3.14 Accelerated Depreciation Methods: Sum-of-the-Years’ Digits (For reporting purposes only)

There are two more methods, which we shall examine, both of which may be referred to as “accelerated” depreciation methods because in the early years there will be more depreciation expense than in the later years.

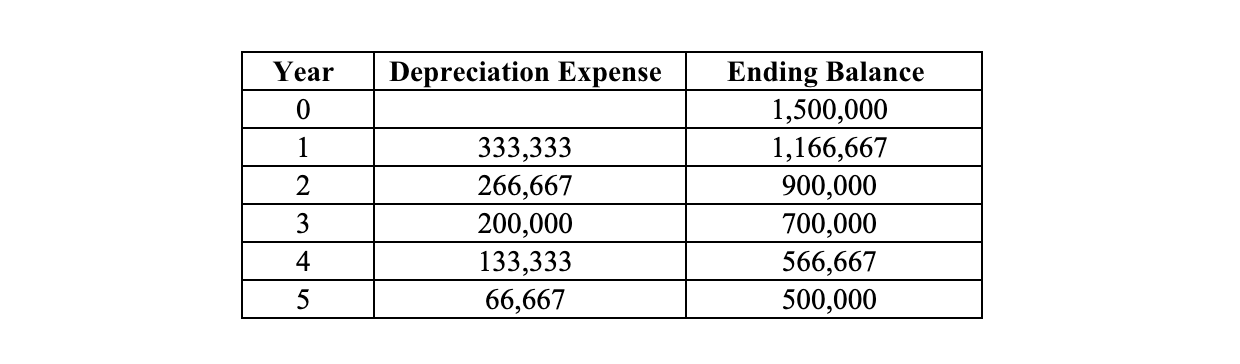

You’ll remember that the ratio we used in the given example for Straight Line was 20%. Under “Sum-of-the-years’ digits” (SOYD), we apply a new ratio against the $1,000,000 depreciable amount.

In the denominator for the SOYD ratio, we calculate the sum of the years’ digits, which, in this five-year example is: 5 + 4 + 3 + 2 + 1 = 15.

In the numerator, we use the reverse order of the years, starting with five, and then going backwards each year. So, in year one, we expense 5/15 of $1,000,000 = $333,333, and reduce the balance accordingly. In the second year the ratio is 4/15. In the third, year the ratio is 3/15, or, as it happens, the same 20% that we used in the straight-line method; you’ll note that the depreciation expense after this third year will be less than under straight-line. At this rate, you will note that after five years we will have depreciated 15/15 or 100% of the depreciable amount.