8.7 The Tax Effect of Depreciation

Depreciation is a non-cash expense (and NOT an “expenditure”), which serves to recognize the consumption of fixed assets over time, e.g., plant and equipment, but NOT property.

The “consumption,” or use, of long-term, fixed assets is reflected as a separate operating, depreciation expense. Although depreciation is a non-cash expense, it provides the corporation with cash because it reduces taxable income and hence the tax liability.

When depreciation can be “imputed” to the manufacturing process, its charges are included in the Cost of Goods Sold (COGS). For example, if the manufacturer of a $1 million piece of equipment warrants that the machine will be used up after manufacturing 1 million units, the accountant may impute (i.e., include) $1 per unit of production to COGS. This could confuse the statements reader. Below, we will not assume such “imputation.”

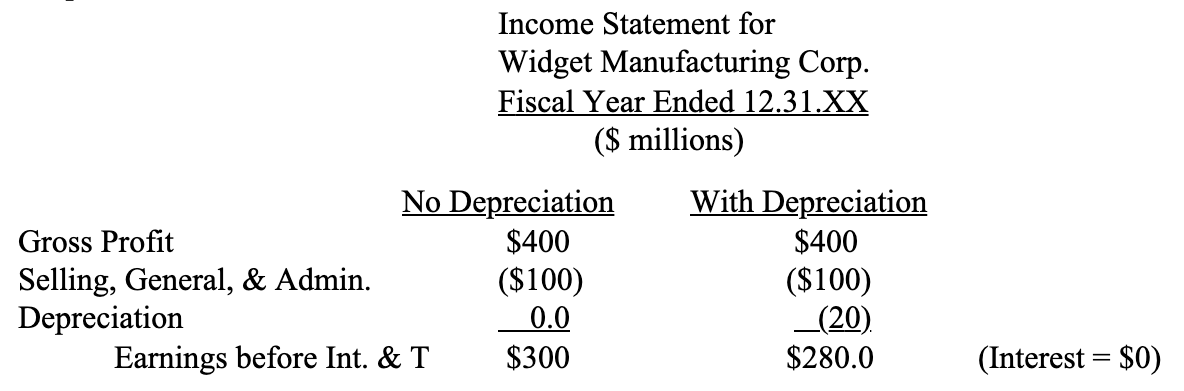

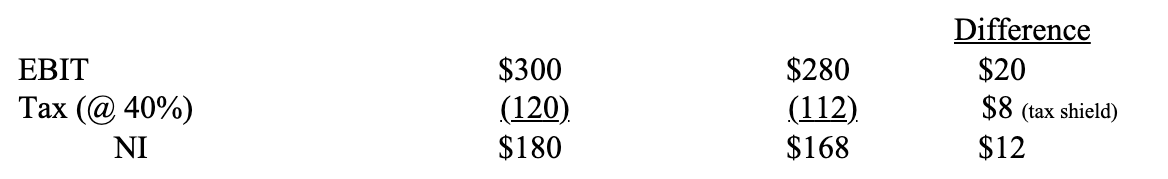

Illustration of Depreciation Tax Shield (Ignoring Interest Expense):

Due to depreciation, a non-cash expense, net income will be lower by only $12 rather than the full $20 of depreciation expensed; the $8 difference represents the tax savings, and hence the “tax shield,” due to the deduction of the depreciation expense.

Tax Shield = (D) (T) = ($20) (0.40) = $8

The “tax shield” of depreciation, i.e., D (T), is a very real phenomenon in that it actually reduces the tax burden, which is viewed as a provision of cash, albeit depreciation alone provides no cash. The acquisition of a depreciable asset, e.g., a building or equipment, creates a tax shield or benefit that provides more cash flow than before the acquisition.

You may think of “EBITDA” (i.e., earnings before interest, tax, depreciation, and amortization) as EBIT plus depreciation (and amortization).

On Humility, Honor, and Accomplishment

A life spent making mistakes is not only more honorable, but more useful than a life spent doing nothing.

-George Bernard Shaw

That’s why pencils have erasers.

-Norman Isaac Bigel

(1917 – 2017)