11.5 Future and Present Annuity Values: The Nature of Their Cash Flows

Note the differences in the nature of compounding versus discounting of annuity cash flows. Let’s assume that the Cash Flows are to be received at the end of the respective periods. In the examples following, there are five cash flows.

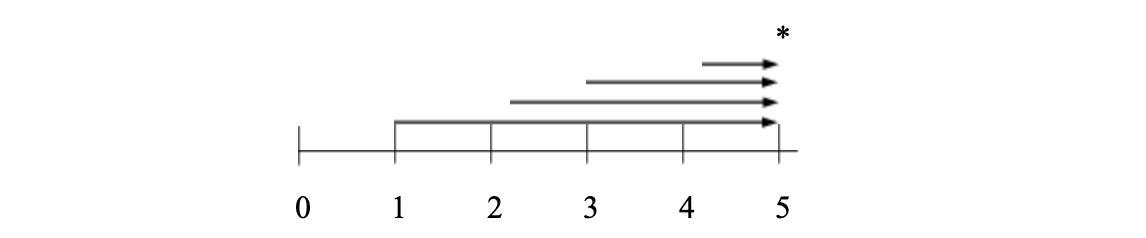

Compounding:

There are, altogether, four compounding “periods”; the last cash flow to be received is not compounded because it is received at the “horizon” of the deal. Indeed, the last CF does have a zero-exponent attached to it: [1 + R] 0 = 1. The exponents are zero through four.

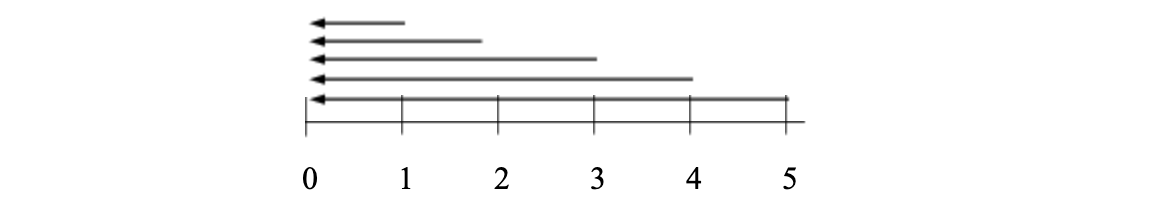

Discounting:

In contrast, there are five discounting periods. The exponents are one through five. Note that the arrows go in the opposite direction from before as we are now discounting to present values rather than compounding to future values.

While Simple Future and Present Values factors (as observed by the relevant tables earlier) are reciprocals, or mirror images of one another, annuities are not.