14.9 Components of the Dividend Discount Model

The DDM formula contains several variables whose values must be ascertained in order to solve for Price (P). Here is the formula (again).

P = [D0 (1 + G)] ÷ (R – G)

= D1 ÷ (R – G)

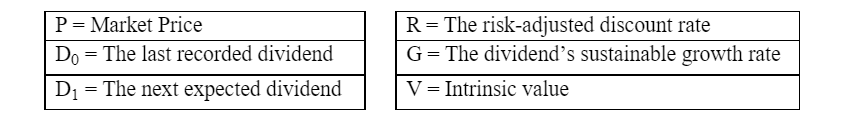

The variables are:

Price = Intrinsic Value

We must solve for “P.” The market price (P) will equal the security’s intrinsic value (V) if the security is efficiently – or correctly – priced in the market. That is what we are trying to uncover with the formula. We will assume here that P = V.

The Last Annual Dividend

D0 is the prior year’s dividend, and is thus a known, historical fact. D1 is the next dividend.

Next Year’s Dividend

Next year’s dividend depends on our expected dividend growth rate, “G.”

D1 = D0 × (1 + G)

Growth Rate in the Dividend

The dividend’s growth rate is defined as:

G = (D1÷ D0) – 1

However, we do not know D1, the next year’s dividend. Therefore, we need a formula for “G.” Here, is the non-intuitive formula for G.

G = ROE × RR

ROE = Return-on-Equity = (NI ÷ Eq.)

RR = Retention Rate = (NI – D ÷ NI) = (A.R.E. ÷ NI)

A.R.E. = Addition to Retained Earnings = NI – D

Therefore:

G = (NI ÷ Eq.) (A.R.E. ÷ NI)

G = (A.R.E.) ÷ Eq.

The “G,” which we formulated above represents the growth rate of the firm’s Equity and not of the Dividend! We must demonstrate that the two growth rates are the same. We will examine “G” more closely below and introduce “R.”