11.25 Personal Financial Planning Problem

You are given the following:

- This year, Abraham will start graduate school. The annual cost is $30,000 per year for each of two years, payable at the start of the year.

- The tuition will increase by 3% in the second year, due to inflation.

- Abraham currently owes $25,000 from his undergraduate student loans.

- When he finishes his M.B.A. in two years, his parents will give him a $50,000 gift.

- Upon graduation, Abraham plans to pay off his loans fully in ten years. How much will he have to pay annually in order to achieve his goal?

- Assume throughout an 8% cost of funds rate, compounded quarterly, except for the annuity payoff payments, which will be at an 8% annual rate.

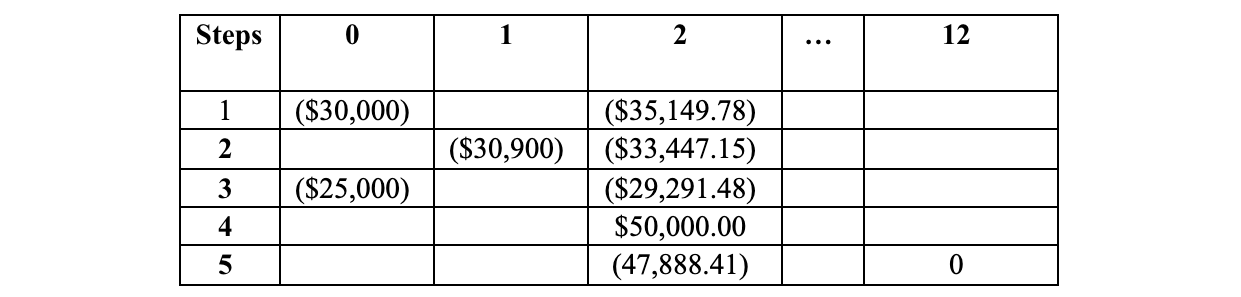

Solution Plan:

- First lay down the given data, in nominal terms, in their proper places in a timeline; then, import the numbers into a spreadsheet.

- Calculate the future value of the costs at the end of year 2, using the cost of funds rate given. Note the gift as money in.

- Use the mortgage formula to calculate the annuity payment required to pay off the accumulated debts in the last 10 years.

Solution:

Calculations:

Step 1: ($30,000) (1 + .08/4) 2 × 4 = $35,149.78

Step 2: $30,000 × 1.03 = $30,900

($30,900) (1 + .08/4) 1 × 4 = $33,447.15

Step 3: $25,000 × (1 + .08/4) 2 × 4 = $29,291.48

Step 4: $50,000 gift

Step 5: Sum of Steps 1-4

Step 6: Calculate the annual annuity payments.

(47,888.41) = (x) (PVAF 0.08; 10)

(47,888.41) (6.7101)

x = 7,136.77