2.12 Chapter 2 Review Questions

Chapter 2: Review Questions

- Is the Balance Sheet a “flow” or a “static” statement? Do its numbers get bigger (flow), smaller, or neither, as time over the course of the period passes?

- When, if ever, and, if so, how do Balance Sheet numbers revert to zero?

- How often, at most, is a public corporation required to issue financial statements?

- Are assets debit- or credit-balance accounts?

- Are liabilities and equity debit- or credit-balance accounts?

- What is the basic accounting equation?

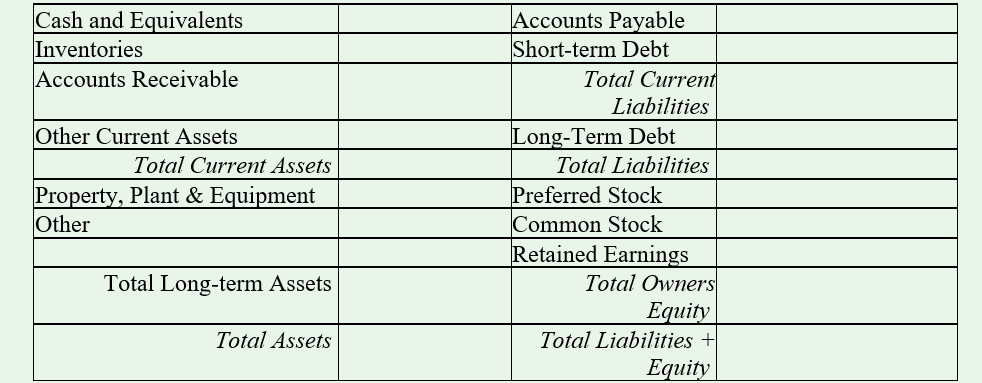

- List all typical Current Assets and Current Liabilities.

- When a Credit Sale is booked, what Balance Sheet item is affected?

- What is meant by “current”?

- What are all the equity section accounts?

- Rank these items in terms of who gets paid first: Preferred stock dividends – interest on debt – common stock dividends.

- When it is said that “dividends have accumulated in arrears,” to which class of stock may we refer – preferred or common? Explain.

- Trace the link from Net Income to the Balance Sheet.

- What are the tax ramifications to the corporation regarding interest and dividends paid?

- To which Capital Component does the word, “Default” apply?

- Which Capital Component (Debt, Preferred Stock, Common Stock, or Retained Earnings) is riskiest? Why?

- Is Bankruptcy “the end”?

- Using the template below, search on-line for a real, true-to-life company’s Balance Sheet and transfer the numbers to the template below. Imagine an airline or a retailer, etc. – perhaps Amazon or Apple. What might their numbers look like?

- Who owns a company’s Retained Earnings?