3.8 Units to Numbers: FIFO and LIFO

If most businesses “do” inventory periodically (rather than perpetually) for practical reasons, by quite literally, physically counting (ending) inventory units, usually monthly, how does the accountant translate the ending inventory units counted into dollars? As we shall see below, management and its accountants have ample discretion regarding choice of inventory costing method.

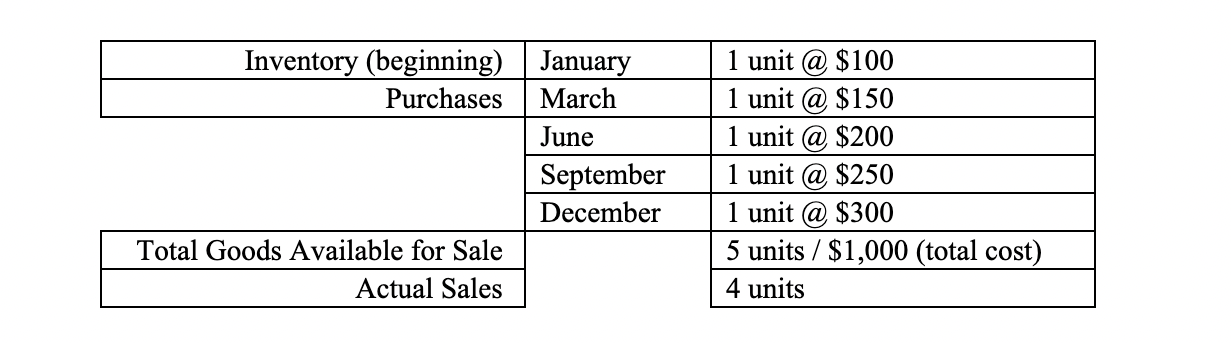

In the following illustration for the two most popular costing methods, the company has started the year with one unit of inventory carried at a cost of $100. You will note that the costs go up in time, reflecting an inflationary environment. It is also assumed that only one identical inventory item is being counted.

Alternate Solutions to the Ending Inventory Problem

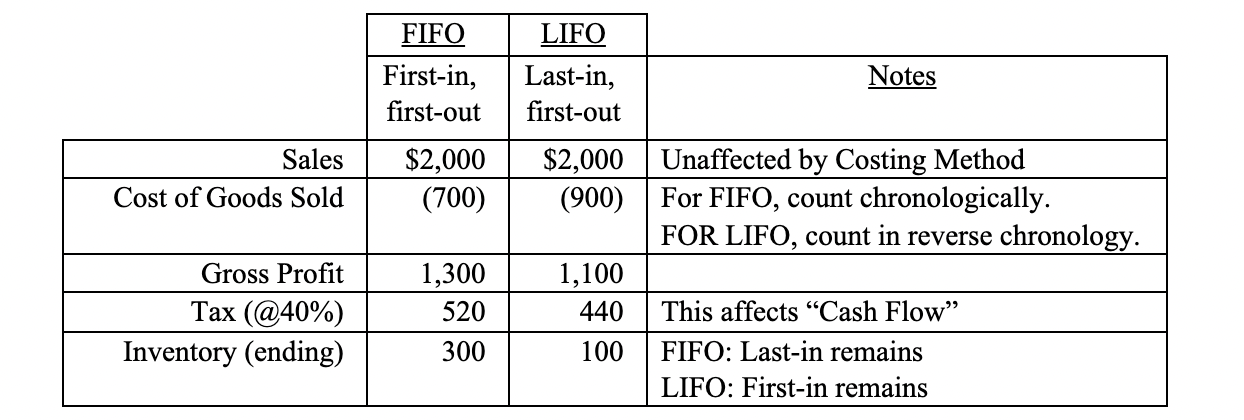

In the chart below, you will find alternate solutions to the Ending Inventory Problem when the accountant employs either of two popular costing methods: FIFO (First In, First Out) and LIFO (Last In, First Out). A detailed step-by-step explanation of the chart is found on the next page. Before flipping to the next page, see if you are able to decipher the table on your own. Immediately following the table is a discussion of the differing results of the two methods. You will note that the choice of method materially affects the Cost of Goods Sold and Ending Inventory values, and therefore all the other values in the table as well.

Clearly, a firm will adopt LIFO if it wishes to reduce inflated, “windfall” profits, and hence taxes, in an inflationary environment. LIFO will consequently reduce inventory assets on the balance sheet and make relevant ratios, and hence loan prospects, possibly less attractive to banks who wish to see more assets against which loans may be made and, possibly, secured. Management and its accountants have to weigh the offsetting considerations of one or the other costing method.

Take note that inventory is part of current assets and “working capital” (WC). WC = Current Assets less Current Liabilities.