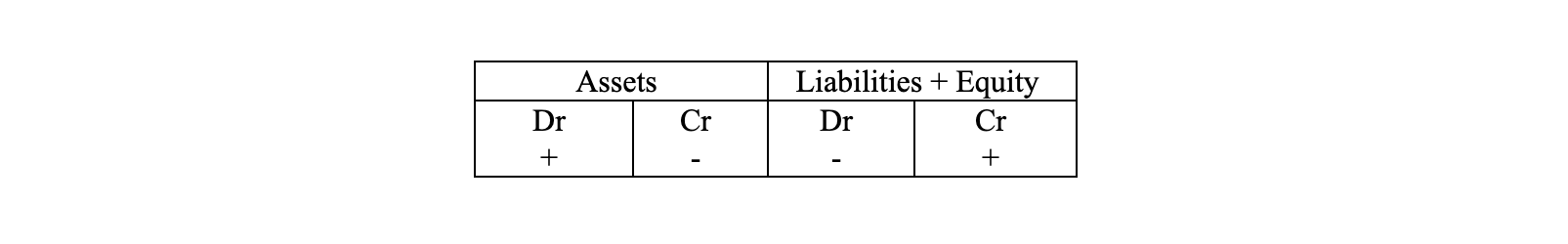

All Asset accounts are “debit balance” accounts. That means that when the account increases (decreases), the amount is recorded on the debit (credit) side of the firm’s ledger. Liability and Equity Accounts are “credit balance” accounts. We make these entries into the bookkeeper’s ledger’s “T-Accounts” (see immediately below). This mechanistic framework is fundamental to “double-entry book-keeping.”

Let’s repeat this: Asset accounts are “debit balance” (debit = “Dr”) accounts, whereas liability and owners’ (or shareholders’) equity are “credit balance” (credit = “Cr”) accounts. Increases (decreases) in asset accounts are characterized by debit (credit) entries; increases (decreases) in liability and equity accounts are characterized by credit (debit) entries.

In “double-entry” bookkeeping, for every debit entry there must be a credit entry. Debits must equal credits, and the balance sheet must balance: Total Assets = Total Liabilities + Equity. This is the basic accounting equation.

Basic accounting equation: The following equations must, by definition, be true:

A = L + E (Assets = Liabilities plus Equity)

A – L = E (Assets minus Liabilities = Equity)

There are also contra-asset accounts (such as accumulated depreciation and allowance for uncollectible accounts receivables), which are “credit balance” (credit = Cr) accounts. These contra-accounts effectively reduce the (net) asset accounts and are credit entries.

The phrase “current,” as in “current assets,” has to do with the life of the asset – or liability. According to the accountant, any asset (or liability), which is consumed (or paid) within an accounting period (i.e., one year), is current. Any asset – or liability – that has a life exceeding one year is “long-term.” Thus, inventory is placed “above the line,” under current assets. So too is the case with accounts payable. Property is long-term, for example. More on this next….