12.2 Security Return: The Holding Pattern Return (Raw Calculation)

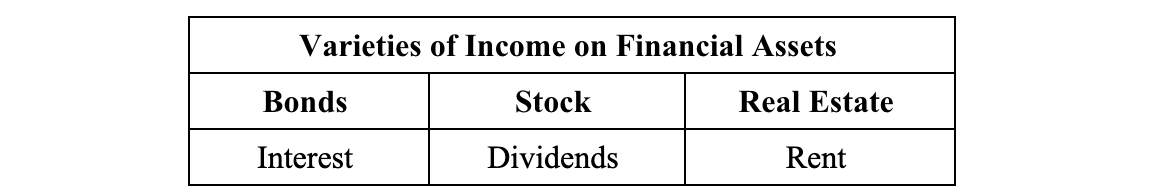

In order to figure the return on an asset (a percent), it is useful to first outline the various components of the return on the asset – and then to calculate the return. The two principal components of return are income and profit, i.e., sales or “exit” price less investment cost. Income is common to many assets including bonds (interest), stocks (dividends), and real estate (rent). The exit price may be equal to, greater or less than the asset’s original investment cost, hence “profit” is included in return.

Example:

- Stock/bond/real estate cost or investment (C) = $1,000. This is an “outflow.”

- Income (I) received over the course of the holding period = $100.

- Sales (exit) price (P) = $1,050.

- The income and sales price are “inflows.”

Holding Period Return (HPR):

HPR = inflows ÷ outflows -1 = [(I + P) / C] – 1

HPR = [(100 + 1,050) / 1,000] – 1 = + 15%

Alternatively, we could have calculated the HPR by focusing only on the profit (“Π”), in which case, we would have left out the “-1” expression at the end. Note that the profit = $1.050 – $1,000 = $50. The result is the same this way as depicted below.

HPR = [(I + Π) / C]

HPR = [(100 + 50) / 1,000] = + 15%

Note:

While the HPR has severe conceptual limits, it provides key information upon which a better model may be constructed. In this section, we will present the calculation for dollar price and return of a bond.

When you make a sale to your fellow…do not victimize one another.

-Leviticus 25:1

And when you transact a purchase to your friend, or acquire from the hand of your friend, you shall not defraud one another.

-Leviticus 25:14