11.3 The Derivation of (Ordinary) Annuity Factors

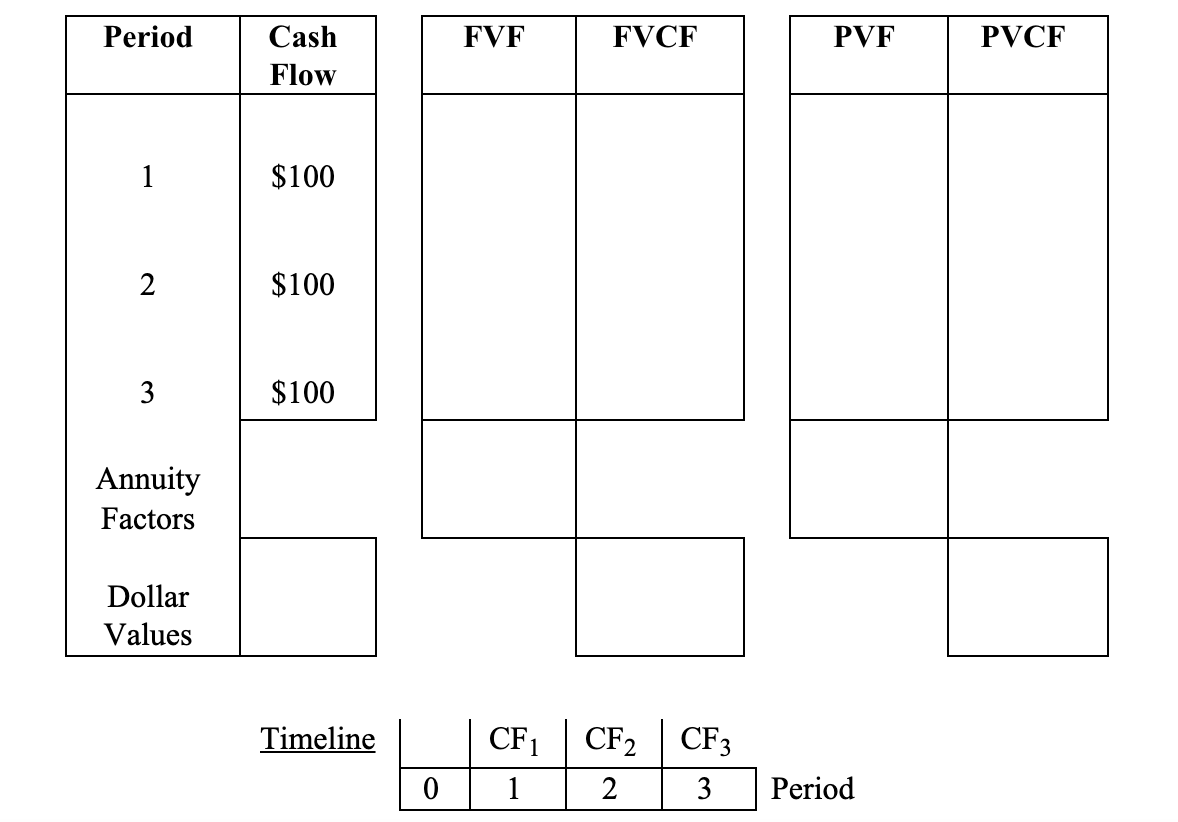

You are given the following information. Column by column, complete the table by filling in the appropriate future value factors (FVF), the future values of each respective cash flow (FVCF), as well as the same for the present value factors and cash flows (PVF and PVCF). Once completed, add up the columns at the bottom.

Note that here we are dealing with “ordinary” annuities, which means that all the cash flows in the series are received at the end of the relevant period. Soon, we will examine another convention. Use the timeline below to properly place each of the three cash flows temporarily (see the timeline below). Placement will determine the proper exponents and hence periods.

Given:

3-year annuity

$100 received per year.

Annual Discounting/Compounding Factor = R = .10

Code:

|

FVF = Future Value Factor FVCF = Future Value of the Cash Flow PVF = Present Value Factor PVCF = Present Value of the Cash Flow |

|

CF1 = First Cash Flow CF2 = Second CF3 = Third |