11.20 Growth Perpetuities

A “growth” perpetuity is a perpetual cash flow stream (CF) that grows at a constant rate of growth, which we shall call “g.” It is a special case of perpetuity. If, in the last period, we received a cash flow of $100 and its growth rate is 5%, the next cash flow would follow this formula: (Last Cash flow: CF0) (1 + g) = Cash flow in next period (CF1). “G” represents a constant rate of growth in the cash flow over time.

CF1 = CF0 (1 + g)

$105 = $100 (1.05)

The formula for a growth-perpetuity is: (Cash flow next period) ÷ (Discount rate – Growth rate). Symbolically, this may be expressed as:

PV = CF1 ÷ (r – g)

In the above example (where r = 0.10), if the growth rate had been 5%, the present value would be (assuming here that the next CF is $105, that is, [$100] [1.05] = $105):

$105 ÷ (.10 – .05) = $2,100

Notice that for this formula to work, “g” cannot equal or exceed “r.” Mathematically, if g exceeds r we would get a negative denominator, resulting in a negative present value, which makes no sense. A mathematical rationale, while necessary, is however not sufficient to justify this relationship. There must be a financial explanation.

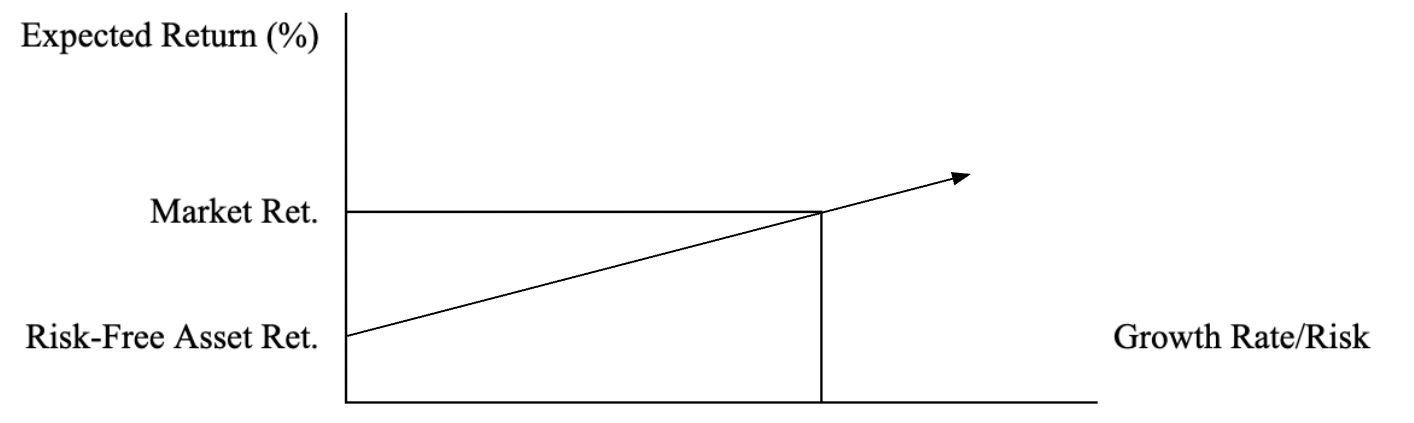

One, theoretically, earns some positive return – “r” – for investing in a no-risk asset[1]; otherwise, no one would invest at all. Even with no risk (and no growth!), there is a positive return. Therefore r > g. As growth rates increase (in linear manner), so too does risk; higher growth rates are more difficult to achieve and hence are riskier. R (“r”) should exceed g, as a practical, non-mathematical matter. This is depicted in the diagram below.

This formula may also come in handy for cases of negative growth. Since “g” would be negative, in this case, the formula would require that one add the growth rate to the interest rate in order to determine the present value.

Suppose the last cash flow (CF0) was $100, there is a nominal cash flow growth rate of negative 5%, and a discount rate of 10%. What would the present value be?

[($100) (1 – (0.05)] ÷ [.10 – (-.05)] =

$95 ÷ .15 = $633.34

Of course, the PV in the case of positive growth far exceeds the outcome we observed with negative growth. Is that not as it should be?

This formula is applicable to common stock, whose dividends may grow – positively or negatively.

Note:

- As this is being written (2021), we observe an unusual environment wherein interest rates in many parts of the world are negative. ↵